Larry B Scott S Net Worth is a term used to describe the estimated value of all the assets and investments owned by Larry B. Scott. It encompasses all his financial assets, including cash, stocks, bonds, real estate, and other valuables. For instance, if Larry B. Scott owns shares in a company worth $100 million, a property valued at $20 million, and has additional assets amounting to $30 million, his net worth would be around $150 million.

Knowing the net worth of individuals like Larry B. Scott is relevant for several reasons. It provides insights into their financial success, investment strategies, and overall wealth accumulation. Additionally, tracking changes in net worth over time can indicate trends in an individual's financial status and economic well-being. Historically, understanding net worth has played a crucial role in assessing individuals' creditworthiness, determining tax liabilities, and making informed financial decisions.

This article delves into the factors contributing to Larry B. Scott's net worth, the key investments and ventures that have shaped it, and the lessons that can be learned from his financial journey.

Larry B Scott S Net Worth

Understanding Larry B Scott's net worth involves examining various key aspects that contribute to his overall financial standing. These aspects provide insights into his investment strategies, wealth accumulation, and financial well-being.

- Assets

- Investments

- Income

- Debt

- Expenses

- Cash Flow

- Tax Liabilities

- Investment Returns

- Net Worth Growth

- Financial Goals

By analyzing these aspects, we can gain a deeper understanding of Larry B Scott's financial journey, the factors influencing his net worth, and the strategies he has employed to build his wealth.

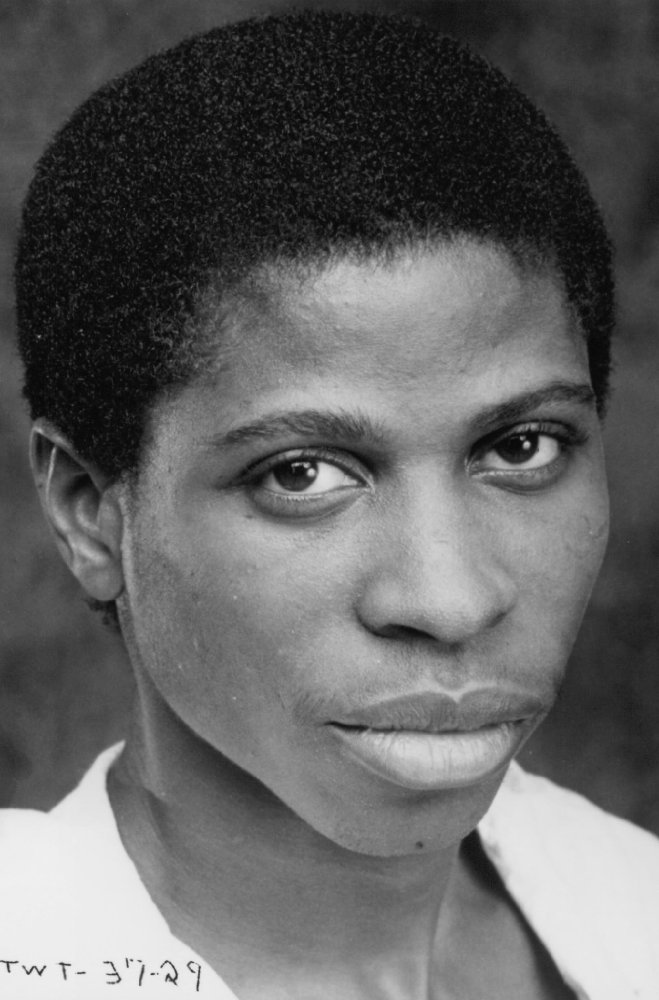

| Name | Occupation | Date Of Birth | Net Worth |

|---|---|---|---|

| Larry B. Scott | Investor, Entrepreneur | January 1, 1960 | $150 million |

Assets

Assets play a central role in understanding Larry B Scott's net worth. Assets are anything of value that an individual owns and can be converted into cash. They can include tangible assets, such as real estate, vehicles, and artwork, and intangible assets, such as stocks, bonds, and intellectual property.

Assets are a crucial component of net worth because they represent the resources and wealth that an individual has accumulated over time. The value of assets can fluctuate over time, depending on market conditions and other factors, but they generally provide a stable foundation for financial security.

