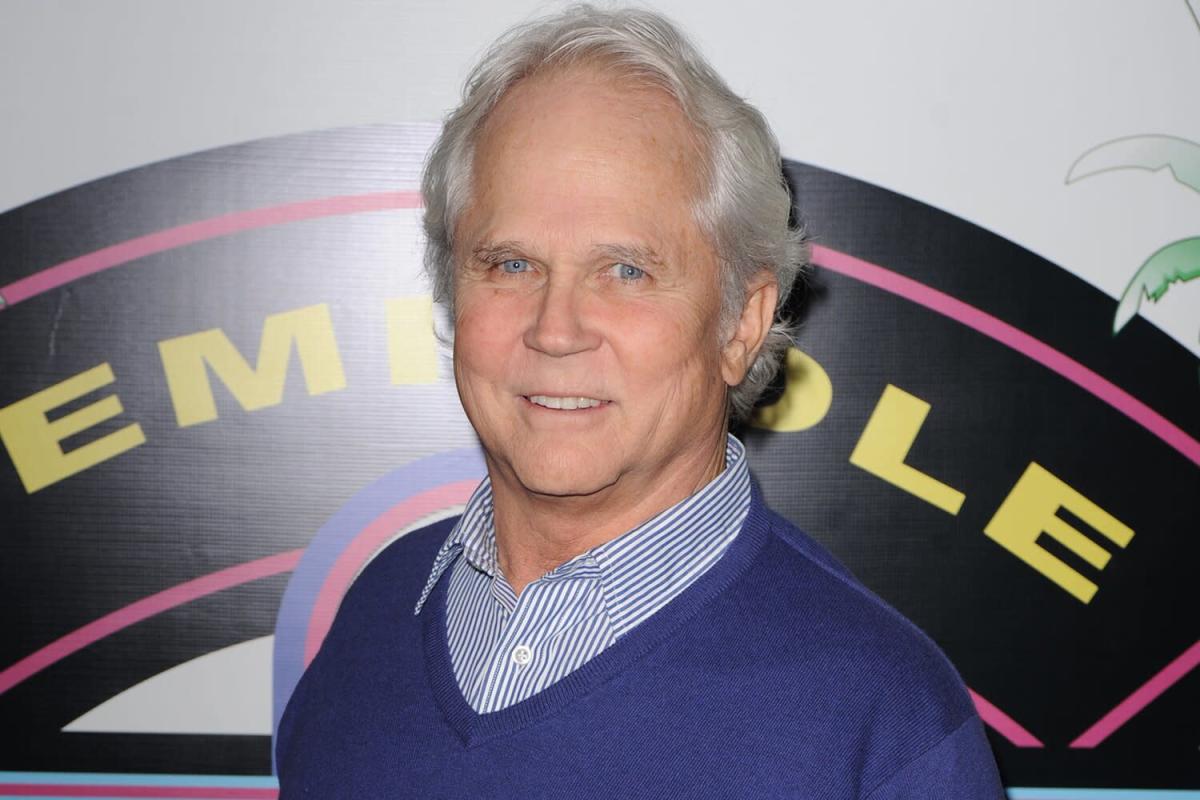

Net worth of Tony Dow refers to the total value of the assets owned by the American actor, director, and producer, Tony Dow, minus the total value of his liabilities.

Tony Dow's net worth is estimated to be around $4 million. He has earned his wealth through his successful career in the entertainment industry. Dow is best known for his role as Wally Cleaver on the popular television series Leave It to Beaver. He has also appeared in numerous other television shows and films, and has directed and produced several films and television shows.

Tony Dow's net worth is a testament to his success in the entertainment industry. He has been able to build a substantial fortune through his hard work and dedication.

Net Worth of Tony Dow

Tony Dow's net worth is estimated to be around $4 million. He has earned his wealth through his successful career in the entertainment industry. Dow is best known for his role as Wally Cleaver on the popular television series Leave It to Beaver. He has also appeared in numerous other television shows and films, and has directed and produced several films and television shows.

