Net worth is the value of all assets owned by an individual or organization minus the total of all debts or liabilities. It is a measure of financial health and can be used to assess an individual's or organization's ability to meet financial obligations.

For individuals, net worth can be a reflection of their financial success and stability. A high net worth can indicate a strong financial position, while a low net worth can indicate financial struggles or debt. Net worth can also be used to track financial progress over time and can be a helpful tool for financial planning and goal setting.

Many factors can affect an individual's or organization's net worth, including income, spending habits, investments, and debt. It is important to regularly monitor net worth and make adjustments as needed to ensure financial health.

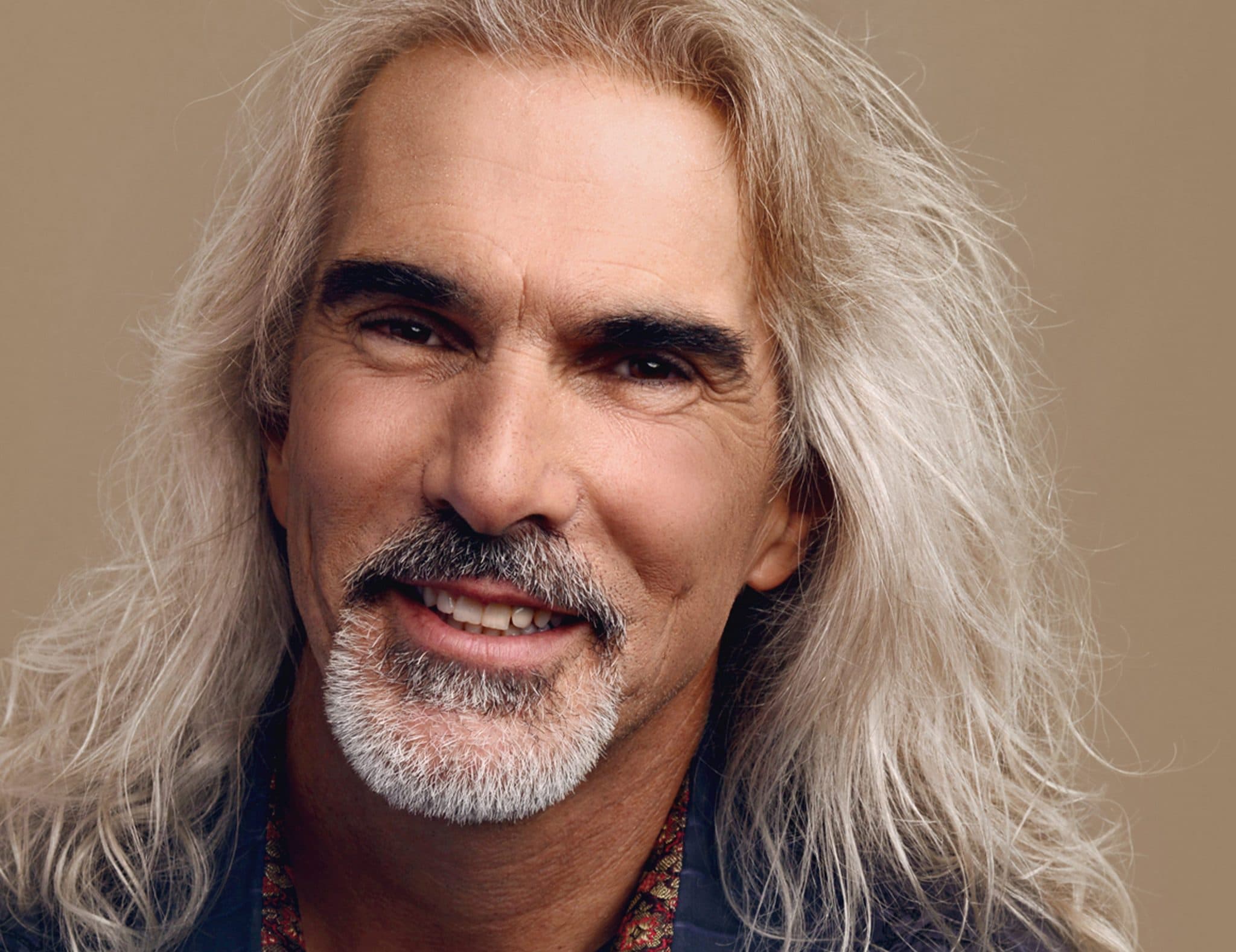

Net Worth of Guy Penrod

Net worth is a measure of an individual's or organization's financial health. It is calculated by subtracting total liabilities from total assets. A high net worth indicates a strong financial position, while a low net worth can indicate financial struggles or debt.

