"How Much Money Does Jamie" is a question that refers to the net worth of an individual named Jamie. It is a common metric used to assess a person's financial status. For instance, when a news article reports that "Jamie Dimon's net worth is estimated at $1.5 billion," this is a direct answer to the question "How much money does Jamie Dimon have?"

The question "How Much Money Does Jamie" is relevant because it provides insights into individuals' financial success, wealth distribution, and economic trends. It is beneficial for understanding the financial landscape and comparing individuals' financial positions. Historically, the concept of net worth has evolved, particularly since the introduction of financial reporting standards and the rise of the internet.

This article delves into the various factors that determine net worth, including income, assets, liabilities, and overall financial management. It also explores the implications of net worth on an individual's financial well-being and provides tips on building and maintaining a healthy net worth.

How Much Money Does Jamie

The question "How Much Money Does Jamie" encompasses various key aspects that contribute to an individual's financial status. These aspects include:

- Income

- Assets

- Liabilities

- Investments

- Savings

- Expenses

- Financial Management

- Taxation

- Estate Planning

Understanding these aspects is crucial for assessing an individual's financial health and making informed decisions about financial planning. For example, knowing the income and expenses of Jamie provides insights into their cash flow and financial stability. Similarly, understanding the assets, liabilities, and investments of Jamie helps evaluate their net worth and risk profile.

