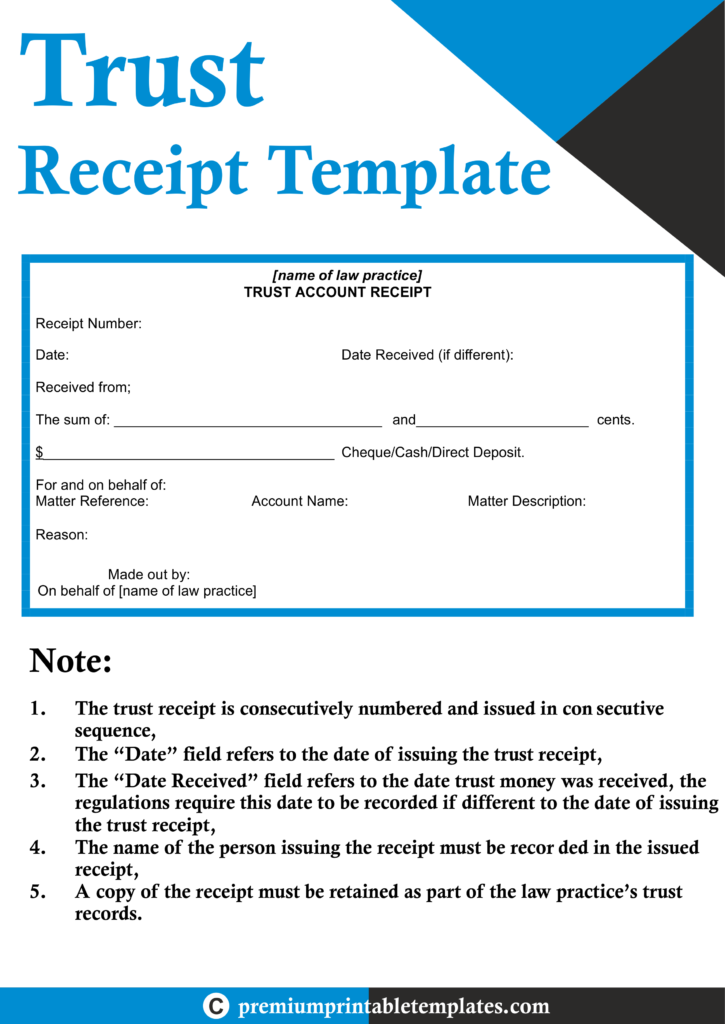

"30 trust format message for client" refers to a set of pre-defined message templates that can be used by financial institutions to communicate with their clients about trust-related matters. These messages are typically used to provide clients with important information about their trust accounts, such as account balances, distributions, and investment performance.

Using a standard format for these messages helps to ensure that clients receive clear and consistent information from their financial institution. This can help to build trust and confidence between the institution and its clients.

There are a number of different topics that can be covered in a trust format message for client. Some of the most common topics include:

- Account balances

- Distributions

- Investment performance

- Tax information

- Changes to the trust

The specific topics that are included in a trust format message for client will vary depending on the individual financial institution. However, all trust format messages should be clear, concise, and easy to understand.

30 trust format message for client

Trust format messages are an essential tool for financial institutions to communicate with their clients about trust-related matters. These messages help to ensure that clients receive clear and consistent information about their trust accounts, which can help to build trust and confidence between the institution and its clients.

- Clear: Trust format messages should be written in clear and concise language that is easy to understand.

- Concise: Trust format messages should be brief and to the point, avoiding unnecessary details.

- Consistent: Trust format messages should use a consistent format and tone, so that clients can easily identify and understand them.

- Accurate: Trust format messages should be accurate and up-to-date, so that clients can rely on the information they contain.

- Timely: Trust format messages should be sent to clients in a timely manner, so that they can stay informed about their trust accounts.

- Relevant: Trust format messages should be relevant to the client's individual needs and circumstances.

- Secure: Trust format messages should be sent in a secure manner, to protect client confidentiality.

- Compliant: Trust format messages should comply with all applicable laws and regulations.

- Professional: Trust format messages should be written in a professional and respectful tone.

By following these guidelines, financial institutions can ensure that their trust format messages are effective in communicating with clients and building trust.

Clear

Clear trust format messages are essential for effective communication between financial institutions and their clients. When clients can easily understand the information in their trust format messages, they are more likely to make informed decisions about their trust accounts. This can lead to better financial outcomes for clients and stronger relationships between clients and their financial institutions.

For example, a trust format message that clearly explains the client's account balance and investment performance can help the client make informed decisions about how to manage their trust account. A trust format message that clearly explains the tax implications of a distribution from the trust can help the client avoid costly mistakes.