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Savings

- Debt

- Equity

- Cash flow

- Financial planning

These are just some of the key aspects that affect Tony Dow's net worth. By carefully managing his finances, Dow has been able to build a substantial fortune. He is a role model for anyone who wants to achieve financial success.

| Name | Tony Dow |

|---|---|

| Occupation | Actor, director, producer |

| Net worth | $4 million |

| Date of birth | April 13, 1945 |

| Place of birth | Hollywood, California |

| Spouse | Lauren Shulkind (m. 1980) |

| Children | Christopher Dow |

Assets

Assets are anything of value that a person or company owns. They can be tangible, such as a house or a car, or intangible, such as a stock or a bond. Assets are important because they represent the value of a person or company's wealth. The more assets a person or company has, the wealthier they are.

Net worth is the value of a person or company's assets minus the value of their liabilities. In other words, it is the value of what a person or company owns outright. Assets are an important component of net worth because they represent the value of a person or company's wealth. The more assets a person or company has, the higher their net worth will be.

Tony Dow's net worth is estimated to be around $4 million. He has earned his wealth through his successful career in the entertainment industry. Dow is best known for his role as Wally Cleaver on the popular television series Leave It to Beaver. He has also appeared in numerous other television shows and films, and has directed and produced several films and television shows.

Dow's assets include his house, his car, his investments, and his savings. He has also built up a substantial amount of equity in his home. Dow's assets are important because they represent the value of his wealth. The more assets he has, the higher his net worth will be.

Liabilities

Liabilities are debts or obligations that a person or company owes to another person or company. They can be short-term, such as a credit card bill, or long-term, such as a mortgage. Liabilities are important because they represent the amount of money that a person or company owes. The more liabilities a person or company has, the less money they have available to invest or save.

Net worth is the value of a person or company's assets minus the value of their liabilities. In other words, it is the value of what a person or company owns outright. Liabilities are an important component of net worth because they represent the amount of money that a person or company owes. The more liabilities a person or company has, the lower their net worth will be.

Tony Dow's net worth is estimated to be around $4 million. He has earned his wealth through his successful career in the entertainment industry. Dow is best known for his role as Wally Cleaver on the popular television series Leave It to Beaver. He has also appeared in numerous other television shows and films, and has directed and produced several films and television shows.

Dow's liabilities include his mortgage, his car loan, and his credit card debt. He also has some outstanding legal bills. Dow's liabilities are important because they represent the amount of money that he owes. The more liabilities he has, the lower his net worth will be.

Income

Income is the money that a person or company earns from their work or investments. It is an important component of net worth because it represents the amount of money that a person or company has available to save or invest.

Tony Dow's net worth is estimated to be around $4 million. He has earned his wealth through his successful career in the entertainment industry. Dow is best known for his role as Wally Cleaver on the popular television series Leave It to Beaver. He has also appeared in numerous other television shows and films, and has directed and produced several films and television shows.

Dow's income comes from a variety of sources, including acting, directing, producing, and investing. He has also earned money from endorsements and personal appearances.

Dow's income is important because it has allowed him to build up his net worth. The more income he earns, the more money he has available to save or invest. This has helped him to build a substantial fortune.

The connection between income and net worth is important to understand because it shows how income can be used to build wealth. By earning a steady income and saving or investing it wisely, it is possible to build a substantial net worth over time.

Expenses

Expenses are the costs that a person or company incurs in the course of their business or personal life. They can be fixed, such as rent or mortgage payments, or variable, such as food or entertainment expenses. Expenses are important because they represent the amount of money that a person or company spends each month. The more expenses a person or company has, the less money they have available to save or invest.

Net worth is the value of a person or company's assets minus the value of their liabilities. In other words, it is the value of what a person or company owns outright. Expenses are an important component of net worth because they represent the amount of money that a person or company spends each month. The more expenses a person or company has, the less money they have available to save or invest. This can have a negative impact on their net worth.