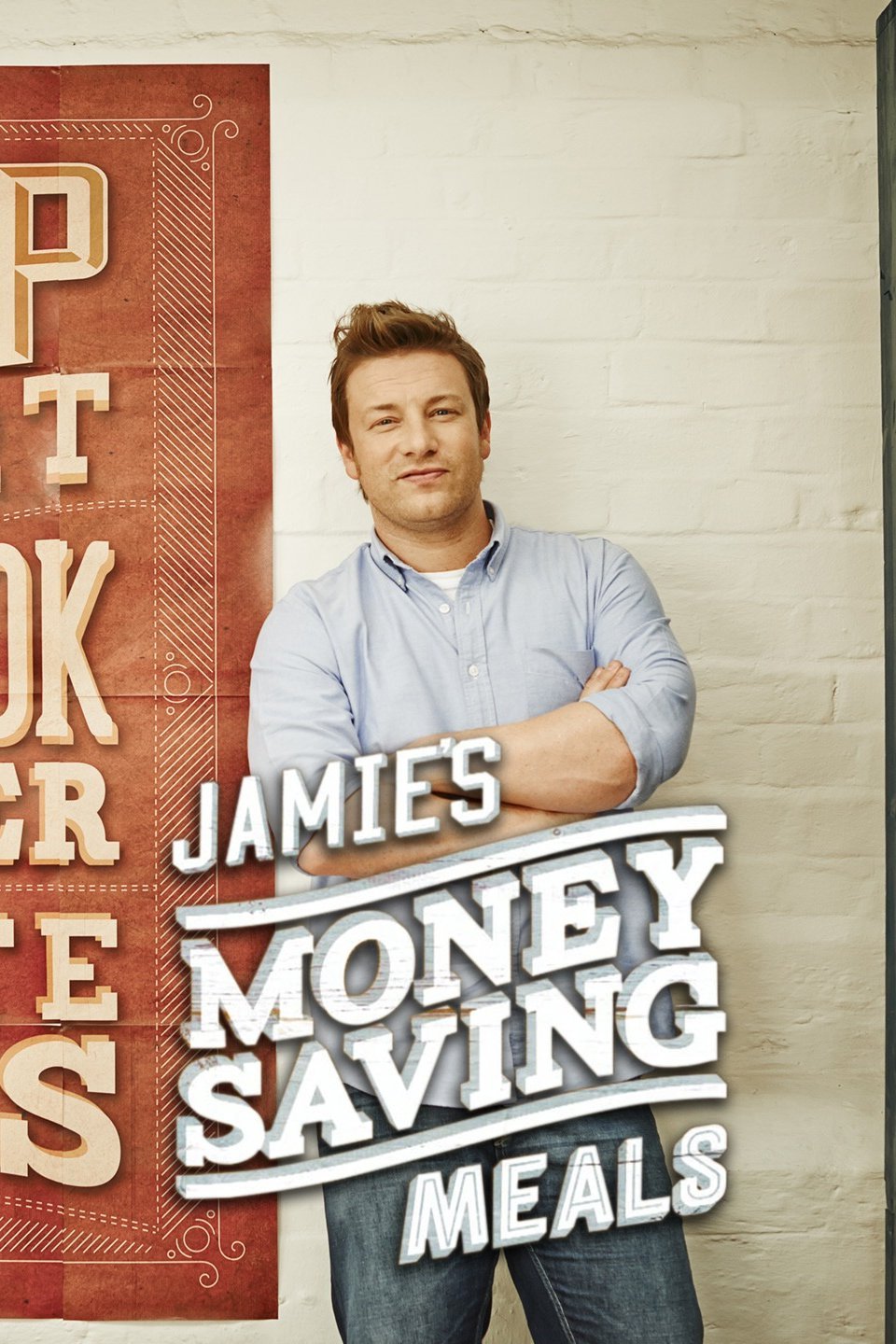

Jamie Oliver is a well-known chef, restaurateur, and television personality. He was born on May 27, 1975, in Clavering, Essex, England. As of 2023, Jamie Oliver's estimated net worth is around $300 million. His main sources of income include his restaurants, cookbooks, television shows, and endorsement deals. Jamie Oliver is known for his emphasis on healthy eating and affordable meals.

Income

Income plays a central role in determining "How Much Money Does Jamie" have. It represents the inflows of money that contribute to an individual's financial status. Income can come from various sources and can be categorized into different types based on its nature and regularity.

- Earned Income

This refers to income earned through employment, self-employment, or professional services. For Jamie Oliver, his earned income primarily comes from his work as a chef, restaurateur, and television personality.

- Passive Income

Passive income is generated from assets or investments that require minimal active involvement. Examples include rental income, dividends, and interest payments. Jamie Oliver may earn passive income from investments in real estate or stocks.

- Portfolio Income

This type of income comes from investments in stocks, bonds, or mutual funds. Portfolio income includes dividends, capital gains, and interest payments. Jamie Oliver's portfolio income may come from his investments in various financial assets.

- Other Income

This category encompasses income from sources that don't fit into the other categories, such as gifts, lottery winnings, or inheritance. Jamie Oliver may receive other income from endorsements, book royalties, or public appearances.

Understanding the various sources and types of income is crucial for evaluating an individual's financial situation. It provides insights into their earning potential, financial stability, and overall wealth accumulation strategy.

Assets

Assets are a crucial component in determining "How Much Money Does Jamie" have. They represent the resources and valuables that contribute to an individual's financial worth. Assets can be categorized into different types based on their nature, liquidity, and risk profile.

One of the key relationships between assets and "How Much Money Does Jamie" is that assets can generate income and appreciate in value over time. For instance, Jamie Oliver owns several restaurants, which are considered assets. These restaurants generate income through sales and can also increase in value if the business is successful. Similarly, Jamie Oliver may invest in stocks or real estate, which can provide passive income through dividends or rental income and potentially appreciate in value.

Understanding the types and value of assets is essential for evaluating an individual's financial health and wealth accumulation strategy. It provides insights into their ability to generate income, manage debt, and withstand financial shocks. For example, having a diversified portfolio of assets, such as a mix of stocks, bonds, and real estate, can help reduce risk and potentially increase overall returns.

In summary, assets play a critical role in determining "How Much Money Does Jamie" have. They represent resources that can generate income, appreciate in value, and contribute to an individual's financial security and well-being. Understanding the types and value of assets is crucial for making informed financial decisions and achieving long-term financial goals.

Liabilities

Liabilities are financial obligations that reduce an individual's net worth and impact their overall financial standing. Understanding liabilities is crucial for evaluating "How Much Money Does Jamie" have, as they represent debts and commitments that must be fulfilled.

- Outstanding Loans

These include personal loans, mortgages, and business loans. Jamie Oliver may have outstanding loans to finance his restaurants or other ventures.

- Credit Card Debt

Unpaid credit card balances accumulate interest and can significantly impact Jamie Oliver's financial situation if not managed properly.

- Accounts Payable

Businesses like Jamie Oliver's restaurants may have accounts payable, which represent unpaid bills to suppliers or vendors.

- Taxes Payable

Unpaid taxes, such as income tax or sales tax, can create liabilities that must be settled with the relevant authorities.

Liabilities play a significant role in determining "How Much Money Does Jamie" have. High levels of debt can strain cash flow, reduce financial flexibility, and impact Jamie Oliver's ability to make investments or save for the future. Managing liabilities effectively is crucial for maintaining a healthy financial position and achieving long-term financial goals.

