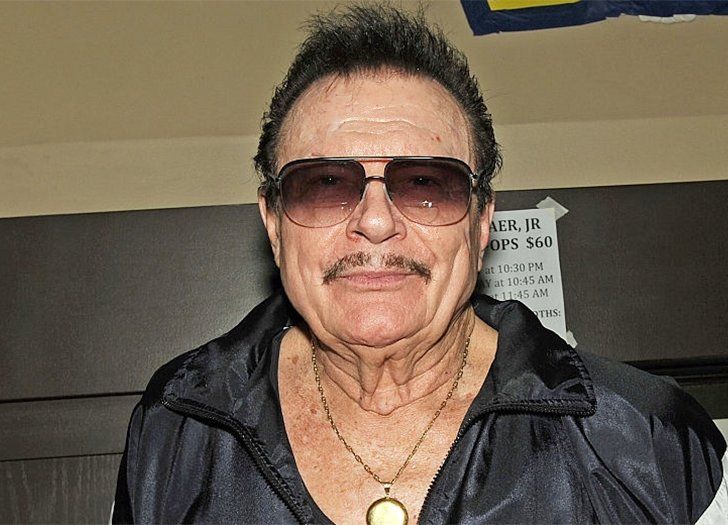

Max Baer Jr Net Worth represents the total financial value of an individual's assets, minus their liabilities. It provides a snapshot of one's financial status at a particular point in time. For instance, the net worth of American actor, producer, and screenwriter Max Baer Jr. was estimated to be around $3 million at the time of his death.

Understanding net worth is important for managing personal finances and making informed investments. It can help individuals assess their financial health and make adjustments to their spending and saving habits. Historically, the concept of net worth has evolved from simple accounting practices to a sophisticated tool utilized by economists and financial advisors.

This article delves into the specifics of Max Baer Jr's net worth, examining his career, investments, and notable financial decisions. It provides insights into the factors that contributed to his financial success and the lessons that can be learned from his experiences.

Max Baer Jr. Net Worth

The essential aspects of Max Baer Jr.'s net worth provide insights into his financial status, career trajectory, and investment strategies. Understanding these aspects is crucial for comprehending his financial success and the factors that contributed to it.

- Income: Acting, producing, screenwriting

- Investments: Real estate, stocks, bonds

- Expenditures: Lifestyle, taxes, charitable donations

- Assets: Properties, vehicles, investments

- Liabilities: Mortgages, loans, debts

- Financial Planning: Estate planning, retirement planning

- Tax Strategies: Minimizing tax liability

- Investment Performance: Return on investments

- Financial Advisors: Role in managing finances

These aspects are interconnected and provide a comprehensive view of Max Baer Jr.'s financial well-being. By analyzing his income sources, investments, and financial planning, we can gain valuable insights into the strategies he employed to accumulate and preserve his wealth. Additionally, understanding the role of financial advisors and tax strategies can provide valuable lessons for managing personal finances effectively.

Income

The success of Max Baer Jr. as an actor, producer, and screenwriter served as a significant driver of his net worth. His income from these creative endeavors played a pivotal role in shaping his financial well-being.

Baer Jr.'s acting career spanned several decades, with notable roles in films such as "The Beverly Hillbillies" and "The Love Boat." His talent and dedication to his craft earned him widespread recognition and financial rewards. Additionally, his involvement in producing and screenwriting further expanded his income streams, contributing to his overall net worth.

The practical significance of understanding the connection between income from acting, producing, and screenwriting and Max Baer Jr.'s net worth lies in its implications for personal finance management. Individuals pursuing careers in the entertainment industry can draw inspiration from Baer Jr.'s success. By developing their skills, building a strong portfolio, and seeking opportunities in various entertainment disciplines, they can increase their earning potential and contribute to their financial growth.

Investments

Max Baer Jr.'s investment portfolio, comprising real estate, stocks, and bonds, played a significant role in shaping his overall net worth. By diversifying his investments across these asset classes, Baer Jr. was able to mitigate risk and maximize his returns.

- Real estate: Baer Jr. invested heavily in real estate, acquiring properties in various locations. Rental income and potential appreciation contributed to his net worth.

- Stocks: Baer Jr.'s stock investments spanned multiple industries, providing exposure to growth opportunities and dividends.

- Bonds: Baer Jr. also held bonds, which provided a steady stream of income and helped balance the riskier components of his portfolio.

- Diversification: The diversification of Baer Jr.'s investments across real estate, stocks, and bonds allowed him to spread his risk and enhance his overall returns.