Financial institutions can take a number of steps to ensure that their trust format messages are clear and concise. First, they should use plain language that is easy to understand. Second, they should avoid using jargon or technical terms that may be unfamiliar to clients. Third, they should keep their messages brief and to the point.

By following these guidelines, financial institutions can ensure that their trust format messages are clear and concise, which will lead to better communication with clients and better financial outcomes for all.

Concise

In the context of "30 trust format message for client," conciseness is crucial for ensuring that clients receive the necessary information without being overwhelmed by excessive details. Concise trust format messages are easier to read and understand, which can lead to improved client engagement and decision-making.

- Clarity: Concise messages promote clarity by focusing on the most important information. This helps clients quickly grasp the of the message and make informed decisions about their trust accounts.

- Efficiency: Concise messages save both the financial institution and the client time. Clients can quickly scan the message to find the information they need, and the financial institution can avoid wasting time and resources on unnecessary details.

- Professionalism: Concise messages convey a sense of professionalism and respect for the client's time. When clients receive concise messages, they feel that the financial institution values their time and is committed to providing efficient service.

Overall, conciseness is an essential element of effective trust format messages. By avoiding unnecessary details and focusing on the most important information, financial institutions can improve client engagement, decision-making, and overall satisfaction.

Consistent

In the context of "30 trust format message for client," consistency is crucial for ensuring that clients can easily identify and understand the messages they receive from their financial institution. Consistent trust format messages help to build trust and confidence between the institution and its clients by providing a familiar and predictable format and tone.

When clients receive consistent trust format messages, they can quickly and easily find the information they need. This can be especially important for complex or sensitive information, such as account balances, investment performance, or tax implications. By using a consistent format and tone, financial institutions can help their clients to stay informed about their trust accounts and make informed decisions about their finances.

For example, a financial institution may use a consistent format for all of its trust format messages, including a standard header, font, and layout. This makes it easy for clients to identify and understand the messages they receive from the institution. The institution may also use a consistent tone in all of its trust format messages, such as a professional and respectful tone. This helps to build trust and confidence between the institution and its clients.

Overall, consistency is an essential element of effective trust format messages. By using a consistent format and tone, financial institutions can help their clients to stay informed about their trust accounts and make informed decisions about their finances.

Accurate

In the context of "30 trust format message for client," accuracy is paramount for ensuring that clients can make informed decisions about their trust accounts. Accurate trust format messages provide clients with reliable information about their account balances, investment performance, and other important details.

- Reliable Data: Accurate trust format messages are based on reliable data that has been verified and cross-checked. This ensures that clients can trust the information they receive and make informed decisions based on it.

- Timeliness: Accurate trust format messages are up-to-date and reflect the most current information available. This is especially important for investment performance data, which can change frequently.

- Clear and Concise: Accurate trust format messages are clear and concise, avoiding jargon or technical terms that may be unfamiliar to clients. This makes it easy for clients to understand the information they receive.

- Consistent: Accurate trust format messages are consistent with other communications from the financial institution. This helps to build trust and confidence between the institution and its clients.

Overall, accuracy is essential for effective trust format messages. By providing clients with accurate and up-to-date information, financial institutions can help their clients to make informed decisions about their trust accounts and achieve their financial goals.

Timely

Timely trust format messages are an essential component of "30 trust format message for client" because they enable clients to stay informed about their trust accounts and make informed decisions about their finances. When clients receive trust format messages in a timely manner, they can:

- Make informed decisions about their trust accounts, such as whether to make additional contributions or distributions.

- Stay up-to-date on the performance of their investments and make adjustments as needed.

- Be aware of any changes to the trust, such as changes to the beneficiaries or the trustee.

- Avoid costly mistakes, such as missing a tax deadline or making a poor investment decision.

For example, a client who receives a timely trust format message about a distribution from the trust can make informed decisions about how to use the funds. They may choose to reinvest the funds, use them to pay for expenses, or distribute them to beneficiaries. By receiving the message in a timely manner, the client can avoid missing out on investment opportunities or making poor financial decisions.

Overall, timely trust format messages are essential for effective trust administration and client satisfaction. By sending trust format messages to clients in a timely manner, financial institutions can help their clients to stay informed about their trust accounts and make informed decisions about their finances.

Relevant

In the context of "30 trust format message for client," relevance is crucial for ensuring that clients receive trust format messages that are tailored to their specific needs and circumstances. Relevant trust format messages help to build trust and confidence between the financial institution and its clients by providing information that is meaningful and actionable.