Investments

Investments are a crucial component of determining "How Much Money Does Jamie" have. Investing involves allocating money with the expectation of generating future income or capital appreciation. Jamie Oliver's investment decisions significantly impact his overall financial status.

Investing allows Jamie Oliver to grow his wealth by putting his money to work in various financial instruments. Stocks, bonds, and real estate are common investment options that offer potential returns over time. For instance, if Jamie Oliver invests in a stock that increases in value, he stands to make a profit when he sells it. Similarly, investing in real estate can generate rental income and potential capital appreciation if the property value rises.

Understanding the connection between investments and "How Much Money Does Jamie" is essential for making informed financial decisions. By investing wisely, Jamie Oliver can increase his net worth, secure his financial future, and achieve his long-term financial goals. Moreover, investments can provide passive income, which can supplement his earned income and reduce his reliance on active work.

Savings

Savings play a central role in determining "How Much Money Does Jamie" have. Savings refer to the portion of income that is not spent but set aside for future use. Jamie Oliver's savings habits significantly impact his overall financial standing.

Savings are critical for several reasons. Firstly, they provide a financial cushion for unexpected expenses or emergencies. Having a healthy savings balance allows Jamie Oliver to handle financial setbacks without incurring debt or jeopardizing his financial security. Secondly, savings enable him to make large purchases, such as a new car or a down payment on a house, without relying solely on loans or credit.

Additionally, savings can be invested to generate passive income. By investing his savings in stocks, bonds, or other financial instruments, Jamie Oliver can earn returns over time, further increasing his net worth. Savings also provide flexibility and financial freedom, allowing him to pursue personal goals, such as travel or early retirement.

In summary, understanding the connection between "Savings" and "How Much Money Does Jamie" is crucial for financial planning and achieving long-term financial goals. By prioritizing saving and investing, Jamie Oliver can secure his financial future, build wealth, and increase his overall financial well-being.

Expenses

Understanding "Expenses" is crucial in determining "How Much Money Does Jamie" have. Expenses represent the outflow of money used to pay for various goods and services, directly impacting Jamie's financial standing. Managing expenses effectively is essential for financial stability and wealth accumulation.

- Fixed Expenses

These are regular expenses that remain relatively constant from month to month, such as rent or mortgage payments, insurance premiums, and car payments. Jamie's fixed expenses provide a baseline for his monthly budget.

- Variable Expenses

These expenses fluctuate in amount from month to month, such as groceries, entertainment, and dining out. Jamie's variable expenses depend on his lifestyle and spending habits.

- Discretionary Expenses

These are non-essential expenses that can be adjusted or eliminated without significantly affecting Jamie's well-being, such as travel, hobbies, and luxury items. Discretionary expenses provide flexibility in his budget.

- Unexpected Expenses

These are unforeseen expenses that arise suddenly, such as medical emergencies or car repairs. Jamie can prepare for unexpected expenses by maintaining an emergency fund.

Analyzing Jamie's expenses offers insights into his financial priorities, spending habits, and areas where he can optimize his budget. By minimizing unnecessary expenses, increasing income, or exploring additional income streams, Jamie can improve his overall financial health and increase his net worth.

Financial Management

Financial management is the process of planning, organizing, directing, and controlling financial resources to achieve specific financial goals. It involves activities such as budgeting, investing, managing cash flow, and making financial decisions. Jamie Oliver's financial management practices significantly impact "How Much Money Does Jamie" have.

Effective financial management enables Jamie Oliver to make informed decisions about his income, expenses, assets, and liabilities. By creating a budget, he can track his cash flow, identify areas for improvement, and prioritize his financial goals. Sound investment strategies can help him grow his wealth over time and generate passive income. Moreover, managing cash flow effectively ensures that Jamie Oliver has sufficient liquidity to meet his financial obligations and take advantage of opportunities.

In summary, financial management is a critical component of determining "How Much Money Does Jamie" have. By implementing sound financial management practices, Jamie Oliver can optimize his financial resources, increase his net worth, and achieve his long-term financial goals. Understanding the connection between financial management and "How Much Money Does Jamie" is crucial for individuals seeking to improve their financial well-being and make informed financial decisions.

Taxation

Taxation plays a crucial role in determining "How Much Money Does Jamie" have. Taxes are mandatory levies imposed by government entities on individuals and businesses to generate revenue for public services and infrastructure. Understanding the relationship between taxation and "How Much Money Does Jamie" is essential for financial planning and decision-making.