Tony Dow's net worth is estimated to be around $4 million. He has earned his wealth through his successful career in the entertainment industry. Dow is best known for his role as Wally Cleaver on the popular television series Leave It to Beaver. He has also appeared in numerous other television shows and films, and has directed and produced several films and television shows.

Dow's expenses include his mortgage, his car payment, his food expenses, and his entertainment expenses. Dow's expenses are important because they represent the amount of money that he spends each month. The more expenses he has, the less money he has available to save or invest. This can have a negative impact on his net worth.

It is important to track your expenses so that you can see where your money is going. Once you know where your money is going, you can start to make changes to reduce your expenses. This can help you to save more money and increase your net worth.

Investments

Investments are an important component of net worth. They can help to increase a person's wealth over time. Tony Dow has made a number of wise investments over the years, which have helped to increase his net worth to an estimated $4 million.

One of the most important investments that Dow has made is in real estate. He owns several properties, including a house in Los Angeles and a vacation home in Palm Springs. Real estate can be a good investment because it can appreciate in value over time. Dow has also invested in stocks and bonds. Stocks are shares of ownership in a company. Bonds are loans that a person or company makes to another person or company. Stocks and bonds can be good investments because they can provide income and capital gains.

Dow's investments have helped him to increase his net worth and achieve financial success. By investing wisely, he has been able to build a comfortable lifestyle for himself and his family.

The connection between investments and net worth is important to understand because it shows how investments can be used to build wealth. By investing wisely, it is possible to increase your net worth over time. This can help you to achieve financial success and live a more comfortable life.

Savings

Savings are an important part of net worth. They represent the amount of money that a person has set aside for future use. Tony Dow has accumulated a substantial amount of savings over the years, which has helped to increase his net worth to an estimated $4 million.

- Emergency fund

An emergency fund is a savings account that is set aside for unexpected expenses, such as a medical emergency or a car repair. Tony Dow has a healthy emergency fund, which gives him peace of mind and financial security.

- Retirement savings

Retirement savings are savings that are set aside for retirement. Tony Dow has been saving for retirement since he was in his early twenties. He has a diversified retirement portfolio that includes stocks, bonds, and real estate.

- Short-term savings

Short-term savings are savings that are set aside for short-term goals, such as a down payment on a house or a new car. Tony Dow has short-term savings goals, such as saving for a new car.

- Long-term savings

Long-term savings are savings that are set aside for long-term goals, such as a child's education or a comfortable retirement. Tony Dow has long-term savings goals, such as saving for his children's education.

Tony Dow's savings have helped him to achieve financial success. By saving wisely, he has been able to build a comfortable lifestyle for himself and his family.

Debt

Debt is a major factor that can affect an individual's net worth. Tony Dow, like many people, has debt. Debt can come in many forms, such as credit card debt, student loans, and mortgages. It's important to understand how debt can impact net worth and take steps to manage debt wisely.

- Type of Debt

There are two main types of debt: secured debt and unsecured debt. Secured debt is backed by collateral, such as a house or a car. Unsecured debt is not backed by collateral. Credit card debt and personal loans are examples of unsecured debt. - Interest Rates

The interest rate on a debt is the cost of borrowing money. Interest rates can vary depending on the type of debt, the lender, and the borrower's credit score. High interest rates can make it difficult to pay off debt and can increase the total amount of interest paid over the life of the loan. - Debt-to-Income Ratio

The debt-to-income ratio is a measure of how much debt a person has relative to their income. Lenders use the debt-to-income ratio to assess a borrower's ability to repay a loan. A high debt-to-income ratio can make it difficult to qualify for loans and can lead to higher interest rates. - Impact on Net Worth

Debt can have a negative impact on net worth. This is because debt is considered a liability. Liabilities are subtracted from assets to calculate net worth. The more debt a person has, the lower their net worth will be.

Tony Dow has managed his debt wisely. He has a low debt-to-income ratio and has never missed a payment. As a result, his debt has not had a negative impact on his net worth. In fact, his net worth has increased over time as he has paid down his debt and increased his assets.

