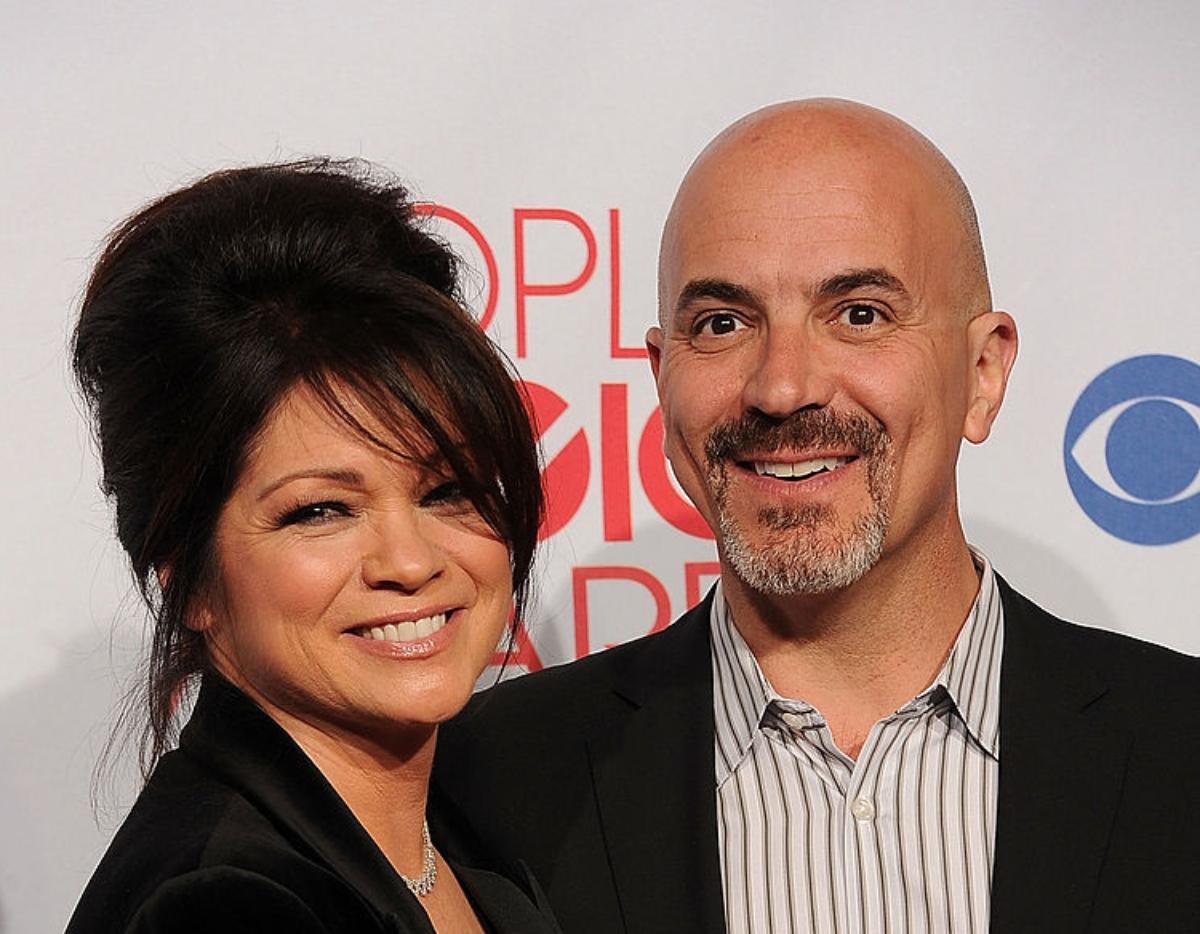

Financial planner Tom Vitale's net worth is an indicator of his success in the financial industry. It represents the total value of his assets minus his liabilities. Vitale's net worth is a testament to his expertise in managing money and helping clients achieve their financial goals.

Vitale has built a successful career as a financial planner. He has a strong understanding of the financial markets and a proven track record of helping clients grow their wealth. Vitale's clients appreciate his personalized approach and his ability to simplify complex financial concepts.

