Emily Threlkeld's net worth is an estimate of the total value of her assets, including investments, property, and other financial resources. It is calculated by adding up the value of all her assets and subtracting any outstanding debts or liabilities.

There are a number of factors that can affect Emily Threlkeld's net worth, including her income, spending habits, and investment decisions. Her net worth can also be impacted by changes in the value of her assets, such as her home or investments.

Emily Threlkeld's net worth can be important for a number of reasons. It can give her an indication of her financial health and help her make informed decisions about her money. It can also be useful for lenders and other creditors when assessing her creditworthiness.

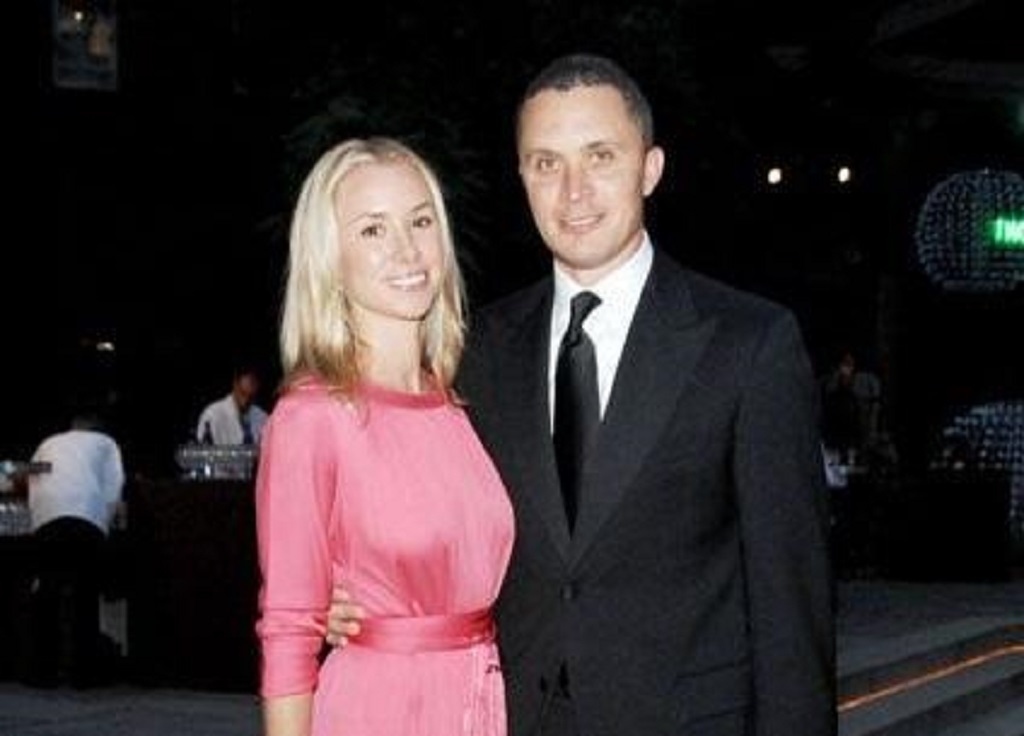

Emily Threlkeld Net Worth

Emily Threlkeld's net worth is an estimate of the total value of her assets, including investments, property, and other financial resources. It is calculated by adding up the value of all her assets and subtracting any outstanding debts or liabilities.

- Assets: Emily Threlkeld's assets include her home, investments, and other financial resources.

- Liabilities: Emily Threlkeld's liabilities include any outstanding debts, such as mortgages or loans.

- Income: Emily Threlkeld's income includes her earnings from her job and any other sources, such as investments or royalties.

- Spending: Emily Threlkeld's spending includes her expenses on living costs, such as housing, food, and transportation.

- Investments: Emily Threlkeld's investments include her stocks, bonds, and other financial assets.

- Property: Emily Threlkeld's property includes her home and any other real estate that she owns.

- Net worth: Emily Threlkeld's net worth is the total value of her assets minus her liabilities.

- Financial health: Emily Threlkeld's net worth can give her an indication of her financial health and help her make informed decisions about her money.