- Assets: Anything of value that an individual or organization owns, such as cash, investments, real estate, and personal property.

- Liabilities: Debts or obligations that an individual or organization owes, such as mortgages, loans, and credit card balances.

- Income: The amount of money that an individual or organization earns from work, investments, or other sources.

- Spending: The amount of money that an individual or organization spends on goods and services.

- Investments: Assets that are purchased with the expectation that they will appreciate in value over time, such as stocks, bonds, and real estate.

- Debt: Money that an individual or organization owes to another party, such as a bank or credit card company.

- Financial planning: The process of creating a plan to achieve financial goals, such as saving for retirement or buying a home.

- Financial stability: The ability to meet financial obligations and maintain a consistent standard of living.

- Net worth statement: A financial statement that shows an individual's or organization's net worth at a specific point in time.

These key aspects of net worth are all interconnected. For example, increasing income or decreasing spending can lead to a higher net worth. Investing in assets that appreciate in value can also increase net worth. Conversely, taking on debt or experiencing a decline in asset values can lead to a lower net worth. It is important to regularly monitor net worth and make adjustments as needed to ensure financial health.

Personal details and bio data of Guy Penrod

| Name: | Guy Penrod |

| Date of birth: | June 11, 1963 |

| Place of birth: | Abilene, Texas |

| Occupation: | Singer, songwriter |

| Net worth: | $10 million |

Assets

Assets are an important part of net worth, as they represent the value of everything that an individual or organization owns. In the case of Guy Penrod, his assets likely include his home, investments, and personal belongings. The value of these assets can fluctuate over time, depending on market conditions and other factors.

- Cash: Cash is the most liquid asset, meaning that it can be easily converted into other forms of value, such as goods or services. Guy Penrod may keep some of his cash in a savings account or checking account.

- Investments: Investments are assets that are purchased with the expectation that they will appreciate in value over time. Guy Penrod may invest in stocks, bonds, or real estate.

- Real estate: Real estate is land and the buildings on it. Guy Penrod may own his home or other properties, which can be a valuable asset.

- Personal belongings: Personal belongings are items that are owned for personal use, such as furniture, jewelry, and clothing. While personal belongings may not be as valuable as other types of assets, they can still contribute to an individual's net worth.

The value of Guy Penrod's assets can change over time. For example, if the stock market declines, the value of his investments may decrease. However, if the real estate market increases, the value of his home may increase. It is important to regularly monitor the value of assets and make adjustments as needed to ensure financial health.

Liabilities

Liabilities are an important part of net worth, as they represent the amount of debt that an individual or organization owes. In the case of Guy Penrod, his liabilities may include his mortgage, car loan, and credit card balances. These debts can have a significant impact on his net worth, as they reduce the value of his assets.

For example, if Guy Penrod has a mortgage balance of $200,000 and a net worth of $1 million, his actual net worth is only $800,000. This is because the mortgage debt reduces the value of his assets by $200,000. It is important to manage liabilities carefully to ensure financial health. This can involve paying down debt, consolidating debt, or refinancing debt at a lower interest rate.

By understanding the connection between liabilities and net worth, individuals can make better financial decisions. For example, they may choose to reduce their debt load in order to increase their net worth. They may also choose to invest in assets that appreciate in value, which can help to offset the impact of liabilities on their net worth.

Income

Income is an important part of net worth, as it represents the amount of money that an individual or organization earns from work, investments, or other sources. In the case of Guy Penrod, his income likely includes his earnings from his music career, as well as any income from investments or other sources.

