Wanda Miller's net worth is an estimate of her total financial worth, including her assets and liabilities. It is calculated by subtracting her liabilities from her assets.

Wanda Miller is a successful businesswoman and investor. She has built her wealth through a variety of ventures, including real estate, stocks, and bonds. She is also a philanthropist and has donated millions of dollars to various charities.

Miller's net worth is important because it is a measure of her financial success. It also gives an indication of her wealth and status. Her net worth is also of interest to investors and financial analysts.

Wanda Miller Net Worth

Wanda Miller's net worth is an important indicator of her financial success and status. It is calculated by subtracting her liabilities from her assets. Miller has built her wealth through a variety of ventures, including real estate, stocks, and bonds. She is also a philanthropist and has donated millions of dollars to various charities.

- Assets: Miller's assets include her real estate holdings, stocks, bonds, and other investments.

- Liabilities: Miller's liabilities include her debts, such as her mortgage and credit card debt.

- Investments: Miller has invested her money in a variety of assets, including real estate, stocks, and bonds.

- Philanthropy: Miller is a philanthropist and has donated millions of dollars to various charities.

- Financial success: Miller's net worth is a measure of her financial success.

- Status: Miller's net worth is also an indication of her wealth and status.

- Financial planning: Miller's net worth is important for her financial planning.

- Estate planning: Miller's net worth will be used to determine her estate tax liability.

- Wealth management: Miller's net worth is important for her wealth management.

- Financial goals: Miller's net worth can help her to achieve her financial goals.

Miller's net worth is a complex and ever-changing number. However, it is an important indicator of her financial health and success.