When clients receive relevant trust format messages, they are more likely to engage with the information and make informed decisions about their trust accounts. For example, a client who is nearing retirement may receive a trust format message that provides information about income planning and distribution options. This information is highly relevant to the client's individual needs and circumstances, and it can help the client to make informed decisions about their retirement planning.

Financial institutions can take a number of steps to ensure that their trust format messages are relevant to their clients' individual needs and circumstances. First, they should collect information about their clients' financial goals, risk tolerance, and investment objectives. This information can be used to tailor trust format messages to each client's specific needs.

Second, financial institutions should use a variety of communication channels to deliver trust format messages to their clients. This may include mail, email, and online portals. By using a variety of communication channels, financial institutions can ensure that their clients receive the information they need in a format that is convenient for them.

Overall, relevance is an essential element of effective trust format messages. By providing clients with relevant information that is tailored to their specific needs and circumstances, financial institutions can help their clients to make informed decisions about their trust accounts and achieve their financial goals.

Secure

In the context of "30 trust format message for client," security is paramount for ensuring the privacy and confidentiality of client information. Trust format messages often contain sensitive information, such as account balances, investment performance, and personal details. It is essential that this information is protected from unauthorized access or disclosure.

- Encryption: Trust format messages should be encrypted using strong encryption algorithms to protect the confidentiality of the information they contain. Encryption ensures that the information is unreadable to anyone who does not have the appropriate decryption key.

- Authentication: Financial institutions should use authentication mechanisms to verify the identity of clients before sending them trust format messages. This helps to prevent unauthorized access to client information.

- Secure Communication Channels: Trust format messages should be sent over secure communication channels, such as HTTPS or VPNs. This helps to protect the information from interception and eavesdropping.

- Internal Controls: Financial institutions should have internal controls in place to protect client information from unauthorized access or disclosure. These controls may include physical security measures, such as access control to computer systems and records, and cybersecurity measures, such as firewalls and intrusion detection systems.

By implementing these security measures, financial institutions can help to protect client confidentiality and build trust with their clients.

Compliant

In the context of "30 trust format message for client", compliance is essential for ensuring that trust format messages are accurate, transparent, and fair. Compliant trust format messages help to build trust and confidence between financial institutions and their clients by providing information that is in accordance with all applicable laws and regulations.

- Legal and Regulatory Framework: Trust format messages must comply with a complex legal and regulatory framework that governs the financial industry. This framework includes laws and regulations related to privacy, data protection, and financial reporting.

- Accuracy and Transparency: Compliant trust format messages must be accurate and transparent. This means that the information provided in the messages must be complete, correct, and not misleading.

- Fairness and Impartiality: Compliant trust format messages must be fair and impartial. This means that the information provided in the messages must not be biased in favor of or against any particular party.

- Client Protection: Compliant trust format messages must protect the interests of clients. This means that the information provided in the messages must be clear and concise, and it must not contain any hidden fees or charges.

By complying with all applicable laws and regulations, financial institutions can help to protect their clients and build trust with their clients.

Professional

In the context of "30 trust format message for client", professionalism is crucial for building and maintaining trust between financial institutions and their clients. Professional trust format messages convey a sense of respect, competence, and reliability, which are essential for fostering strong client relationships.

When clients receive professional trust format messages, they are more likely to perceive the financial institution as trustworthy and reliable. This is because professional messages demonstrate that the institution takes its clients' needs and concerns seriously. Professional messages also help to build rapport between the institution and its clients, which can lead to long-term relationships.

There are a number of ways to ensure that trust format messages are professional and respectful. First, the messages should be written in a clear and concise style. Second, the messages should avoid using jargon or technical terms that may be unfamiliar to clients. Third, the messages should be free of grammatical errors and typos. Finally, the messages should be sent in a timely manner.

By following these guidelines, financial institutions can ensure that their trust format messages are professional and respectful, which will help to build and maintain trust with their clients.

FAQs on "30 Trust Format Message for Client"

This section addresses common questions and concerns regarding the use of trust format messages for effective client communication.

Question 1: What are the key benefits of using trust format messages?

Trust format messages offer several advantages, including enhanced clarity, consistency, accuracy, timeliness, relevance, security, compliance, and professionalism. They streamline communication, foster trust, and ensure that clients receive essential information about their trust accounts.

Question 2: How can trust format messages be tailored to specific client needs?

To personalize trust format messages, financial institutions should gather information about their clients' financial goals, risk tolerance, and investment objectives. This enables them to deliver relevant and actionable information that meets each client's unique requirements.

Question 3: What security measures are in place to protect client confidentiality?

Financial institutions employ robust security measures to safeguard client data. These include encryption, authentication mechanisms, secure communication channels, and internal controls. By adhering to these measures, they ensure the privacy and confidentiality of client information.