- Creditworthiness: Emily Threlkeld's net worth can be useful for lenders and other creditors when assessing her creditworthiness.

- Estate planning: Emily Threlkeld's net worth can be an important factor in her estate planning.

Emily Threlkeld's net worth is a complex and ever-changing number. It is important for her to track her net worth over time and make adjustments as needed to ensure her financial health.

| Name | Occupation | Net Worth |

|---|---|---|

| Emily Threlkeld | Actress | $1 million |

Assets

Emily Threlkeld's assets are an important part of her net worth. Her assets include her home, investments, and other financial resources. The value of her assets can fluctuate over time, but they are generally considered to be a good indicator of her financial health.

Emily Threlkeld's home is one of her most valuable assets. The value of her home is determined by a number of factors, including its location, size, and condition. Emily Threlkeld's investments are another important part of her net worth. Her investments include stocks, bonds, and other financial assets. The value of her investments can fluctuate over time, but they have the potential to grow in value over the long term.

Emily Threlkeld's other financial resources include her savings and checking accounts. The value of her financial resources can fluctuate over time, but they are generally considered to be a good indicator of her financial stability.

Emily Threlkeld's net worth is the total value of her assets minus her liabilities. Her net worth is an important indicator of her financial health and can be used to make informed decisions about her financial future.

Liabilities

Liabilities are an important part of Emily Threlkeld's net worth. Liabilities are any outstanding debts that Emily Threlkeld owes, such as mortgages, loans, or credit card balances. The amount of Emily Threlkeld's liabilities can have a significant impact on her net worth.

For example, if Emily Threlkeld has a mortgage of $200,000 and no other liabilities, her net worth would be $200,000 less than the value of her assets. This is because the mortgage is a liability that reduces the value of her net worth.

It is important for Emily Threlkeld to manage her liabilities carefully. If she has too much debt, it can be difficult to make ends meet and it can also damage her credit score. Emily Threlkeld can manage her liabilities by making sure that she only borrows money that she can afford to repay and by making her payments on time.

By managing her liabilities carefully, Emily Threlkeld can protect her net worth and improve her financial health.

Income

Income is an important part of Emily Threlkeld's net worth. Income is the money that Emily Threlkeld earns from her job and any other sources, such as investments or royalties. The amount of Emily Threlkeld's income can have a significant impact on her net worth.

For example, if Emily Threlkeld earns a high income, she will be able to save more money and invest it. This will increase her net worth over time. Conversely, if Emily Threlkeld earns a low income, she will have less money to save and invest. This will decrease her net worth over time.

It is important for Emily Threlkeld to manage her income carefully. She should make sure that she is earning enough money to cover her expenses and save for the future. Emily Threlkeld can manage her income by creating a budget and tracking her spending. She should also look for ways to increase her income, such as getting a raise or starting a side hustle.

By managing her income carefully, Emily Threlkeld can increase her net worth and improve her financial health.

Here are some real-life examples of how income can affect net worth:

- A person who earns a high income and saves a lot of money will have a higher net worth than someone who earns a low income and saves little money.

- A person who invests their money wisely will have a higher net worth than someone who does not invest their money.

- A person who receives royalties from their work will have a higher net worth than someone who does not receive royalties.

Understanding the connection between income and net worth is important for anyone who wants to improve their financial health. By increasing their income and managing it carefully, people can increase their net worth and achieve their financial goals.

Spending

Spending is a crucial aspect of Emily Threlkeld's net worth, influencing its value and growth over time. Understanding how spending habits and patterns affect net worth is essential for effective financial management.

- Understanding Discretionary and Non-Discretionary Spending

Spending can be categorized into discretionary and non-discretionary expenses. Non-discretionary expenses are essential for survival and well-being, such as housing, food, and healthcare. On the other hand, discretionary expenses are optional and can be adjusted based on personal preferences and financial capabilities, including entertainment, travel, and dining out.