Debt can be a useful tool if it is used wisely. However, it is important to understand the different types of debt, interest rates, and debt-to-income ratios. By managing debt wisely, individuals can avoid the negative impact that debt can have on their net worth.

Equity

Equity is the value of an asset minus the amount of any liens or encumbrances on the asset. In other words, it is the value of an asset that is owned outright. Equity is an important component of net worth because it represents the value of an asset that can be sold or used as collateral for a loan. The more equity a person has, the higher their net worth will be.

Tony Dow has a significant amount of equity in his home. He has owned his home for many years and has paid off a large portion of his mortgage. As a result, the equity in his home has increased over time. Tony Dow's equity in his home is a valuable asset that he can use to secure a loan or to sell for a profit.

Equity is an important concept to understand because it can help you to build wealth. By increasing your equity in your home or other assets, you can increase your net worth. This can give you more financial security and freedom.

Cash flow

Cash flow is the net amount of cash and cash-equivalents flowing into and out of a business, institution, or other account. Understanding a company's or individual's cash flow is an important part of understanding its overall financial health. Tony Dow's net worth is estimated to be around $4 million. His cash flow has played a significant role in helping him to achieve this level of wealth.

- Positive Cash Flow

Positive cash flow means that more money is coming in than going out. This can be a sign of a healthy business or a strong financial position. Tony Dow has been able to generate positive cash flow throughout his career by earning more money than he spends. - Negative Cash Flow

Negative cash flow means that more money is going out than coming in. This can be a sign of a struggling business or a weak financial position. Tony Dow has avoided negative cash flow by carefully managing his expenses and investments. - Cash Flow Management

Cash flow management is the process of managing the flow of cash into and out of a business or individual account. Effective cash flow management can help to improve a company's or individual's financial health and stability. Tony Dow has been able to achieve financial success by managing his cash flow wisely. - Investing for Cash Flow

Investing for cash flow involves investing in assets that generate regular income. This can be a good way to increase your cash flow and improve your financial security. Tony Dow has invested in a variety of assets that generate cash flow, such as real estate and stocks.

Cash flow is an important part of net worth. By understanding cash flow and managing it wisely, you can improve your financial health and achieve your financial goals.

Financial planning

Financial planning is the process of creating a roadmap for your financial future. It involves setting financial goals, creating a budget, and developing a strategy to achieve your goals. Financial planning is an important part of net worth management because it can help you to make informed decisions about your money and reach your financial goals faster.

- Goal setting

The first step in financial planning is to set your financial goals. What do you want to achieve with your money? Do you want to retire early? Buy a house? Pay for your children's education? Once you know what you want to achieve, you can start to develop a plan to reach your goals.

- Budgeting

A budget is a plan for how you will spend your money each month. It is an important tool for tracking your income and expenses, and for making sure that you are living within your means. A budget can also help you to identify areas where you can cut back on spending and save more money.

- Investing

Investing is a way to grow your money over time. There are many different investment options available, and the best option for you will depend on your financial goals and risk tolerance. Investing can be a great way to reach your financial goals faster, but it is important to understand the risks involved before you invest.

- Retirement planning

Retirement planning is the process of saving and investing for your retirement years. The sooner you start planning for retirement, the more time your money has to grow. There are many different retirement savings options available, and the best option for you will depend on your financial situation and goals.

Financial planning is an ongoing process. As your life changes, so will your financial goals and needs. It is important to review your financial plan regularly and make adjustments as needed. By following a sound financial plan, you can increase your net worth and achieve your financial goals.

FAQs about Net Worth of Tony Dow

This section answers common questions about Tony Dow's net worth. It provides brief and informative answers to help you understand his financial situation and wealth.

Question 1: What is Tony Dow's net worth?

Tony Dow's net worth is estimated to be around $4 million. He has earned his wealth through his successful career in the entertainment industry, primarily through his role as Wally Cleaver on the popular television series Leave It to Beaver.

Question 2: How did Tony Dow earn his wealth?