- Work: Guy Penrod earns income from his work as a singer and songwriter. He has released several albums and singles, and has toured extensively throughout his career.

- Investments: Guy Penrod may also earn income from investments, such as stocks, bonds, or real estate. Investments can provide a passive income stream, which can supplement his income from work.

- Other sources: Guy Penrod may also earn income from other sources, such as royalties, endorsements, or sponsorships. These sources of income can be significant, especially for high-profile celebrities.

The amount of income that Guy Penrod earns each year can vary depending on a number of factors, such as the success of his music career, the performance of his investments, and the availability of other sources of income. However, his income is likely a significant contributor to his net worth.

Spending

Spending is an important part of net worth, as it represents the amount of money that an individual or organization spends on goods and services. In the case of Guy Penrod, his spending likely includes his expenses on housing, food, transportation, and entertainment.

- Discretionary spending: Discretionary spending is spending on goods and services that are not essential for survival, such as entertainment, dining out, and travel. Guy Penrod may spend money on discretionary items such as concert tickets, restaurant meals, and vacations.

- Non-discretionary spending: Non-discretionary spending is spending on goods and services that are essential for survival, such as housing, food, and transportation. Guy Penrod may spend money on non-discretionary items such as rent or mortgage payments, groceries, and car payments.

- Fixed expenses: Fixed expenses are expenses that remain the same each month, such as rent or mortgage payments, car payments, and insurance premiums. Guy Penrod's fixed expenses likely include his housing costs and car payment.

- Variable expenses: Variable expenses are expenses that can vary from month to month, such as groceries, utilities, and entertainment. Guy Penrod's variable expenses may include his spending on food, electricity, and gas.

The amount of money that Guy Penrod spends each month can vary depending on a number of factors, such as his income, lifestyle, and financial goals. However, his spending is likely a significant factor in his net worth.

Investments

Investments are an important part of net worth, as they can provide a source of income and help to grow wealth over time. In the case of Guy Penrod, his investments likely include stocks, bonds, and real estate. These investments can help to increase his net worth if they appreciate in value.

- Stocks: Stocks are shares of ownership in a company. When a company does well, the value of its stock can increase. Guy Penrod may invest in stocks in order to earn a return on his investment.

- Bonds: Bonds are loans that are made to companies or governments. When a bond matures, the investor receives the principal amount of the loan plus interest. Guy Penrod may invest in bonds in order to earn a steady stream of income.

- Real estate: Real estate is land and the buildings on it. Real estate can be a good investment because it can appreciate in value over time. Guy Penrod may invest in real estate in order to earn rental income or to sell the property for a profit.

The value of Guy Penrod's investments can fluctuate over time, depending on market conditions and other factors. However, if his investments perform well, they can help to increase his net worth significantly.

Debt

Debt is a significant factor in net worth, as it represents the amount of money that an individual or organization owes to others. In the case of Guy Penrod, debt could include mortgages, personal loans, credit card balances, and other financial obligations. High levels of debt can reduce net worth and make it more difficult to achieve financial goals.

- Impact of Debt on Net Worth: Debt reduces net worth by decreasing the value of assets. For example, if Guy Penrod has a mortgage of $200,000 and a net worth of $1 million, his actual net worth is only $800,000. This is because the mortgage debt reduces the value of his assets by $200,000.

- Debt Consolidation: Debt consolidation involves combining multiple debts into a single loan, often with a lower interest rate. This can reduce monthly payments and make it easier to manage debt. Guy Penrod may consider debt consolidation if he has multiple high-interest debts.

- Debt Management Plans: Debt management plans are agreements with creditors to reduce interest rates or monthly payments. These plans can help individuals get out of debt more quickly and improve their credit scores. Guy Penrod may consider a debt management plan if he is struggling to keep up with his debt payments.

- Bankruptcy: Bankruptcy is a legal proceeding that allows individuals to discharge their debts. This can be a last resort for individuals who are unable to repay their debts. Guy Penrod should carefully consider the pros and cons of bankruptcy before filing.

Overall, debt can have a significant impact on net worth. By understanding the different types of debt and the impact of debt on net worth, individuals can make informed decisions about how to manage their debt and improve their financial health.