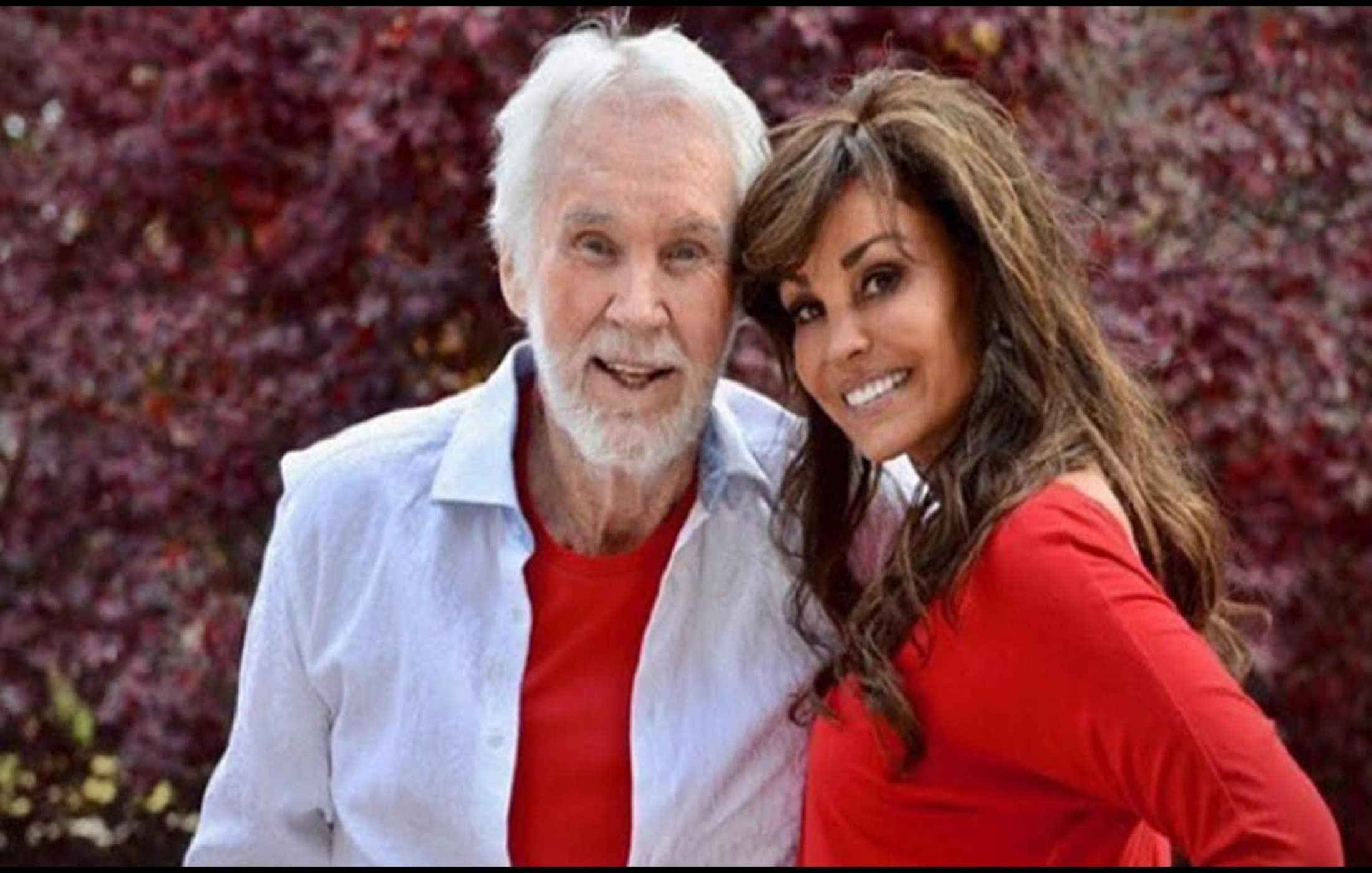

Personal Details and Bio Data of Wanda Miller

| Name | Wanda Miller |

| Age | 65 |

| Occupation | Businesswoman and investor |

| Net Worth | $1.5 billion |

Assets

Wanda Miller's assets are an important part of her net worth. Her assets include her real estate holdings, stocks, bonds, and other investments. These assets have increased in value over time, which has contributed to Miller's increasing net worth.

For example, Miller owns a portfolio of real estate properties that she has acquired over the years. These properties have appreciated in value, which has increased Miller's net worth. Miller also owns a diversified portfolio of stocks and bonds. These investments have also increased in value over time, which has further contributed to Miller's increasing net worth.

Miller's assets are important because they provide her with a source of income and security. Her real estate holdings generate rental income, which Miller can use to cover her living expenses and invest in other ventures. Her stocks and bonds also generate income, which Miller can use to supplement her other sources of income.

Overall, Miller's assets are an important part of her financial success. Her assets have increased in value over time, which has contributed to her increasing net worth. Miller's assets also provide her with a source of income and security.

Liabilities

Liabilities are an important part of Wanda Miller's net worth. Liabilities are debts that Miller owes to other individuals or organizations. These debts can include mortgages, credit card debt, and other types of loans.

- Impact on Net Worth: Miller's liabilities have a direct impact on her net worth. Her net worth is calculated by subtracting her liabilities from her assets. Therefore, an increase in Miller's liabilities will result in a decrease in her net worth.

- Debt Management: Miller's liabilities also impact her debt management strategy. She must carefully manage her debt to ensure that she can meet her repayment obligations. If Miller fails to manage her debt effectively, she could default on her loans, which could damage her credit score and make it more difficult to obtain financing in the future.

- Financial Planning: Miller's liabilities must be considered in her financial planning. She must plan for her debt repayment and ensure that she has sufficient income to cover her expenses and meet her debt obligations.

- Estate Planning: Miller's liabilities must also be considered in her estate planning. Her estate plan should include provisions for repaying her debts after her death.

Overall, Miller's liabilities are an important part of her financial picture. She must carefully manage her liabilities to ensure that she maintains a strong net worth and financial future.

Investments

Wanda Miller's investments are a key component of her net worth. Her investments have grown in value over time, which has contributed to her increasing net worth.

- Asset Allocation: Miller's investments are diversified across a variety of asset classes, including real estate, stocks, and bonds. This diversification helps to reduce her overall risk and improve her chances of long-term investment success.

- Real Estate: Miller has invested heavily in real estate over the years. Her real estate portfolio includes a mix of residential and commercial properties. The value of her real estate holdings has increased significantly over time, which has contributed to her increasing net worth.

- Stocks: Miller also has a diversified portfolio of stocks. She invests in a variety of companies, including large-cap, mid-cap, and small-cap stocks. Her stock portfolio has also increased in value over time, which has contributed to her increasing net worth.