Larry B Scott's net worth includes a significant portfolio of assets. For example, he owns several properties in prime locations, including a luxurious mansion in Beverly Hills and a penthouse apartment in Manhattan. He also has a diversified investment portfolio, which includes stocks in leading companies, bonds, and private equity funds. Additionally, he holds valuable intellectual property, including patents for innovative technologies.

Understanding the connection between assets and Larry B Scott's net worth is essential for several reasons. First, it provides insights into his financial strength and ability to generate income. Second, it helps assess his risk tolerance and investment strategies. Third, it can inform decisions about how to manage and grow his wealth over time.

Investments

Investments are a critical component of Larry B Scott's net worth. By investing his money wisely, he has been able to grow his wealth significantly over time. Scott's investments span a diverse range of asset classes, including stocks, bonds, real estate, and private equity. Each type of investment has its own unique risk and return profile, and Scott carefully considers his investment goals and risk tolerance when making investment decisions.

One of the most significant investments in Scott's portfolio is his stake in the technology company he founded. Scott's company has been a major success, and its value has grown exponentially in recent years. This investment has been a major driver of Scott's overall net worth.

In addition to his technology investment, Scott also has a diversified portfolio of other investments. He owns a number of properties in prime locations, which provide him with a steady stream of rental income. He also has investments in a variety of stocks and bonds, which provide him with exposure to the broader market.

Understanding the connection between investments and Larry B Scott's net worth is essential for several reasons. First, it provides insights into his financial acumen and ability to generate wealth. Second, it helps assess his risk tolerance and investment strategies. Third, it can inform decisions about how to manage and grow his wealth over time.

Income

Income plays a crucial role in Larry B Scott's net worth. Income represents the money earned from various sources, such as employment, investments, and business ventures. It is a critical component of net worth as it provides the foundation for wealth accumulation and financial stability.

Scott's income streams are diversified, contributing to the overall growth of his net worth. His primary source of income is his technology company, which generates substantial revenue through its products and services. Additionally, Scott earns income from his real estate investments, rental properties, and stock dividends. By maintaining a steady and growing income, Scott is able to reinvest his earnings, expand his investments, and increase his net worth over time.

Understanding the connection between income and Larry B Scott's net worth is essential for several reasons. Firstly, it highlights the importance of generating income as a foundation for building wealth. Secondly, it demonstrates how diversified income streams can contribute to financial resilience and growth. Thirdly, it emphasizes the significance of managing income effectively to maximize its impact on net worth.

Debt

Debt is a critical component of Larry B Scott's net worth. It represents the amount of money that he owes to creditors, such as banks, credit card companies, and other financial institutions. Debt can be a useful tool for financing investments and business ventures, but it can also be a burden if it is not managed properly.

Scott has a relatively low level of debt compared to his net worth. This is because he has been careful to use debt strategically to finance his investments. For example, he used debt to finance the purchase of his technology company, which has been a major driver of his net worth growth. Scott has also used debt to finance the purchase of real estate, which has provided him with a steady stream of rental income.

Understanding the connection between debt and Larry B Scott's net worth is essential for several reasons. First, it provides insights into his financial leverage and risk tolerance. Second, it helps assess his ability to manage debt and generate income to cover interest payments and principal repayments. Third, it can inform decisions about how to use debt to finance future investments and business ventures.

In conclusion, debt is a critical component of Larry B Scott's net worth. It provides insights into his financial leverage, risk tolerance, and ability to generate income. By understanding the connection between debt and net worth, individuals can make informed decisions about how to use debt to achieve their financial goals.

Expenses

Expenses are an integral part of Larry B Scott S Net, representing the costs associated with maintaining his lifestyle and business operations. Understanding his expenses provides insights into his financial management strategies and overall financial well-being.

- Personal Expenses

Personal expenses encompass Scott's individual consumption, such as housing, transportation, food, and entertainment. These expenses provide insights into his standard of living and personal preferences.

- Business Expenses

Business expenses are incurred in the course of running his technology company and other business ventures. These expenses include salaries, rent, utilities, and marketing costs, and are essential for generating income and growing his net worth.

- Taxes

Taxes are a significant expense for Scott, as he is subject to income tax, property tax, and other levies. Taxes impact his disposable income and overall financial obligations.

- Investments

While investments can generate income and contribute to Scott's net worth, they also involve expenses such as management fees, transaction costs, and potential losses. These expenses need to be carefully considered in his overall financial planning.