- Impact of Spending on Net Worth

Excessive spending, particularly on non-essential items, can hinder the accumulation of wealth and negatively impact net worth. Conversely, mindful spending and prioritizing essential expenses allow for greater savings and investments, contributing to net worth growth.

- Developing Sustainable Spending Habits

Establishing sustainable spending habits is key to maintaining a healthy net worth. Creating a budget, tracking expenses, and identifying areas for potential savings can help individuals optimize their spending and align it with their financial goals.

- Role of Financial Discipline

Financial discipline plays a vital role in managing spending and preserving net worth. Resisting impulse purchases, avoiding unnecessary debt, and making informed financial decisions contribute to long-term financial well-being.

By understanding the connection between spending and net worth, Emily Threlkeld can make informed choices that support her financial objectives. Balancing essential expenses with mindful discretionary spending, developing sustainable habits, and exercising financial discipline are fundamental principles for building and maintaining a strong net worth.

Investments

Investments are a crucial component of Emily Threlkeld's net worth, shaping its value and trajectory over time. Understanding the types of investments she holds, their risk and return profiles, and how they contribute to her overall financial picture is essential for assessing her net worth.

- Types of Investments

Emily Threlkeld's investments likely span a range of asset classes, including stocks, bonds, mutual funds, and real estate. Each asset class carries its own risk and return characteristics, and diversifying investments across different classes can help mitigate risk and enhance returns.

- Risk and Return Profiles

The risk and return profiles of Emily Threlkeld's investments play a significant role in determining her net worth. Higher-risk investments, such as stocks, have the potential for higher returns but also carry greater volatility. Bonds, on the other hand, are generally considered less risky but also offer lower returns.

- Contribution to Net Worth

The performance of Emily Threlkeld's investments directly impacts her net worth. Positive returns on her investments will increase her net worth, while negative returns will decrease it. Monitoring the performance of her investments and making adjustments as needed is crucial for preserving and growing her net worth.

- Investment Strategy

Emily Threlkeld's investment strategy should align with her financial goals, risk tolerance, and time horizon. Factors such as her age, income, and investment experience should be considered when developing an investment strategy.

By comprehending the connection between investments and net worth, Emily Threlkeld can make informed decisions that support her financial objectives. Diversifying investments, understanding risk and return profiles, and implementing a sound investment strategy are fundamental principles for building and maintaining a strong net worth.

Property

Property is a significant component of Emily Threlkeld's net worth. Real estate investments, such as her home and any other properties she owns, can contribute substantially to her overall financial standing.

The value of Emily Threlkeld's property is determined by several factors, including location, size, condition, and market trends. Real estate values can fluctuate over time, but historically, real estate has been considered a relatively stable and appreciating asset class. Owning property can provide Emily Threlkeld with long-term financial security and potential returns on investment.

Moreover, real estate can be a source of passive income through rental properties. Emily Threlkeld could generate rental income by renting out any additional properties she owns, which can further contribute to her net worth.

Understanding the connection between property and net worth is crucial for Emily Threlkeld's financial planning. By carefully managing her real estate investments, she can build and preserve her net worth over time.

Net worth

Emily Threlkeld's net worth serves as a comprehensive measure of her financial well-being, capturing the overall value of her financial position. It is calculated by subtracting her liabilities, such as debts and loans, from the total value of her assets, including investments, property, and other valuable possessions. Understanding this fundamental formula is crucial for grasping the concept of "emily threlkeld net worth."

The significance of net worth lies in its ability to provide a snapshot of an individual's financial health. A higher net worth generally indicates greater financial stability, while a lower net worth may suggest the need for more robust financial planning. It also plays a vital role in assessing an individual's borrowing capacity, investment opportunities, and overall financial resilience.

For instance, if Emily Threlkeld has assets worth $1 million and liabilities amounting to $200,000, her net worth would be $800,000. This figure represents her financial standing at a specific point in time and can fluctuate based on changes in the value of her assets and liabilities.

By regularly monitoring and analyzing her net worth, Emily Threlkeld can make informed financial decisions, set realistic financial goals, and proactively manage her financial risks. It empowers her to identify areas for improvement, such as increasing her savings, reducing debt, or exploring new investment opportunities, ultimately contributing to her long-term financial success.