In conclusion, Max Baer Jr.'s investments in real estate, stocks, and bonds were a crucial aspect of his net worth. By carefully allocating his assets and diversifying his portfolio, Baer Jr. was able to achieve financial success and secure his financial future.

Expenditures

Expenditures, encompassing lifestyle choices, tax obligations, and charitable donations, are integral components of Max Baer Jr.'s net worth. These expenses affect his financial standing and provide insights into his priorities and values.

Lifestyle expenditures, such as housing, transportation, and entertainment, directly impact Baer Jr.'s net worth. His decisions regarding the allocation of funds for these expenses influence his overall financial well-being. Tax obligations, including income, property, and sales taxes, are mandatory expenses that reduce his net worth. Baer Jr.'s charitable donations, motivated by philanthropic interests, also affect his financial position.

Understanding the relationship between expenditures and net worth is crucial for effective financial management. Individuals can optimize their financial plans by carefully considering their spending habits, tax liabilities, and charitable giving. By analyzing Baer Jr.'s expenditures, we gain valuable insights into the delicate balance between personal consumption, financial obligations, and social responsibility.

Assets

Assets, encompassing properties, vehicles, and investments, constitute a vital component of Max Baer Jr.'s net worth, offering insights into his financial holdings and overall financial well-being.

- Real estate: Baer Jr. owned multiple properties, including residential and commercial buildings, generating rental income and potential capital appreciation.

- Vehicles: His collection of classic and luxury vehicles represented both a personal passion and a valuable asset.

- Investments: Baer Jr.'s investment portfolio included stocks, bonds, and mutual funds, providing diversification and potential for long-term growth.

- Intellectual property: As an actor, producer, and screenwriter, Baer Jr. held rights to his creative works, contributing to his overall net worth.

These assets played a significant role in shaping Baer Jr.'s financial security and provided a foundation for his future financial well-being. By carefully managing and leveraging his assets, Baer Jr. was able to maintain a comfortable lifestyle and achieve financial success.

Liabilities

Liabilities, such as mortgages, loans, and debts, represent financial obligations that reduce Max Baer Jr.'s net worth. These liabilities arise from various financial transactions, including property purchases, business ventures, and personal expenses.

Understanding the relationship between liabilities and net worth is crucial for assessing financial health. Liabilities directly impact an individual's financial standing by decreasing their overall net worth. As Baer Jr. incurs more liabilities, the value of his net worth decreases. Conversely, reducing liabilities through debt repayment or asset sales can positively impact his net worth.

In Baer Jr.'s case, his liabilities may include mortgages on his properties, loans for business investments, or personal debts. By carefully managing these liabilities, Baer Jr. can maintain his financial stability and ensure that his net worth remains positive. Real-life examples of Baer Jr.'s liabilities could include a mortgage on his Beverly Hills mansion or a loan taken out to finance a film production.

Understanding the connection between liabilities and net worth is essential for effective financial planning. Individuals can make informed decisions about their spending, saving, and investment strategies by considering the impact of liabilities on their overall financial picture. By managing liabilities strategically, Max Baer Jr. and others can optimize their financial well-being and achieve long-term financial success.

Financial Planning

Financial planning plays a crucial role in determining Max Baer Jr.'s net worth. Estate planning and retirement planning are essential components that ensure his financial security and legacy. By proactively managing his finances, Baer Jr. safeguards his wealth and provides for his future and the well-being of his loved ones.

Estate planning involves organizing and distributing one's assets after death. It includes creating a will or trust to ensure that Baer Jr.'s wishes are carried out, minimizing estate taxes, and providing for the distribution of his assets to his beneficiaries. Effective estate planning ensures that Baer Jr.'s legacy is preserved and that his assets are managed according to his intentions.

Retirement planning focuses on accumulating savings and investments to maintain a comfortable lifestyle during retirement. Baer Jr.'s retirement planning involves setting financial goals, investing wisely, and maximizing tax-advantaged accounts. By planning for retirement, he ensures financial independence and security in his later years, reducing the risk of financial strain or dependence on others.

Understanding the connection between financial planning and net worth is essential for individuals seeking financial well-being. By implementing sound financial planning strategies, Max Baer Jr. and others can optimize their net worth, protect their assets, and secure their financial futures. Effective financial planning empowers individuals to achieve their financial goals and live a secure and fulfilling life, regardless of their age or circumstances.

Tax Strategies

Tax strategies play a crucial role in maximizing Max Baer Jr.'s net worth by reducing his tax obligations. By implementing effective tax strategies, Baer Jr. can legally minimize the amount of taxes he pays, thereby increasing his overall financial wealth.