Taxation directly impacts Jamie's disposable income and net worth. Income taxes, such as personal income tax or corporate tax, reduce Jamie's after-tax income, affecting his cash flow and savings potential. Additionally, taxes on assets, such as property tax or capital gains tax, can impact the value of Jamie's investments and overall wealth. Effective tax planning and optimization can help Jamie minimize his tax liability and maximize his financial resources.

Real-life examples within "How Much Money Does Jamie" illustrate the significance of taxation. Jamie Oliver, the renowned chef and restaurateur, is subject to various taxes, including income tax on his earnings, sales tax on restaurant revenue, and property tax on his business premises. The amount of tax Jamie pays depends on his income, expenses, and tax deductions. Understanding the tax implications of his financial decisions allows Jamie to make informed choices that optimize his financial position.

Practically, this understanding helps individuals like Jamie make informed decisions about their income, investments, and expenses to minimize their tax liability. It also highlights the importance of tax compliance and the consequences of tax evasion or avoidance. By fulfilling tax obligations, individuals contribute to the public good while ensuring their financial well-being.

Estate Planning

Estate planning plays a pivotal role in determining "How Much Money Does Jamie" have in the long run. It involves devising a strategy to manage and distribute assets during one's lifetime and after death. Effective estate planning ensures that Jamie's wealth is preserved, distributed according to his wishes, and minimizes the tax burden on his beneficiaries.

- Asset Allocation

Estate planning involves allocating assets strategically to maximize their value and minimize taxes. Jamie may choose to diversify his portfolio, invest in tax-advantaged accounts, or establish trusts to preserve his wealth.

- Inheritance Planning

Through estate planning, Jamie can specify how his assets will be distributed upon his death. He can create a will or trust to ensure that his beneficiaries receive their inheritances in a timely and efficient manner.

- Tax Minimization

Estate planning offers various strategies to reduce tax liability. Jamie can utilize trusts, charitable giving, and other techniques to minimize estate taxes and maximize the value of his inheritance.

In summary, estate planning is crucial for "How Much Money Does Jamie" have, as it enables him to control the distribution of his wealth, minimize taxes, and protect his assets. By implementing a comprehensive estate plan, Jamie can ensure that his financial legacy aligns with his wishes and provides for his loved ones.

This article has delved into the multifaceted factors that determine "How Much Money Does Jamie" have, encompassing income, assets, liabilities, investments, savings, expenses, financial management, taxation, and estate planning. Understanding these components provides a comprehensive view of Jamie's financial well-being and the strategies he employs to manage his wealth.

Key takeaways include the interconnectedness of these elements. Income and expenses form the foundation of cash flow, while assets and liabilities impact net worth. Investments and savings contribute to wealth accumulation and financial security. Effective financial management, taxation strategies, and estate planning ensure the preservation and distribution of wealth according to Jamie's wishes. By considering these factors holistically, Jamie can make informed financial decisions and achieve his long-term financial goals.

Detail Author:

- Name : Delphine Davis

- Username : iadams

- Email : schumm.baron@hotmail.com

- Birthdate : 2002-08-15

- Address : 3720 Hailie Flat Branditown, OR 61680

- Phone : 505.989.0309

- Company : Kessler-Auer

- Job : Environmental Scientist

- Bio : Ipsum quo pariatur odio. Dolorem culpa iusto et est sed similique adipisci in. Quam veritatis modi illum facere aut ducimus recusandae.

Socials

twitter:

- url : https://twitter.com/ruthe.abshire

- username : ruthe.abshire

- bio : Illum animi libero ut ullam odio omnis aut. Ea adipisci dolor quae maiores nihil consequatur. Quia qui reprehenderit aliquam et iste vel et suscipit.

- followers : 3388

- following : 345

linkedin:

- url : https://linkedin.com/in/ruthe141

- username : ruthe141

- bio : Facere tempore adipisci ex ipsa est ab.

- followers : 3450

- following : 2434

tiktok:

- url : https://tiktok.com/@abshirer

- username : abshirer

- bio : Ratione rerum dolorum et dolore. Blanditiis sunt perferendis qui.

- followers : 6048

- following : 2287

instagram:

- url : https://instagram.com/rutheabshire

- username : rutheabshire

- bio : Saepe vitae nostrum ut in delectus. Maxime nam esse incidunt.

- followers : 1844

- following : 921