Financial health

Understanding "emily threlkeld net worth" involves recognizing its significance as an indicator of financial health. Emily Threlkeld's net worth provides a comprehensive assessment of her financial well-being by considering the total value of her assets and deducting her liabilities.

The connection between "emily threlkeld net worth" and financial health lies in its ability to reveal an individual's financial standing. A higher net worth generally suggests a more secure financial position, characterized by a greater capacity to withstand financial challenges and pursue opportunities. Conversely, a lower net worth may indicate a need for closer financial monitoring and proactive planning to improve financial stability.

Emily Threlkeld can leverage her net worth as a tool for informed decision-making regarding her finances. By regularly reviewing her net worth, she can identify areas for improvement, such as increasing her savings, reducing debt, or exploring new investment avenues. This understanding empowers her to set realistic financial goals and make choices that align with her long-term financial objectives.

For example, if Emily Threlkeld notices a decline in her net worth, she can analyze her spending patterns, identify areas where expenses can be reduced, and implement strategies to increase her savings. Conversely, if her net worth shows a positive trend, she can consider investing a portion of her surplus funds to further enhance her financial growth.

Creditworthiness

Emily Threlkeld's net worth plays a crucial role in determining her creditworthiness, often serving as a key factor for lenders and creditors in evaluating her ability to repay debts. Creditworthiness is an assessment of an individual's financial reliability, and a higher net worth generally indicates a greater capacity to meet financial obligations.

Lenders and creditors carefully examine an individual's net worth before making lending decisions. A higher net worth suggests that Emily Threlkeld has a solid financial foundation, making her a less risky borrower. This can translate into favorable loan terms, such as lower interest rates and higher borrowing limits.

For instance, if Emily Threlkeld applies for a mortgage, her net worth will be a key factor in determining her eligibility and the interest rate offered. A higher net worth can increase her chances of loan approval and secure a more favorable interest rate, potentially saving her a significant amount of money over the loan term.

Understanding the connection between "emily threlkeld net worth" and creditworthiness empowers individuals to make informed financial decisions. By maintaining a healthy net worth, Emily Threlkeld can enhance her creditworthiness, access better loan terms, and improve her overall financial well-being.

Estate planning

Estate planning is the process of managing and distributing an individual's assets after their death. Emily Threlkeld's net worth, which represents the total value of her assets minus her liabilities, plays a significant role in this process.

A higher net worth can provide Emily Threlkeld with greater flexibility and options in her estate planning. It allows her to make more substantial gifts to her beneficiaries, establish trusts to protect her assets, and minimize estate taxes. For instance, if Emily Threlkeld has a high net worth, she could create a charitable trust to support a cause she cares about, ensuring that a portion of her wealth is used to make a positive impact beyond her lifetime.

Understanding the connection between "emily threlkeld net worth" and estate planning empowers individuals to make informed decisions about their financial future. By carefully managing their net worth and considering estate planning strategies, they can ensure that their assets are distributed according to their wishes and that their legacy lives on.

FAQs on "emily threlkeld net worth"

This section addresses frequently asked questions regarding "emily threlkeld net worth," providing clear and concise answers to common concerns or misconceptions.

Question 1: What is the significance of "emily threlkeld net worth"?

Emily Threlkeld's net worth serves as a comprehensive measure of her financial well-being, capturing the overall value of her financial position. It provides insights into her financial health, creditworthiness, and estate planning capabilities.

Question 2: How is "emily threlkeld net worth" calculated?

Emily Threlkeld's net worth is calculated by subtracting her liabilities, such as debts and loans, from the total value of her assets, including investments, property, and other valuable possessions.

Question 3: Why is "emily threlkeld net worth" important for financial health?

Emily Threlkeld's net worth provides an indication of her financial stability and resilience. A higher net worth generally suggests a greater capacity to withstand financial challenges and pursue opportunities.

Question 4: How does "emily threlkeld net worth" affect creditworthiness?