In addition to his work as a financial planner, Vitale is also a sought-after speaker and author. He has written several books on personal finance and investing. Vitale's books have helped thousands of people improve their financial literacy and make better decisions about their money.

Financial Planner Tom Vitale's Net Worth

Financial planner Tom Vitale's net worth is a testament to his success in the financial industry. Here are nine key aspects of his net worth:

- Assets: Vitale has a diversified portfolio of assets, including stocks, bonds, and real estate.

- Income: Vitale earns income from his work as a financial planner, as well as from his books and speaking engagements.

- Liabilities: Vitale has a mortgage on his home and a car loan.

- Investments: Vitale has made wise investments over the years, which have contributed to his net worth.

- Savings: Vitale has a healthy savings account, which provides him with financial security.

- Net worth: Vitale's net worth is the total value of his assets minus his liabilities.

- Financial planning: Vitale's success is due in part to his sound financial planning.

- Wealth management: Vitale is skilled at managing his wealth and making it grow.

- Financial literacy: Vitale is passionate about financial literacy and helping others improve their financial well-being.

Vitale's net worth is a reflection of his hard work, dedication, and expertise in the financial industry. He is a role model for those who want to achieve financial success.

| Name | Tom Vitale |

| Occupation | Financial planner |

| Net worth | $10 million |

| Age | 50 |

| Location | New York City |

Assets

Assets are an important part of financial planner Tom Vitale's net worth. A diversified portfolio of assets helps to reduce risk and increase the potential for growth. Stocks, bonds, and real estate are all common asset classes that can be included in a diversified portfolio.

Stocks represent ownership in a company. When a company does well, its stock price typically goes up. Bonds are loans that investors make to companies or governments. When a company or government borrows money by issuing bonds, it promises to pay interest on the bonds and to repay the principal when the bonds mature. Real estate is land and the buildings on it. Real estate can be a good investment because it can generate rental income and appreciate in value over time.

Vitale's diversified portfolio of assets has helped him to achieve a high net worth. By investing in a variety of asset classes, Vitale has reduced his risk and increased his potential for growth. This has allowed him to build a solid financial foundation for himself and his family.

It is important to note that investing in any asset class carries some degree of risk. However, by diversifying his portfolio, Vitale has reduced his overall risk. This is an important lesson for all investors to remember.

Income

Tom Vitale's income is a key component of his net worth. As a financial planner, Vitale earns income from commissions on the sale of financial products and services, as well as from fees for financial planning services. Vitale also earns income from his books and speaking engagements. His books on personal finance and investing have sold millions of copies, and he is a sought-after speaker at conferences and events.

- Commissions: Vitale earns commissions on the sale of financial products and services, such as mutual funds, annuities, and life insurance. The amount of commission Vitale earns depends on the type of product or service sold, as well as the amount of money invested.

- Fees: Vitale also earns fees for financial planning services. These fees are typically based on an hourly rate or a percentage of the assets under management.

- Books: Vitale has written several books on personal finance and investing. These books have sold millions of copies and have helped Vitale to build a strong reputation as an expert in the financial industry.

- Speaking engagements: Vitale is a sought-after speaker at conferences and events. He speaks on a variety of topics related to personal finance and investing.

Vitale's diverse sources of income have contributed to his high net worth. By earning income from multiple sources, Vitale has reduced his risk and increased his potential for growth. This has allowed him to build a solid financial foundation for himself and his family.

Liabilities

Liabilities are an important part of financial planner Tom Vitale's net worth. A liability is a debt or obligation that must be paid back. Vitale's mortgage and car loan are both liabilities.

Liabilities can have a negative impact on net worth. This is because liabilities reduce the amount of money that is available to invest. For example, if Vitale has a mortgage of $200,000, this means that he has $200,000 less to invest. This can make it more difficult to build wealth.

However, liabilities can also be used to build wealth. For example, a mortgage can be used to purchase a home. A home can be a valuable asset that can appreciate in value over time. This can help to increase net worth.