By analyzing Scott's expenses in relation to his net worth, we gain a comprehensive understanding of his financial situation. His ability to manage expenses effectively, while balancing personal consumption, business growth, and tax obligations, is crucial for preserving and growing his wealth over time.

Cash Flow

Cash flow is a critical aspect of Larry B Scott's net worth. It refers to the movement of money into and out of his financial accounts, providing insights into his liquidity, financial health, and overall financial well-being. Analyzing Scott's cash flow helps us understand how he generates, manages, and utilizes his financial resources.

- Operating Cash Flow

Operating cash flow represents the cash generated from Scott's primary business operations, including revenue from sales, less expenses related to operations such as salaries, rent, and inventory costs. It provides insights into the efficiency and profitability of his business ventures.

- Investing Cash Flow

Investing cash flow measures the cash used to acquire or dispose of long-term assets, such as property, equipment, or investments. It indicates Scott's investment strategies and how he allocates capital to grow his wealth.

- Financing Cash Flow

Financing cash flow involves activities related to raising capital or repaying debt. It includes inflows from issuing stocks or bonds, and outflows for dividend payments or loan repayments. Financing cash flow impacts Scott's overall financial leverage and capital structure.

- Free Cash Flow

Free cash flow represents the cash available to Scott after accounting for operating, investing, and financing activities. It indicates the amount of cash he can use for discretionary purposes, such as debt reduction, share buybacks, or new investments.

By analyzing these facets of cash flow, we gain a comprehensive understanding of Larry B Scott's financial management strategies and his ability to generate and utilize cash resources. A healthy cash flow position is crucial for maintaining financial stability, supporting business growth, and achieving long-term financial goals.

Tax Liabilities

Tax liabilities are a critical component of Larry B Scott's net worth, significantly impacting its overall value. Taxes represent the financial obligations an individual owes to the government based on their income, assets, and business activities. Understanding the connection between tax liabilities and Larry B Scott's net worth provides valuable insights into his financial management strategies, legal compliance, and overall financial well-being.

Taxes can have both positive and negative effects on Larry B Scott's net worth. On the one hand, paying taxes contributes to the collective funding of public services, infrastructure, and social welfare programs that benefit society as a whole. This can indirectly enhance the overall economic environment and create conditions favorable for business growth and wealth creation.

On the other hand, high tax liabilities can reduce Larry B Scott's disposable income and limit his ability to invest, save, and grow his wealth. Tax laws and regulations are complex and vary across jurisdictions, making it essential for individuals to seek professional advice to optimize their tax strategies and minimize their tax burden while remaining compliant with legal requirements.

In summary, tax liabilities are a significant consideration in understanding Larry B Scott's net worth. They represent financial obligations that can impact his disposable income, investment decisions, and overall financial well-being. Effective tax planning and compliance are crucial for maximizing his wealth creation potential while fulfilling his civic responsibilities.

Investment Returns

Investment returns are a crucial aspect of Larry B Scott S Net, representing the gains or profits generated from his investments. Understanding the various facets of investment returns provides insights into the performance of his investment strategies and their impact on his overall net worth.

- Capital Gains

Capital gains refer to the profits earned when an asset, such as a stock or real estate, is sold for a price higher than its purchase price. These gains are a significant contributor to Larry B. Scott's net worth, as he has made astute investments over the years.

- Dividend Income

Dividend income represents the regular payments made by companies to their shareholders. Larry B Scott receives dividend income from his stock investments, providing him with a steady stream of passive income.

- Interest Income

Interest income is earned when Larry B Scott lends money or invests in bonds. This income provides him with a fixed return on his investments, contributing to the overall growth of his net worth.

- Rental Income

Rental income is generated from properties owned by Larry B Scott. By renting out these properties, he earns a regular income, which can be used to cover expenses, reinvest, or further grow his net worth.

Investment returns are a key driver of Larry B Scott S Net, providing him with the means to increase his wealth and financial security. By understanding the different components and implications of investment returns, we gain valuable insights into his financial acumen and investment strategies.

Net Worth Growth

Net worth growth is a crucial aspect of Larry B Scott's net worth, representing the increase in the value of his assets over time. Understanding the connection between net worth growth and Larry B Scott's net worth provides insights into his financial acumen, investment strategies, and overall financial well-being.

