David Principe is an American entrepreneur and investor, best known for founding the private equity firm Cerberus Capital Management.

Principe co-founded Cerberus in 1992 with Stephen Feinberg and William Richter. The firm has since grown to become one of the largest private equity firms in the world, with over $50 billion in assets under management. Principe has been instrumental in Cerberus's success, leading the firm's investments in a wide range of industries, including finance, real estate, and manufacturing.

In addition to his work at Cerberus, Principe is also a co-founder of the non-profit organization The Opportunity Network, which provides educational and job training programs to underprivileged youth.

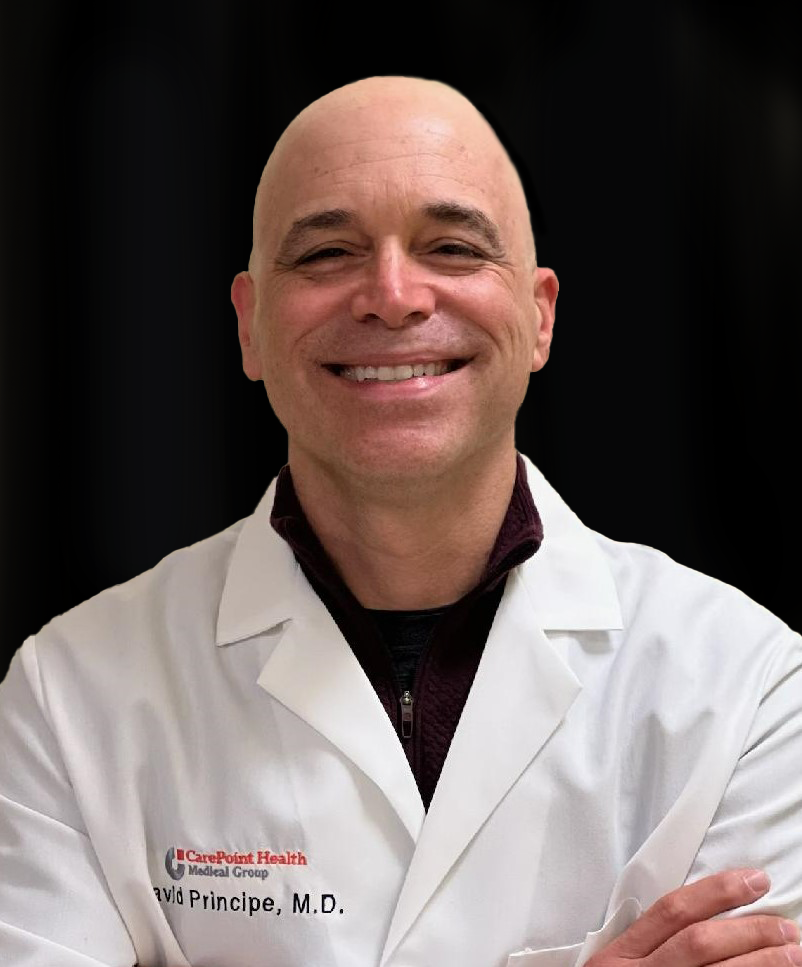

David Principe

David Principe is an American entrepreneur and investor, best known for founding the private equity firm Cerberus Capital Management.

- Founder: Cerberus Capital Management

- Co-founder: The Opportunity Network

- Investor: Private equity, real estate, manufacturing

- Philanthropist: Supports education and job training for underprivileged youth

- Leader: In the private equity industry

- Visionary: Sees opportunities in distressed assets

- Strategist: Develops and executes complex investment plans

- Negotiator: Closes deals that benefit all parties involved

- Mentor: Guides young professionals in the financial industry

David Principe is a highly successful entrepreneur and investor who has made a significant impact on the private equity industry. He is a visionary leader with a strong commitment to philanthropy. He is also a generous mentor who is dedicated to helping others succeed.

| Name | David Principe |

| Birth Date | 1959 |

| Birth Place | New York City, New York |

| Education | A.B., Harvard College; J.D., Harvard Law School |

| Occupation | Entrepreneur, investor, philanthropist |

| Known for | Co-founder and CEO of Cerberus Capital Management |

Founder

In 1992, David Principe co-founded Cerberus Capital Management, a private equity firm that specializes in investing in distressed assets. Cerberus has since grown to become one of the largest private equity firms in the world, with over $50 billion in assets under management.