One of the key components of tax strategies is tax planning. Baer Jr.'s financial team likely engages in proactive tax planning to identify potential tax deductions, credits, and exemptions that can reduce his tax liability. This involves analyzing his income, expenses, investments, and other financial factors to optimize his tax position.

A real-life example of a tax strategy employed by Baer Jr. could be the utilization of tax-advantaged retirement accounts, such as 401(k)s or IRAs. Contributions to these accounts are typically tax-deductible, meaning they reduce Baer Jr.'s current taxable income. Additionally, the earnings within these accounts grow tax-deferred, further minimizing his overall tax burden.

Understanding the connection between tax strategies and net worth is essential for individuals seeking to preserve and grow their wealth. By implementing sound tax strategies, Max Baer Jr. and others can reduce their tax liability, increase their net worth, and achieve long-term financial success. Effective tax planning empowers individuals to make informed decisions about their finances and maximize their financial well-being.

Investment Performance

Investment Performance, measured as the Return on Investments (ROI), holds a significant connection to Max Baer Jr.'s Net Worth. ROI represents the profit or loss generated from investments, directly influencing the overall value of his financial assets.

Positive ROI contributes to an increase in Max Baer Jr.'s Net Worth. For instance, if he invests in stocks that appreciate in value, the ROI on those investments will increase his Net Worth. Conversely, negative ROI, such as a loss incurred on a real estate investment, will decrease his Net Worth. Therefore, consistent positive ROI on investments is crucial for maintaining and growing Max Baer Jr.'s Net Worth.

To illustrate, consider Max Baer Jr.'s investment in a classic car that he purchased for $100,000. If he later sells the car for $120,000, he has generated a positive ROI of $20,000. This ROI directly adds to his Net Worth, increasing it from its previous value. Understanding this relationship is vital for investors seeking to maximize their financial gains and preserve their Net Worth.

Financial Advisors

Financial advisors play a crucial role in managing Max Baer Jr.'s Net Worth, contributing to its growth and preservation through expert financial guidance and strategic planning. They provide personalized advice tailored to his unique financial situation, considering his income, expenses, investments, and long-term financial goals.

The relationship between financial advisors and Max Baer Jr.'s Net Worth is reciprocal. Effective financial management directly influences the growth of his Net Worth, as advisors help him make informed decisions about investments, tax strategies, and estate planning. Conversely, a well-managed Net Worth provides a solid foundation for implementing financial strategies and achieving long-term financial objectives.

Real-life examples of financial advisors' roles in Max Baer Jr.'s financial affairs include managing his investment portfolio, advising on real estate acquisitions, and assisting with tax optimization strategies. By leveraging their expertise, financial advisors help Baer Jr. navigate complex financial landscapes, minimize risks, and maximize returns.

Understanding the connection between financial advisors and Net Worth is essential for individuals seeking to optimize their financial well-being. Financial advisors provide invaluable guidance, helping individuals make informed financial decisions, plan for the future, and secure their financial futures.

Max Baer Jr.'s Net Worth, a testament to his financial acumen and savvy investments, provides valuable insights into the intricate relationship between wealth management and overall financial well-being. The exploration of his income sources, investment strategies, and financial planning techniques unveils a roadmap for building and preserving wealth. Key findings include the importance of income diversification, prudent investment allocation, and strategic tax planning in maximizing Net Worth.

The interconnectedness of these elements highlights the multifaceted nature of wealth management. A well-rounded financial portfolio, coupled with sound financial planning, serves as a cornerstone for long-term financial success. Max Baer Jr.'s Net Worth serves as a reminder that financial well-being is an ongoing journey, requiring constant attention and a commitment to informed decision-making. By understanding the principles that have shaped his financial success, individuals can navigate their own financial paths with greater confidence and achieve their long-term financial goals.

Detail Author:

- Name : Mafalda Barton

- Username : chelsie85

- Email : gorczany.jamal@gmail.com

- Birthdate : 1975-07-05

- Address : 720 Heller Oval South Lailabury, ND 64388-4443

- Phone : (276) 767-6999

- Company : Murray Ltd

- Job : Bench Jeweler

- Bio : Quod ut eaque minima doloremque. Nobis esse dolores corporis eveniet corrupti commodi et. Laborum rerum nostrum qui quia enim. Nemo enim veniam aut asperiores magnam veritatis minus mollitia.

Socials

linkedin:

- url : https://linkedin.com/in/purdy1994

- username : purdy1994

- bio : Corrupti et corporis quod culpa inventore.

- followers : 6914

- following : 349

instagram:

- url : https://instagram.com/purdy1988

- username : purdy1988

- bio : Nemo labore nam rem sit veritatis. Dolorem inventore deserunt suscipit ut id.

- followers : 5742

- following : 658