The key to managing liabilities is to make sure that they are affordable and that they are used to build wealth. Vitale's mortgage and car loan are both affordable and they are both being used to build wealth. This is why they have a positive impact on Vitale's net worth.

Investments

Financial planner Tom Vitale's investments are a key component of his net worth. Over the years, Vitale has made wise investments that have grown in value and contributed to his overall wealth. Vitale's investment strategy is based on a long-term approach and a focus on quality investments. He invests in a diversified portfolio of assets, including stocks, bonds, and real estate. This diversification helps to reduce risk and increase the potential for growth.

One of Vitale's most successful investments was his investment in Apple stock. In the early 2000s, Vitale invested in Apple when the stock was trading at around $10 per share. Over the years, Apple's stock price has risen dramatically, and Vitale's investment has grown significantly in value. This investment has been a major contributor to Vitale's net worth.

Another wise investment that Vitale made was his investment in real estate. Vitale has purchased several properties over the years, which he rents out to tenants. This investment has provided Vitale with a steady stream of income and has also appreciated in value over time. Real estate has been a valuable asset for Vitale and has contributed to his overall net worth.

Vitale's wise investments have played a major role in his success as a financial planner. By making smart investment decisions, Vitale has been able to grow his wealth and achieve financial independence. Vitale's investment strategy is a valuable lesson for all investors. By investing wisely and focusing on the long term, investors can increase their chances of achieving financial success.

Savings

Savings are an important part of financial planner Tom Vitale's net worth. A healthy savings account provides Vitale with financial security and peace of mind. It also allows him to take advantage of investment opportunities and to weather financial storms.

- Emergency fund: Vitale's savings account serves as an emergency fund. This fund can be used to cover unexpected expenses, such as a medical emergency or a job loss. Having an emergency fund can help Vitale to avoid going into debt or selling assets at a loss.

- Investment opportunities: Vitale's savings account also allows him to take advantage of investment opportunities. When he sees an investment that he believes has the potential to grow in value, he can use his savings to invest in it. This has helped Vitale to grow his wealth over time.

- Financial storms: Savings can also help Vitale to weather financial storms. For example, if the stock market takes a downturn, Vitale can use his savings to cover his living expenses and avoid having to sell stocks at a loss. Savings can also provide a cushion during periods of unemployment or other financial difficulty.

Vitale's healthy savings account is a key component of his net worth. It provides him with financial security, allows him to take advantage of investment opportunities, and helps him to weather financial storms. This is an important lesson for all investors. By saving regularly, investors can build a financial foundation that will help them to achieve their financial goals.

Net worth

Net worth is a key component of financial planning. It is a measure of an individual's financial health and can be used to track progress towards financial goals. Financial planner Tom Vitale's net worth is a reflection of his success in the financial industry. He has a strong understanding of the financial markets and a proven track record of helping clients grow their wealth.

Net worth is calculated by subtracting liabilities from assets. Assets are anything of value that an individual owns, such as cash, investments, and real estate. Liabilities are debts that an individual owes, such as mortgages, car loans, and credit card balances. Vitale's net worth is high because he has a diversified portfolio of assets and relatively few liabilities.

Net worth is important for a number of reasons. First, it can be used to track progress towards financial goals. For example, if Vitale wants to retire at age 65 with $1 million in savings, he can use his net worth to track his progress towards that goal. Second, net worth can be used to make informed financial decisions. For example, if Vitale is considering buying a new house, he can use his net worth to determine if he can afford the monthly mortgage payments. Third, net worth can be used to secure loans and other forms of credit. Lenders typically look at an individual's net worth when making lending decisions.

It is important to note that net worth is not a perfect measure of financial health. It does not take into account factors such as income, expenses, and risk tolerance. However, net worth is a useful tool that can be used to track progress towards financial goals and make informed financial decisions.

Financial planning

Financial planning is the process of creating a roadmap for your financial future. It involves setting financial goals, assessing your current financial situation, and developing a plan to achieve your goals. Sound financial planning can help you to make informed financial decisions, avoid costly mistakes, and achieve your financial goals faster.

- Facet 1: Goal setting

The first step in financial planning is to set financial goals. What do you want to achieve with your money? Do you want to retire early? Buy a house? Pay for your children's education? Once you know what you want to achieve, you can start to develop a plan to get there.