Tony Dow has earned his wealth through his successful career in the entertainment industry. He has appeared in numerous television shows and films, and has also directed and produced several films and television shows.

Question 3: What are Tony Dow's assets?

Tony Dow's assets include his house, his car, his investments, and his savings. He has also built up a substantial amount of equity in his home.

Question 4: What are Tony Dow's liabilities?

Tony Dow's liabilities include his mortgage, his car loan, and his credit card debt. He also has some outstanding legal bills.

Question 5: What is Tony Dow's income?

Tony Dow's income comes from a variety of sources, including acting, directing, producing, and investing. He has also earned money from endorsements and personal appearances.

Question 6: What are Tony Dow's expenses?

Tony Dow's expenses include his mortgage, his car payment, his food expenses, and his entertainment expenses.

Summary: Tony Dow's net worth is a reflection of his successful career in the entertainment industry. He has earned his wealth through hard work, dedication, and wise financial management.

Transition to the next article section: Tony Dow's net worth is an example of how wealth can be accumulated through a combination of talent, hard work, and financial savvy. It is a testament to his success in the entertainment industry and his ability to manage his finances wisely.

Tips for Building Your Net Worth

Building net worth is an important goal for many people. It can provide financial security and freedom, and it can help you achieve your financial goals. Here are a few tips to help you build your net worth:

1. Track your income and expensesThe first step to building net worth is to track your income and expenses. This will help you to see where your money is going and where you can cut back. There are many different ways to track your income and expenses, such as using a budgeting app or a spreadsheet.

2. Create a budgetOnce you know where your money is going, you can create a budget. A budget is a plan for how you will spend your money each month. It will help you to make sure that you are living within your means and that you are saving money.

3. Invest your moneyInvesting is a great way to grow your money over time. There are many different investment options available, so it is important to do your research and find the options that are right for you. Investing can be a bit risky, but it can also be very rewarding.

4. Reduce your debtDebt can be a drag on your net worth. If you have any debt, make a plan to pay it off as quickly as possible. There are many different ways to reduce your debt, such as making extra payments on your loans or consolidating your debt.

5. Increase your incomeOne of the best ways to build your net worth is to increase your income. There are many different ways to do this, such as getting a raise, starting a side hustle, or investing in your education.

Building net worth takes time and effort, but it is definitely possible. By following these tips, you can start building your net worth today.

Summary: Building net worth is an important goal that can provide financial security and freedom. By tracking your income and expenses, creating a budget, investing your money, reducing your debt, and increasing your income, you can start building your net worth today.

Conclusion

Tony Dow's net worth is a testament to his successful career in the entertainment industry. He has earned his wealth through hard work, dedication, and wise financial management. His net worth is an example of how wealth can be accumulated through a combination of talent, hard work, and financial savvy.

Building net worth is an important goal for many people. It can provide financial security and freedom, and it can help you achieve your financial goals. By following the tips outlined in this article, you can start building your net worth today.

Detail Author:

- Name : Jan Schimmel

- Username : hhegmann

- Email : wade.torphy@gmail.com

- Birthdate : 1977-07-13

- Address : 705 Oberbrunner Skyway North Rico, NV 69257

- Phone : 1-312-816-2879

- Company : Johnston, Waelchi and Connelly

- Job : Hand Trimmer

- Bio : Nisi rerum ea autem labore aut. Amet facere sint et voluptatem alias asperiores. Sapiente vel maxime alias ullam nemo. Ipsam nemo minus perferendis praesentium magnam.

Socials

instagram:

- url : https://instagram.com/ernie_dev

- username : ernie_dev

- bio : Quam ut est quibusdam perspiciatis iusto quis quis. Dignissimos est veritatis voluptas pariatur.

- followers : 5926

- following : 2727

twitter:

- url : https://twitter.com/elang

- username : elang

- bio : Et itaque debitis et nostrum. Qui illo quidem numquam dicta quisquam voluptates voluptates. Iure repellendus dolorum quae aut vitae.

- followers : 2677

- following : 930