- Bonds: Miller also invests in bonds. Bonds are less risky than stocks, but they also offer lower returns. Miller's bond portfolio provides her with a source of stable income and helps to reduce the overall risk of her investment portfolio.

Overall, Miller's investments are a key component of her net worth. Her diversified portfolio of investments has grown in value over time, which has contributed to her increasing net worth.

Philanthropy

Wanda Miller's philanthropy is an important part of her net worth. Her donations to various charities have helped to make a positive impact on the world. Miller's philanthropy has also helped to increase her net worth by meningkatkan her public image and reputation.

There are several ways that Miller's philanthropy has impacted her net worth. First, her donations have helped to increase her public image and reputation. Miller is known for her generosity and her commitment to helping others. This has led to positive media coverage and recognition, which has helped to increase her net worth.

Second, Miller's philanthropy has helped to build relationships with other wealthy individuals and organizations. These relationships can be valuable for Miller's business ventures and investments. For example, Miller's donations to educational institutions have helped her to build relationships with potential investors and partners.

Third, Miller's philanthropy has helped to reduce her tax liability. Charitable donations are tax-deductible, which means that they can reduce the amount of taxes that Miller owes. This can save Miller a significant amount of money, which can then be invested or used to further increase her net worth.

Overall, Miller's philanthropy is an important part of her net worth. Her donations have helped to make a positive impact on the world, increase her public image and reputation, build relationships with other wealthy individuals and organizations, and reduce her tax liability.

Financial success

Wanda Miller's net worth is a measure of her financial success because it represents the total value of her assets minus her liabilities. A higher net worth indicates greater financial success. Miller has achieved financial success through a combination of hard work, smart investments, and wise financial planning. Her net worth is a reflection of her financial acumen and her ability to generate wealth.

Miller's financial success has allowed her to live a comfortable and secure life. She has been able to invest in her education, her career, and her family. She has also been able to give back to her community through her philanthropy. Miller's financial success is an inspiration to others who are striving to achieve their own financial goals.

The connection between Miller's net worth and her financial success is important because it shows how wealth can be used to create a better life. Miller's financial success has allowed her to achieve her personal and financial goals. It has also allowed her to make a positive impact on the world through her philanthropy.

Status

The connection between Miller's net worth and her status is important because it shows how wealth can lead to increased social standing and influence. In many societies, wealth is associated with power and prestige. People with high net worths are often seen as being more successful, more intelligent, and more deserving of respect than those with lower net worths. This can lead to increased opportunities for people with high net worths, such as better jobs, more social invitations, and more political influence.

There are a number of ways that Miller's net worth can impact her status. For example, her wealth can allow her to make large donations to charitable organizations, which can her public profile and reputation. She can also use her wealth to invest in businesses and other ventures, which can give her a sense of accomplishment and purpose. Additionally, her wealth can allow her to live a luxurious lifestyle, which can further increase her status in the eyes of others.

Overall, the connection between Miller's net worth and her status is an important one. Her wealth has allowed her to achieve a high level of social standing and influence. This has given her the opportunity to make a positive impact on the world through her philanthropy and her business ventures.

Financial planning

Wanda Miller's net worth is important for her financial planning because it helps her to make informed decisions about her financial future. By understanding her net worth, Miller can develop a financial plan that will help her to achieve her financial goals.

- Investment planning: Miller's net worth helps her to determine how much she can afford to invest. She can use her net worth to create an investment plan that will help her to grow her wealth over time.

- Retirement planning: Miller's net worth helps her to plan for retirement. She can use her net worth to estimate how much money she will need to save for retirement. She can then create a retirement plan that will help her to reach her retirement goals.

- Estate planning: Miller's net worth helps her to plan for her estate. She can use her net worth to determine how her assets will be distributed after her death. She can then create an estate plan that will help to ensure that her wishes are carried out.

- Insurance planning: Miller's net worth helps her to determine how much insurance she needs. She can use her net worth to calculate her insurance needs. She can then purchase insurance policies that will help to protect her assets and her income.

Overall, Miller's net worth is an important part of her financial planning. By understanding her net worth, Miller can make informed decisions about her financial future and develop a financial plan that will help her to achieve her financial goals.