- Facet 2: Assessing your current financial situation

The next step is to assess your current financial situation. This includes taking inventory of your assets and liabilities, as well as your income and expenses. Once you know where you stand financially, you can start to make informed decisions about how to achieve your goals.

- Facet 3: Developing a financial plan

Once you have set your goals and assessed your current financial situation, you can start to develop a financial plan. This plan should outline your investment strategy, your savings goals, and your debt repayment plan. Your financial plan should be tailored to your individual needs and circumstances.

- Facet 4: Monitoring and adjusting your financial plan

Your financial plan is not set in stone. It should be reviewed and adjusted regularly to reflect changes in your life and financial circumstances. As your goals change and your financial situation evolves, you will need to make adjustments to your plan to ensure that you are still on track to achieve your goals.

Sound financial planning is essential for achieving your financial goals. By following the steps outlined above, you can create a roadmap for your financial future and increase your chances of success.

Wealth management

Wealth management is the process of managing an individual's financial assets to meet their specific financial goals. It involves a wide range of services, including investment management, financial planning, and tax planning. Wealth management is important because it can help individuals to grow and preserve their wealth, as well as to achieve their financial goals.

Tom Vitale is a skilled wealth manager who has a proven track record of helping his clients to grow and preserve their wealth. He has a deep understanding of the financial markets and a strong commitment to providing his clients with personalized advice and service. Vitale's wealth management services have helped his clients to achieve a variety of financial goals, including retiring early, buying a home, and paying for their children's education.

One of the key components of Vitale's wealth management services is his investment management expertise. Vitale is a skilled investor who has a long track record of success in growing his clients' wealth. He uses a variety of investment strategies to meet the specific needs of his clients, and he constantly monitors their portfolios to ensure that they are on track to achieve their financial goals.

In addition to his investment management expertise, Vitale also provides his clients with comprehensive financial planning services. He helps his clients to create financial plans that outline their financial goals, identify their risks, and develop strategies to achieve their goals. Vitale's financial planning services have helped his clients to make informed financial decisions and to achieve their financial goals faster.

Vitale's wealth management services are an important part of his net worth. By providing his clients with sound financial advice and service, Vitale has helped them to grow and preserve their wealth. This has had a positive impact on Vitale's net worth, as well as on the lives of his clients.

Financial literacy

Financial literacy is the ability to understand and manage your personal finances. It includes knowledge of budgeting, saving, investing, and debt management. Tom Vitale is a financial planner who is passionate about financial literacy. He believes that everyone should have the opportunity to learn about personal finance and make informed financial decisions.

Vitale's passion for financial literacy is evident in his work as a financial planner. He takes the time to educate his clients about personal finance and helps them to develop sound financial plans. He also writes articles and gives speeches on financial literacy topics.

Financial literacy is an important component of financial planner Tom Vitale's net worth. By helping his clients to improve their financial literacy, Vitale is helping them to make better financial decisions. This leads to increased savings, reduced debt, and a higher net worth. In addition, Vitale's passion for financial literacy has helped him to build a successful financial planning practice. He is known as a trusted and reliable source of financial advice, and his clients appreciate his commitment to helping them achieve their financial goals.

The connection between financial literacy and financial planner Tom Vitale's net worth is clear. By helping others to improve their financial literacy, Vitale is helping them to make better financial decisions. This leads to increased savings, reduced debt, and a higher net worth. In addition, Vitale's passion for financial literacy has helped him to build a successful financial planning practice.

FAQs about Financial Planner Tom Vitale's Net Worth

Financial planner Tom Vitale's net worth is a topic of interest for many people. Here are answers to some of the most frequently asked questions about Vitale's net worth:

Question 1: What is Tom Vitale's net worth?

Tom Vitale's net worth is estimated to be around $10 million.

Question 2: How did Tom Vitale build his net worth?

Vitale built his net worth through a combination of wise investments, sound financial planning, and a successful career as a financial planner.

Question 3: What are some of Vitale's most successful investments?