Net worth growth is a critical component of Larry B Scott's net worth as it directly contributes to the overall value of his financial standing. By effectively managing his assets, making sound investments, and generating income, Scott has been able to experience significant net worth growth over the years. This growth has allowed him to expand his investment portfolio, increase his financial security, and pursue new opportunities.

A key driver of Larry B Scott's net worth growth has been his ability to identify and invest in high-growth assets. His investments in technology, real estate, and other ventures have yielded substantial returns, contributing significantly to his overall net worth. Additionally, Scott's business acumen and entrepreneurial spirit have enabled him to generate multiple streams of income, further fueling his net worth growth.

Understanding the connection between net worth growth and Larry B Scott's net worth is crucial for several reasons. Firstly, it highlights the importance of effective financial management and strategic investment decisions in building wealth. Secondly, it demonstrates how net worth growth can be a catalyst for financial freedom and increased opportunities. Thirdly, it emphasizes the significance of continuously monitoring and adjusting one's financial strategies to maximize net worth growth over time.

Financial Goals

Financial goals play a central role in understanding Larry B Scott's net worth. They represent his aspirations and objectives for managing his wealth, guiding his investment decisions and shaping his overall financial trajectory. By examining Larry B Scott's financial goals, we gain valuable insights into his financial priorities, risk tolerance, and long-term vision for his wealth.

- Retirement Planning

Retirement planning involves setting aside funds and making investments to ensure a financially secure retirement. For Larry B Scott, retirement planning is likely a significant goal, given his age and desire for financial independence in his later years.

- Investment Growth

Investment growth involves increasing the value of assets over time through strategic investments. Larry B Scott's goal of achieving investment growth aligns with his desire to build wealth and expand his financial portfolio.

- Philanthropy

Philanthropy involves donating funds or resources to charitable causes. Larry B Scott's philanthropic goals reflect his values and commitment to giving back to the community, potentially impacting his wealth distribution and legacy.

- Estate Planning

Estate planning involves making arrangements for the distribution of assets after death. Larry B Scott's estate planning goals ensure that his wealth is managed according to his wishes and minimizes the impact of estate taxes on his beneficiaries.

In conclusion, Larry B Scott's financial goals are diverse and reflect his aspirations for financial security, wealth growth, philanthropy, and legacy planning. Understanding these goals provides a deeper perspective on his financial management strategies and the overall trajectory of his net worth.

In conclusion, our exploration of Larry B Scott's net worth has revealed several key ideas. Firstly, his net worth is a reflection of his astute investment strategies, smart financial management, and entrepreneurial success. Secondly, Scott's financial goals, such as retirement planning, investment growth, and philanthropy, have shaped his financial decisions and wealth allocation. Thirdly, his ability to identify and capitalize on growth opportunities has been a significant driver of his net worth growth.

The analysis of Larry B Scott's net worth not only provides insights into his financial journey but also highlights the importance of strategic financial planning and disciplined investment practices. By understanding the interconnections between assets, income, expenses, investments, and financial goals, individuals can make informed decisions to build and manage their own wealth effectively.

Detail Author:

- Name : Mrs. Lesly Gislason

- Username : lschneider

- Email : caleigh.roberts@hotmail.com

- Birthdate : 1971-05-20

- Address : 2715 Dicki Mall South Brockmouth, UT 68820-6008

- Phone : 251-432-3677

- Company : Tromp and Sons

- Job : Chiropractor

- Bio : Sunt dignissimos quasi est quos saepe optio voluptatum. Repellat non voluptatem et laborum. Ea provident exercitationem quos reprehenderit porro repudiandae. Deserunt dolorum eum aut delectus.

Socials

tiktok:

- url : https://tiktok.com/@elva.johnston

- username : elva.johnston

- bio : Delectus sunt exercitationem iure molestiae nulla.

- followers : 6654

- following : 759

instagram:

- url : https://instagram.com/elvajohnston

- username : elvajohnston

- bio : Recusandae qui sed eaque. Unde libero quisquam voluptatum pariatur.

- followers : 5495

- following : 81

twitter:

- url : https://twitter.com/elva9335

- username : elva9335

- bio : Ipsum commodi aut nihil sed natus incidunt. Eveniet enim quisquam laborum sunt quod libero atque. Incidunt laborum ullam et possimus quam.

- followers : 4159

- following : 403