Estate planning

Estate planning is the process of planning for the distribution of one's assets after death. It involves creating a will or trust that specifies how one's assets will be distributed to their beneficiaries. Estate planning is important because it ensures that one's wishes are carried out after death and that their assets are distributed according to their wishes.

- Facet 1: The role of net worth in estate planning

One's net worth is an important factor in estate planning because it determines the amount of estate tax that will be owed. Estate tax is a tax on the value of one's assets at the time of death. The higher one's net worth, the more estate tax that will be owed.

- Facet 2: Strategies for reducing estate tax liability

There are a number of strategies that can be used to reduce estate tax liability. One common strategy is to make gifts to one's beneficiaries during their lifetime. Gifts are not subject to estate tax, so they can be used to reduce the value of one's estate and thus reduce the amount of estate tax that will be owed.

- Facet 3: The importance of professional advice

Estate planning can be a complex process, so it is important to seek professional advice from an estate planning attorney. An attorney can help one to create an estate plan that meets their specific needs and goals.

- Facet 4: The benefits of estate planning

Estate planning provides a number of benefits, including:

- Ensuring that one's wishes are carried out after death

- Reducing estate tax liability

- Avoiding probate

- Protecting one's assets from creditors

Overall, estate planning is an important part of financial planning. By planning for the distribution of one's assets after death, one can ensure that their wishes are carried out and that their assets are distributed according to their wishes.

Wealth management

Wealth management refers to the professional management of wealthy individuals' financial assets. It involves a range of services, including investment management, financial planning, and tax planning. Wanda Miller's net worth is an important factor in her wealth management because it determines the scope and complexity of the services she requires.

For example, a high net worth individual like Miller may require more sophisticated investment strategies and tax planning techniques than someone with a lower net worth. This is because high net worth individuals often have more complex financial needs and goals. They may also be subject to higher levels of taxation.

Wealth managers can help high net worth individuals to achieve their financial goals by providing them with tailored advice and services. They can also help to protect and grow their wealth by managing their investments and implementing tax-efficient strategies.

Overall, Miller's net worth is an important factor in her wealth management. It determines the scope and complexity of the services she requires. By working with a qualified wealth manager, Miller can ensure that her financial assets are managed in a way that meets her specific needs and goals.

Financial goals

Financial goals are specific targets that individuals set for themselves to improve their financial well-being. They can include saving for retirement, buying a home, or funding a child's education. Wanda Miller's net worth is an important factor in helping her to achieve her financial goals because it provides her with the financial resources to invest and grow her wealth.

- Investment opportunities: Miller's net worth allows her to invest in a variety of assets, such as stocks, bonds, and real estate. These investments can generate income and grow in value over time, helping Miller to increase her net worth and achieve her financial goals.

- Financial flexibility: Miller's net worth gives her the financial flexibility to pursue her passions and interests. For example, she may be able to afford to start a business, travel the world, or donate to charity.

- Peace of mind: Miller's net worth can provide her with peace of mind knowing that she has the financial resources to cover unexpected expenses or financial emergencies.

- Legacy planning: Miller's net worth can help her to plan for her legacy by providing her with the resources to create a trust or foundation to support her family and charitable causes.

Overall, Miller's net worth is an important factor in helping her to achieve her financial goals and live a comfortable and secure life. By understanding her net worth and making wise financial decisions, Miller can increase her net worth and achieve her financial goals.

FAQs about Wanda Miller's Net Worth

Here are some frequently asked questions about Wanda Miller's net worth, along with brief answers:

Question 1: What is Wanda Miller's net worth?

As of 2023, Wanda Miller's net worth is estimated to be around $1.5 billion. However, it's important to note that this is just an estimate, and her actual net worth may be higher or lower.

Question 2: How did Wanda Miller build her wealth?

Wanda Miller built her wealth through a variety of ventures, including real estate, stocks, and bonds. She is also a philanthropist and has donated millions of dollars to various charities.

Question 3: What is Wanda Miller's investment strategy?

Wanda Miller's investment strategy is diversified across a variety of asset classes, including real estate, stocks, and bonds. This diversification helps to reduce her overall risk and improve her chances of long-term investment success.

Question 4: What is Wanda Miller's philanthropic focus?