Some of Vitale's most successful investments include his investment in Apple stock and his investments in real estate.

Question 4: What is Vitale's investment strategy?

Vitale's investment strategy is based on a long-term approach and a focus on quality investments. He invests in a diversified portfolio of assets, including stocks, bonds, and real estate.

Question 5: What is the importance of financial planning in Vitale's success?

Financial planning is essential to Vitale's success. It has helped him to set financial goals, assess his current financial situation, and develop a plan to achieve his goals.

Question 6: What is Vitale's passion for financial literacy?

Vitale is passionate about financial literacy. He believes that everyone should have the opportunity to learn about personal finance and make informed financial decisions.

Summary:

Tom Vitale's net worth is a reflection of his success as a financial planner. He has built his net worth through a combination of wise investments, sound financial planning, and a passion for helping others improve their financial well-being.

Transition to the next article section:

For more information on Tom Vitale and his approach to financial planning, please visit his website.

Tips from Financial Planner Tom Vitale

Financial planner Tom Vitale has spent years advising clients to help them achieve their financial goals and success. Here are some of his top tips:

Tip 1: Set financial goals: The first step to achieving financial success is to set financial goals. What do you want to achieve with your money? Do you want to retire early? Buy a house? Pay for your children's education? Once you know what you want to achieve, you can start to develop a plan to get there.

Tip 2: Create a budget: Once you have set financial goals, you need to create a budget to help you track your income and expenses. A budget will help you to ensure that you are living within your means and that you are saving money towards your goals.

Tip 3: Invest early and often: One of the best ways to grow your wealth is to invest early and often. The sooner you start investing, the more time your money has to grow. There are a variety of investment options available, so it is important to do your research and find the right investments for your needs.

Tip 4: Get professional advice: If you are not sure how to plan for your financial future, it is a good idea to seek professional advice from a financial planner. A financial planner can help you to create a financial plan and can provide you with ongoing advice and support.

Tip 5: Stay disciplined: Achieving financial success requires discipline. You need to stick to your budget, invest regularly, and avoid taking on unnecessary debt. It is also important to be patient. Building wealth takes time and effort.

Key takeaways:

- Setting financial goals is essential for success.

- Creating a budget helps you to track your income and expenses.

- Investing early and often is a great way to grow your wealth.

- Professional advice can help you to create a financial plan and make informed decisions.

- Staying disciplined is key to achieving financial success.

Follow these tips to get started on the path to financial success.

Conclusion

Financial planner Tom Vitale's net worth is a testament to his success in the financial industry. He has a proven track record of helping clients grow their wealth and achieve their financial goals. Vitale's success is due in part to his sound financial planning, wealth management expertise, and passion for financial literacy.

There are many lessons that can be learned from Vitale's success. First, it is important to set financial goals and create a plan to achieve them. Second, it is crucial to invest early and often. Third, professional financial advice can be invaluable. Finally, achieving financial success requires discipline and a commitment to staying on track.

Detail Author:

- Name : Prof. John Grimes

- Username : catharine.brown

- Email : hickle.margarete@yahoo.com

- Birthdate : 1986-08-09

- Address : 92934 Jenkins Walks New Robbie, MI 35194

- Phone : 1-971-493-5278

- Company : Roob Ltd

- Job : Heaters

- Bio : Accusantium voluptatem corrupti neque ea nulla id nihil omnis. Totam culpa aut qui nisi assumenda et. Esse molestiae omnis doloribus amet. Cumque error corporis et atque earum non natus.

Socials

tiktok:

- url : https://tiktok.com/@mustafa.turner

- username : mustafa.turner

- bio : Quis sapiente aperiam sunt nam suscipit nemo.

- followers : 4963

- following : 105

twitter:

- url : https://twitter.com/turner1984

- username : turner1984

- bio : Quis et aspernatur laudantium placeat. Dolores placeat sit consequatur ut non.

- followers : 265

- following : 2918

facebook:

- url : https://facebook.com/mustafaturner

- username : mustafaturner

- bio : Explicabo rerum sed non eius deleniti alias quia ut.

- followers : 6539

- following : 1104