Financial planning

Financial planning is essential for building and maintaining a strong net worth. It involves creating a roadmap to achieve specific financial goals, such as saving for retirement, buying a home, or funding a child's education. By developing a comprehensive financial plan, considering factors such as income, expenses, assets, and liabilities, individuals can make informed decisions about how to allocate their financial resources and manage their debt.

For example, in the case of Guy Penrod, a well-structured financial plan could have helped him accumulate a higher net worth. By setting clear financial goals, such as saving for retirement or investing in real estate, and developing strategies to achieve these goals, he could have increased his net worth over time. Financial planning can also help individuals avoid common financial pitfalls, such as excessive debt or poor investment decisions, which can negatively impact net worth.

In summary, financial planning is a crucial component of building and preserving a strong net worth. By creating a roadmap to achieve specific financial goals, individuals can make informed decisions about how to manage their finances and increase their net worth over time.

Financial stability

Financial stability is closely intertwined with the concept of net worth, particularly in the context of "net worth of Guy Penrod". A high net worth can contribute to financial stability, providing a financial cushion to withstand unexpected events and maintain a consistent standard of living.

- Income and Expenses: Stable income and well-managed expenses are crucial for financial stability. Guy Penrod's consistent earnings from his music career and wise financial decisions have allowed him to maintain a stable financial footing.

- Assets and Liabilities: The composition of assets and liabilities plays a critical role in financial stability. Guy Penrod's diversified investment portfolio and relatively low debt-to-asset ratio contribute to his overall financial stability.

- Emergency Fund: An emergency fund is essential for handling unexpected expenses and financial shocks. Guy Penrod likely maintains a substantial emergency fund, providing him with peace of mind and the ability to respond to unforeseen circumstances.

- Financial Planning: Sound financial planning is vital for long-term financial stability. Guy Penrod's financial advisors and estate planning strategies help ensure his financial well-being now and in the future.

In conclusion, financial stability is a cornerstone of a strong net worth and is essential for maintaining a consistent standard of living. By understanding the components of financial stability and its connection to net worth, we can gain valuable insights into the financial well-being of individuals like Guy Penrod and the strategies they employ to achieve financial success.

Net worth statement

In the context of "net worth of Guy Penrod," a net worth statement plays a crucial role in providing a snapshot of his overall financial health at a specific point in time. This statement is a comprehensive report that details Guy Penrod's assets, liabilities, and net worth, offering valuable insights into his financial standing.

- Assets: Guy Penrod's net worth statement would include a detailed listing of his assets, which may include cash, investments, real estate, and personal property. These assets represent the value of everything he owns.

- Liabilities: The statement would also list Guy Penrod's liabilities, such as mortgages, loans, and credit card balances. These liabilities represent the amount of debt he owes to others, reducing the overall value of his assets.

- Net worth: The net worth statement's most critical component is the calculation of Guy Penrod's net worth. This figure is obtained by subtracting his total liabilities from his total assets. A positive net worth indicates that his assets exceed his liabilities, while a negative net worth suggests that he owes more than he owns.

- Financial analysis: Guy Penrod's net worth statement can be used for financial analysis to assess his financial health and make informed decisions. It can help him identify areas where he can improve his financial position, such as reducing debt or increasing investments.

Overall, a net worth statement is a valuable tool for understanding the "net worth of Guy Penrod." It provides a clear picture of his financial standing, allowing him to make informed decisions about his financial future.

FAQs on "Net Worth of Guy Penrod"

Question 1: How is Guy Penrod's net worth calculated?

Guy Penrod's net worth is calculated by subtracting his total liabilities (debts and obligations) from his total assets (cash, investments, properties, etc.).

Question 2: What factors contribute to Guy Penrod's high net worth?

His successful music career, wise financial decisions, and diversified investments have significantly contributed to his substantial net worth.

Question 3: How does Guy Penrod maintain his financial stability?

Through consistent income, well-managed expenses, and a strong financial plan, Guy Penrod ensures his financial stability and long-term financial well-being.

Question 4: What is the significance of a net worth statement for Guy Penrod?