- Investment strategy: Cerberus typically invests in companies that are undervalued or in financial distress. The firm then works to improve the performance of these companies and sell them for a profit.

- Track record: Cerberus has a strong track record of success. The firm has generated an average annual return of over 15% since its inception.

- Impact on the economy: Cerberus's investments have helped to create jobs and revitalize businesses. The firm has also played a role in stabilizing the financial system during times of economic crisis.

Principe's role as founder and CEO of Cerberus has been instrumental to the firm's success. He is a visionary leader with a deep understanding of the financial markets. He is also a skilled negotiator and dealmaker.

Co-founder

In addition to his work at Cerberus, David Principe is also a co-founder of The Opportunity Network, a non-profit organization that provides educational and job training programs to underprivileged youth.

Principe's involvement with The Opportunity Network reflects his commitment to giving back to the community. He believes that everyone deserves a chance to succeed, regardless of their background.

The Opportunity Network has helped thousands of young people to improve their lives. The organization's programs provide academic support, job training, and mentoring. The Opportunity Network also works to connect young people with employers.

Principe's work with The Opportunity Network is an example of his commitment to making a difference in the world. He is a passionate advocate for education and job training. He believes that these are the keys to unlocking opportunity and creating a more just and equitable society.

Investor

David Principe is a prominent investor in private equity, real estate, and manufacturing. His investment strategy has been instrumental in the success of Cerberus Capital Management, the private equity firm he co-founded in 1992. Cerberus has over $50 billion in assets under management and has generated an average annual return of over 15% since its inception.

Principe's investment philosophy is based on the belief that there is value to be found in distressed assets. Cerberus typically invests in companies that are undervalued or in financial distress. The firm then works to improve the performance of these companies and sell them for a profit.

Principe's investment strategy has been successful in a variety of industries, including private equity, real estate, and manufacturing. For example, Cerberus's investment in Chrysler in 2007 helped to save the automaker from bankruptcy. Cerberus also played a major role in the revitalization of General Motors in 2009.

Principe's success as an investor is due in part to his deep understanding of the financial markets. He is also a skilled negotiator and dealmaker. Principe is a visionary leader who is able to see opportunities that others may miss.

The connection between "Investor: Private equity, real estate, manufacturing" and "david principe" is significant because it highlights Principe's expertise in these areas. Principe's investment strategy has been successful in a variety of industries, and he has a proven track record of generating strong returns for his investors.

Philanthropist

David Principe is a philanthropist who supports education and job training for underprivileged youth. His involvement with The Opportunity Network, a non-profit organization that provides these services, reflects his commitment to giving back to the community and creating opportunities for young people to succeed.

- Providing access to education: The Opportunity Network provides academic support and tutoring to help young people succeed in school. This is essential for underprivileged youth who may not have the same access to educational resources as their more affluent peers.

- Preparing for the workforce: The Opportunity Network also provides job training and mentoring to help young people prepare for the workforce. This is critical for underprivileged youth who may not have the same opportunities to learn about different careers or to develop the skills they need to be successful in the job market.

- Creating pathways to success: The Opportunity Network helps young people to develop the skills and knowledge they need to succeed in college, career, and life. This includes providing them with support and guidance, as well as connecting them with resources and opportunities.

- Investing in the future: Principe's support for The Opportunity Network is an investment in the future. By providing education and job training to underprivileged youth, he is helping to create a more just and equitable society.

Principe's commitment to education and job training for underprivileged youth is an example of his generosity and compassion. He believes that everyone deserves a chance to succeed, regardless of their background. His work with The Opportunity Network is making a real difference in the lives of young people, and it is helping to create a brighter future for all.

Leader

David Principe is a leader in the private equity industry. He is the co-founder and CEO of Cerberus Capital Management, one of the largest private equity firms in the world. Principe has over 30 years of experience in the private equity industry, and he has a deep understanding of the financial markets. He is a skilled negotiator and dealmaker, and he has a proven track record of success.

Principe's leadership has been instrumental to the success of Cerberus. He has led the firm through some of its most challenging investments, including the acquisition of Chrysler in 2007 and the restructuring of General Motors in 2009. Principe's leadership has also been essential to Cerberus's strong financial performance. The firm has generated an average annual return of over 15% since its inception.

Principe's leadership in the private equity industry has had a significant impact on the global economy. Cerberus's investments have helped to create jobs and revitalize businesses. The firm has also played a role in stabilizing the financial system during times of economic crisis.