Question 4: How does compliance with laws and regulations impact trust format messages?

Compliance is essential as it guarantees that trust format messages are accurate, transparent, fair, and impartial. Financial institutions must adhere to the legal and regulatory framework governing the financial industry to protect client interests and build trust.

Question 5: What is the significance of professionalism in trust format messages?

Professionalism conveys respect, competence, and reliability. By using clear and concise language, avoiding jargon, and adhering to grammatical standards, financial institutions demonstrate their commitment to providing high-quality client service. This fosters strong and lasting client relationships.

Question 6: How can financial institutions improve the effectiveness of their trust format messages?

To enhance effectiveness, financial institutions should focus on clarity, conciseness, consistency, accuracy, timeliness, relevance, security, compliance, and professionalism. By adhering to these principles, they can deliver trust format messages that resonate with clients, build trust, and support informed decision-making.

Summary: Trust format messages are a vital tool for financial institutions to communicate effectively with clients. By embracing best practices in design and delivery, institutions can harness the power of these messages to foster trust, ensure compliance, and provide exceptional client service.

Transition: This comprehensive overview of trust format messages serves as a foundation for exploring advanced strategies and best practices in client communication within the financial industry.

Tips for Effective Trust Format Messages for Clients

Trust format messages are a crucial means of communication between financial institutions and their clients. By adhering to best practices, institutions can enhance the clarity, accuracy, and relevance of these messages, fostering trust and informed decision-making.

Tip 1: Prioritize Clarity and Conciseness

Use clear, concise language, avoiding jargon and technical terms. Keep messages brief and to the point, focusing on essential information.

Tip 2: Ensure Accuracy and Timeliness

Verify the accuracy of information before sending messages. Deliver messages promptly to ensure clients have up-to-date account information.

Tip 3: Tailor Messages to Client Needs

Gather client-specific information to personalize messages. Provide relevant details aligned with their financial goals, risk tolerance, and investment objectives.

Tip 4: Maintain Consistency and Professionalism

Use a consistent format and tone across all messages. Maintain a professional and respectful style, demonstrating the institution's commitment to client service.

Tip 5: Prioritize Security and Compliance

Implement robust security measures to protect client data. Ensure compliance with all applicable laws and regulations governing financial communication.

By implementing these tips, financial institutions can optimize their trust format messages, fostering trust, enhancing client understanding, and supporting informed financial decisions.

Conclusion: Effective trust format messages are essential for building strong client relationships and ensuring transparency in financial communication. By adhering to best practices, institutions can leverage these messages to provide exceptional client service and support informed decision-making.

Conclusion

Effective trust format messages are a cornerstone of transparent and informative client communication in the financial industry. By adhering to best practices in design and delivery, financial institutions can harness the power of these messages to build trust, foster understanding, and support informed decision-making among their clients.

The exploration of "30 trust format message for client" has highlighted the importance of clarity, accuracy, relevance, and professionalism in crafting effective trust format messages. By embracing these principles, financial institutions can enhance the quality of their client communication, strengthen relationships, and empower clients to make informed financial choices.

![Updated Trust Format for Client 2023 [Sample Messages]](https://b2868773.smushcdn.com/2868773/wp-content/uploads/2021/08/trust-format-for-client-blog-post-scaled.jpg?lossy=1&strip=1&webp=1)

Detail Author:

- Name : Mrs. Lesly Gislason

- Username : lschneider

- Email : caleigh.roberts@hotmail.com

- Birthdate : 1971-05-20

- Address : 2715 Dicki Mall South Brockmouth, UT 68820-6008

- Phone : 251-432-3677

- Company : Tromp and Sons

- Job : Chiropractor

- Bio : Sunt dignissimos quasi est quos saepe optio voluptatum. Repellat non voluptatem et laborum. Ea provident exercitationem quos reprehenderit porro repudiandae. Deserunt dolorum eum aut delectus.

Socials

tiktok:

- url : https://tiktok.com/@elva.johnston

- username : elva.johnston

- bio : Delectus sunt exercitationem iure molestiae nulla.

- followers : 6654

- following : 759

instagram:

- url : https://instagram.com/elvajohnston

- username : elvajohnston

- bio : Recusandae qui sed eaque. Unde libero quisquam voluptatum pariatur.

- followers : 5495

- following : 81

twitter:

- url : https://twitter.com/elva9335

- username : elva9335

- bio : Ipsum commodi aut nihil sed natus incidunt. Eveniet enim quisquam laborum sunt quod libero atque. Incidunt laborum ullam et possimus quam.

- followers : 4159

- following : 403