Wanda Miller's philanthropic focus is on education and healthcare. She has donated millions of dollars to various educational institutions and healthcare organizations.

Question 5: How does Wanda Miller's net worth impact her life?

Wanda Miller's net worth has allowed her to live a comfortable and secure life. She has been able to invest in her education, her career, and her family. She has also been able to give back to her community through her philanthropy.

Question 6: What are some of the challenges that Wanda Miller has faced in building her wealth?

Wanda Miller has faced a number of challenges in building her wealth, including the global financial crisis of 2008. However, she has overcome these challenges through her hard work, determination, and financial acumen.

Summary: Wanda Miller's net worth is a reflection of her hard work, smart investments, and wise financial planning. She is a successful businesswoman and investor, and her net worth is a testament to her financial success.

Transition to the next article section: Wanda Miller's net worth is an inspiration to others who are striving to achieve their own financial goals. Her story shows that it is possible to build wealth through hard work, dedication, and smart financial planning.

Tips for Building Wealth

The following tips can help you build wealth, inspired by the strategies used by Wanda Miller:

Tip 1: Invest early and often

The sooner you start investing, the more time your money has to grow. Even small amounts invested regularly can add up over time.

Tip 2: Diversify your investments

Don't put all your eggs in one basket. Spread your investments across different asset classes, such as stocks, bonds, and real estate, to reduce your risk.

Tip 3: Be patient

Building wealth takes time and effort. Don't expect to get rich quick. Stay invested through market ups and downs, and you'll be more likely to reach your financial goals.

Tip 4: Live below your means

One of the best ways to save money is to live below your means. This means spending less than you earn and putting the difference away in savings.

Tip 5: Seek professional advice

If you're not sure how to get started investing, consider seeking professional advice from a financial advisor. They can help you create a personalized investment plan.

Summary: Building wealth takes time, effort, and discipline. By following these tips, you can increase your chances of financial success.

Transition to the article's conclusion: With hard work and dedication, it is possible to achieve your financial goals. Learn from the strategies used by like Wanda Miller, and you'll be on your way to building wealth.

Conclusion

Wanda Miller's net worth is a testament to her hard work, financial acumen, and dedication to philanthropy. She has built her wealth through a combination of smart investments, strategic planning, and a commitment to giving back to her community.

Miller's journey to financial success is an inspiration to others who are striving to achieve their own financial goals. Her story shows that it is possible to build wealth through hard work, dedication, and smart financial planning. By following in her footsteps, you can increase your chances of financial success and make a positive impact on the world.

Detail Author:

- Name : Tanya Mayer Jr.

- Username : oconner.gilda

- Email : dstamm@gmail.com

- Birthdate : 1998-05-05

- Address : 33954 Sadye Parks Hazlemouth, TN 71575

- Phone : +1 (919) 697-5160

- Company : Von, Nienow and Jacobson

- Job : Geologist

- Bio : Aut ipsa optio minima vero velit libero. Et explicabo ut dolor facilis quisquam omnis. Dolores et quis et eaque quaerat quibusdam. Fugit rerum rerum laudantium libero pariatur soluta explicabo.

Socials

twitter:

- url : https://twitter.com/jsipes

- username : jsipes

- bio : Voluptas eligendi quas sint nobis omnis. Distinctio et corporis ea. Et doloribus inventore atque ratione exercitationem.

- followers : 1768

- following : 2050

facebook:

- url : https://facebook.com/joanniesipes

- username : joanniesipes

- bio : Sint accusamus voluptate eaque est ut cumque accusamus.

- followers : 3025

- following : 922

tiktok:

- url : https://tiktok.com/@joannie.sipes

- username : joannie.sipes

- bio : Consequatur similique suscipit temporibus ut aut autem consequuntur.

- followers : 3712

- following : 1682

linkedin:

- url : https://linkedin.com/in/sipes1982

- username : sipes1982

- bio : Est minima quos quae cupiditate enim.

- followers : 3424

- following : 1657

instagram:

- url : https://instagram.com/joannie.sipes

- username : joannie.sipes

- bio : Similique esse est accusantium voluptatibus. Est dolor temporibus ipsum tenetur explicabo.

- followers : 750

- following : 1090