Visionary

David Principe is a visionary investor who sees opportunities in distressed assets. This has been a key factor in the success of Cerberus Capital Management, the private equity firm he co-founded in 1992. Cerberus has generated an average annual return of over 15% since its inception, and Principe's ability to identify and capitalize on undervalued assets has been a major contributor to this performance.

- Identifying undervalued assets: Principe has a keen eye for identifying undervalued assets, often in companies that are experiencing financial distress. He is able to see the potential in these assets and develop a plan to turn them around.

- Negotiating favorable terms: Principe is a skilled negotiator who is able to negotiate favorable terms for Cerberus's investments. This allows Cerberus to acquire assets at a discount to their intrinsic value.

- Improving operational performance: Once Cerberus has acquired an asset, Principe works to improve its operational performance. He brings in experienced management teams and implements new strategies to increase efficiency and profitability.

- Exiting investments: Principe has a strong track record of exiting investments at a profit. He is able to identify the right time to sell an asset and maximize Cerberus's return on investment.

Principe's ability to see opportunities in distressed assets has been a key factor in the success of Cerberus Capital Management. He is a visionary investor who has generated strong returns for his investors.

Strategist

David Principe is a strategist who develops and executes complex investment plans. This has been a key factor in the success of Cerberus Capital Management, the private equity firm he co-founded in 1992. Cerberus has generated an average annual return of over 15% since its inception, and Principe's ability to develop and execute complex investment plans has been a major contributor to this performance.

Principe's investment plans are often complex and involve multiple stages. He carefully considers the risks and rewards of each investment and develops a plan that is designed to maximize returns. Principe also has a strong track record of executing his plans successfully. He is able to negotiate favorable terms for Cerberus's investments and implement strategies that improve the performance of the businesses that Cerberus acquires.

The ability to develop and execute complex investment plans is a critical skill for any investor. It allows investors to identify and capitalize on opportunities, even in complex and challenging markets. Principe's success as a strategist is a testament to his skill and experience in the investment industry.

Negotiator

David Principe is a skilled negotiator who is able to close deals that benefit all parties involved. This has been a key factor in the success of Cerberus Capital Management, the private equity firm he co-founded in 1992. Cerberus has generated an average annual return of over 15% since its inception, and Principe's ability to negotiate favorable terms for Cerberus's investments has been a major contributor to this performance.

- Understanding the interests of all parties: Principe takes the time to understand the interests of all parties involved in a negotiation. This allows him to develop creative solutions that meet the needs of everyone at the table.

- Building relationships: Principe builds strong relationships with the people he negotiates with. This trust and rapport make it more likely that he will be able to reach a mutually beneficial agreement.

- Being prepared: Principe is always well-prepared for negotiations. He knows the facts and figures inside and out, and he is able to articulate his position clearly and persuasively.

- Being creative: Principe is not afraid to think outside the box in order to find solutions that work for everyone. He is always looking for ways to create value and build consensus.

Principe's ability to negotiate favorable terms for Cerberus's investments has been a major contributor to the firm's success. He is a skilled negotiator who is able to close deals that benefit all parties involved.

Mentor

David Principe is a mentor who guides young professionals in the financial industry. He is passionate about helping others succeed, and he is always willing to share his knowledge and experience. Principe has mentored many young people over the years, and he has had a positive impact on their careers.

One of the most important things that Principe teaches his mentees is the value of hard work. He believes that success is not something that is given to you; it is something that you have to earn. Principe also teaches his mentees the importance of integrity and ethics. He believes that it is important to always do the right thing, even when it is difficult.

Principe's mentorship has had a significant impact on the financial industry. His mentees have gone on to become successful professionals in a variety of fields, including investment banking, private equity, and hedge funds. Principe's mentorship has helped to shape the next generation of leaders in the financial industry.

FAQs About David Principe

This section provides answers to frequently asked questions about David Principe, an American entrepreneur, investor, and philanthropist.

Question 1: What is David Principe best known for?

David Principe is best known for founding Cerberus Capital Management, a private equity firm that specializes in investing in distressed assets.

Question 2: What is David Principe's investment philosophy?

David Principe's investment philosophy is based on the belief that there is value to be found in distressed assets. Cerberus typically invests in companies that are undervalued or in financial distress. The firm then works to improve the performance of these companies and sell them for a profit.

Question 3: What is David Principe's role at Cerberus Capital Management?

David Principe is the co-founder and CEO of Cerberus Capital Management.