A net worth statement provides a comprehensive overview of his financial standing at a specific point in time, allowing him to monitor his progress and make informed decisions.

Question 5: How has Guy Penrod's net worth changed over time?

Guy Penrod's net worth has likely grown over time due to his ongoing music career success, strategic investments, and prudent financial management.

Question 6: What can we learn from Guy Penrod's approach to wealth management?

His emphasis on financial planning, diversification, and long-term thinking offers valuable lessons for managing personal finances.

In summary, Guy Penrod's net worth reflects his financial success and prudent management of his assets and liabilities. By understanding the factors contributing to his wealth and the strategies he employs, we can gain insights into effective wealth management practices.

Transition to the next article section: Understanding the intricacies of net worth is crucial for assessing an individual's financial well-being. Let's delve deeper into the components that shape net worth and explore strategies for building and preserving wealth.

Tips for Building and Preserving Wealth

Understanding the concept of net worth is essential for effective wealth management. Here are several tips to help build and preserve your financial well-being:

Tip 1: Create a Budget and Stick to It

A budget is a roadmap for your financial resources, ensuring that your expenses align with your income. Track your income and expenses meticulously to identify areas where you can save and allocate funds wisely.

Tip 2: Invest Regularly

Investing is crucial for growing your wealth over time. Diversify your portfolio across different asset classes, such as stocks, bonds, and real estate, to mitigate risk and maximize returns.

Tip 3: Reduce Debt

High levels of debt can hinder your ability to build wealth. Prioritize paying off high-interest debts and consider consolidating or refinancing to lower your interest rates.

Tip 4: Increase Your Income

Explore opportunities to increase your income through career advancements, side hustles, or investments. Additional income can be reinvested or used to pay down debt, further strengthening your financial position.

Tip 5: Live Below Your Means

Resist the temptation to spend beyond your means. By living a modest lifestyle and avoiding unnecessary expenses, you can accumulate wealth more effectively.

Tip 6: Seek Professional Advice

Consider consulting with a financial advisor or wealth manager for personalized guidance and expertise. They can help you develop a comprehensive financial plan and make informed investment decisions.

Tip 7: Review Your Progress Regularly

Monitor your financial progress regularly and make adjustments as needed. Track your net worth periodically to assess your financial health and identify areas for improvement.

By following these tips, you can build a solid foundation for long-term financial success and preserve your wealth for the future.

In conclusion, managing your net worth effectively requires a combination of financial discipline, strategic planning, and continuous monitoring. Embrace these tips to build and preserve your wealth, securing financial freedom and well-being.

Conclusion

Understanding the concept of "net worth" is crucial for assessing an individual's financial well-being. Through the exploration of Guy Penrod's net worth, this article has highlighted the significance of managing assets, liabilities, and overall financial stability.

Building and preserving wealth requires a multifaceted approach, encompassing budgeting, investing, debt reduction, income growth, and mindful spending. Seeking professional advice and regularly reviewing your progress can further enhance your financial decision-making.

Detail Author:

- Name : Vince Kihn

- Username : ebert.lourdes

- Email : stiedemann.norbert@hotmail.com

- Birthdate : 1993-02-19

- Address : 7258 Hane Mountain Suite 085 Agnesport, MO 77268-5709

- Phone : 854-970-8393

- Company : Nader-Kirlin

- Job : Refrigeration Mechanic

- Bio : Quia debitis autem ex quibusdam repellat nulla. Eveniet sapiente architecto et esse. Reiciendis eum corporis nisi magnam.

Socials

instagram:

- url : https://instagram.com/toney_dev

- username : toney_dev

- bio : Et totam neque quo et ipsa quia. Enim numquam impedit sint rerum.

- followers : 3648

- following : 1323

linkedin:

- url : https://linkedin.com/in/tmitchell

- username : tmitchell

- bio : Veniam aperiam beatae quam quae aut.

- followers : 1482

- following : 543

tiktok:

- url : https://tiktok.com/@toney.mitchell

- username : toney.mitchell

- bio : Molestiae fugit neque itaque dolore omnis voluptas.

- followers : 2814

- following : 2422