Question 4: What is David Principe's philanthropic work?

David Principe is a philanthropist who supports education and job training for underprivileged youth. He is a co-founder of The Opportunity Network, a non-profit organization that provides these services.

Question 5: What is David Principe's leadership style?

David Principe is a visionary leader who is able to see opportunities that others may miss. He is also a skilled negotiator and dealmaker.

Question 6: What are David Principe's career accomplishments?

David Principe has had a successful career in the private equity industry. He is the co-founder and CEO of Cerberus Capital Management, one of the largest private equity firms in the world. Cerberus has generated an average annual return of over 15% since its inception.

Summary

David Principe is a successful entrepreneur, investor, and philanthropist. He is best known for founding Cerberus Capital Management, a private equity firm that specializes in investing in distressed assets. Principe is also a co-founder of The Opportunity Network, a non-profit organization that provides education and job training for underprivileged youth.

Transition to the next article section

For more information about David Principe, please visit his website or LinkedIn profile.

Investing Tips from David Principe

David Principe is a successful investor and entrepreneur. He is the co-founder and CEO of Cerberus Capital Management, a private equity firm that specializes in investing in distressed assets. Principe has over 30 years of experience in the investment industry, and he has a deep understanding of the financial markets. Here are some investing tips from David Principe:

Tip 1: Invest in what you know. Principe believes that it is important to invest in businesses that you understand. This will give you a better chance of making sound investment decisions.

Tip 2: Do your research. Before you invest in any company, it is important to do your research and understand the company's business model, financial, and competitive landscape.

Tip 3: Be patient. Investing is a long-term game. It is important to be patient and let your investments grow over time.

Tip 4: Don't try to time the market. It is impossible to predict when the stock market will go up or down. Instead, focus on investing in good companies and holding them for the long term.

Tip 5: Diversify your portfolio. Don't put all of your eggs in one basket. Diversify your portfolio by investing in a variety of different asset classes, such as stocks, bonds, and real estate.

Summary

These are just a few investing tips from David Principe. By following these tips, you can increase your chances of success in the investment markets.

Conclusion

Investing is a complex and challenging endeavor, but it can also be very rewarding. By following these tips from David Principe, you can increase your chances of success in the investment markets.

Conclusion

David Principe is a successful entrepreneur, investor, and philanthropist. He is best known for founding Cerberus Capital Management, a private equity firm that specializes in investing in distressed assets. Principe is also a co-founder of The Opportunity Network, a non-profit organization that provides education and job training for underprivileged youth.

Principe's success is a testament to his hard work, dedication, and vision. He is a visionary leader who is able to see opportunities that others may miss. He is also a skilled negotiator and dealmaker. Principe's success is not only measured by his financial wealth, but also by the positive impact he has had on the lives of others.

/Dolores-Catania-David-Principe-688c5066c97e413788f1c0827151f744.jpg)

Detail Author:

- Name : Earline Ziemann

- Username : micaela22

- Email : monahan.christiana@moen.org

- Birthdate : 2003-02-09

- Address : 69091 Mohammad Ridges Apt. 781 South Bill, WY 75223

- Phone : +1-781-261-5364

- Company : Schumm, Schamberger and Brown

- Job : Cartographer

- Bio : Consequatur ut officia est qui nesciunt dolores commodi. Ut eos aut quasi. Cupiditate velit unde et. Quibusdam nihil omnis et ut.

Socials

tiktok:

- url : https://tiktok.com/@hermann1970

- username : hermann1970

- bio : Dolorem doloribus perspiciatis nobis repudiandae mollitia quisquam.

- followers : 2954

- following : 388

linkedin:

- url : https://linkedin.com/in/hermannt

- username : hermannt

- bio : Eum assumenda nulla dolorem voluptas velit.

- followers : 5590

- following : 960

facebook:

- url : https://facebook.com/thora9018

- username : thora9018

- bio : Facilis quis neque aut dicta explicabo.

- followers : 3475

- following : 1937

twitter:

- url : https://twitter.com/thora_dev

- username : thora_dev

- bio : Dolor numquam nihil optio minus. Quo sit velit in. Itaque ratione blanditiis dolor fuga iure natus.

- followers : 6369

- following : 1056

instagram:

- url : https://instagram.com/thora_hermann

- username : thora_hermann

- bio : Culpa expedita eveniet blanditiis. Excepturi officia alias distinctio at vero iusto fugiat vero.

- followers : 4662

- following : 2932