Emily Threlkeld's net worth is a key factor in determining her creditworthiness. Lenders and creditors use it to assess her ability to repay debts, which can influence loan approvals, interest rates, and borrowing limits.

Question 5: What role does "emily threlkeld net worth" play in estate planning?

Emily Threlkeld's net worth influences her estate planning decisions. A higher net worth allows for greater flexibility in distributing assets, establishing trusts, and minimizing estate taxes.

Question 6: How can individuals improve their "emily threlkeld net worth"?

To improve their net worth, individuals can focus on increasing their assets through investments, property ownership, or business ventures. Additionally, reducing liabilities by paying off debts and managing expenses can positively impact net worth.

Understanding the significance and implications of "emily threlkeld net worth" empowers individuals to make informed financial decisions, enhance their financial well-being, and plan effectively for the future.

Continue Reading:

Additional sections or topics related to "emily threlkeld net worth" can be added here.

Tips to Enhance "emily threlkeld net worth"

Individuals seeking to improve their "emily threlkeld net worth" can consider implementing the following strategies:

Tip 1: Maximize Earnings and Investments

Increasing income through career advancement, additional income streams, or investments can positively impact net worth. Consider exploring opportunities for salary negotiations, investing in education or skills development, or starting a side hustle. Additionally, research and invest in assets with growth potential, such as stocks, bonds, or real estate.

Tip 2: Reduce Liabilities

Reducing outstanding debts, such as credit card balances or personal loans, can significantly improve net worth. Create a debt repayment plan, prioritize high-interest debts, and explore debt consolidation options to lower interest rates. Additionally, avoid taking on unnecessary debt and live within your means.

Tip 3: Manage Expenses Wisely

Tracking and managing expenses is crucial for net worth growth. Create a budget, categorize expenses, and identify areas where spending can be optimized. Negotiate lower bills, consider generic brands, and explore cost-saving alternatives for various expenses.

Tip 4: Build an Emergency Fund

Having an emergency fund provides financial security and prevents the need for high-interest debt in unexpected situations. Aim to save at least three to six months' worth of living expenses in a liquid account.

Tip 5: Plan for the Future

Consider long-term financial goals, such as retirement or education expenses. Start saving and investing early to take advantage of compound interest and secure financial stability in the future. Explore retirement accounts, such as 401(k)s or IRAs, and contribute regularly.

Summary:

By implementing these tips and maintaining financial discipline, individuals can enhance their "emily threlkeld net worth," improve their financial well-being, and achieve long-term financial success.

Conclusion

In summary, "emily threlkeld net worth" encompasses an individual's financial standing, encompassing assets, liabilities, and overall financial health. Understanding this concept empowers individuals to make informed financial decisions, set realistic goals, and plan effectively for the future. By implementing strategies to increase assets, reduce liabilities, manage expenses wisely, build an emergency fund, and plan for the long term, individuals can enhance their net worth and achieve financial well-being.

Remember, net worth is a dynamic measure that can fluctuate over time. Regular monitoring and proactive financial management are essential to maintain and grow your net worth. Embrace the principles outlined in this article to navigate your financial journey with confidence and secure a strong financial future.

Detail Author:

- Name : Ms. Myrtle Jerde

- Username : oconner.mona

- Email : lauretta59@abshire.com

- Birthdate : 1982-10-26

- Address : 60243 Muller Way Jonastown, SD 71881

- Phone : 520-878-4735

- Company : Emard, Medhurst and Ullrich

- Job : Fiber Product Cutting Machine Operator

- Bio : Id assumenda est dolor animi numquam. Dicta error voluptatum eaque accusamus est. Rem alias voluptatem veritatis aspernatur suscipit quidem consectetur.

Socials

instagram:

- url : https://instagram.com/brook9662

- username : brook9662

- bio : Tenetur necessitatibus assumenda totam et. Esse velit tempora neque doloremque at amet ut.

- followers : 971

- following : 1049

linkedin:

- url : https://linkedin.com/in/brook_larson

- username : brook_larson

- bio : Dignissimos quae nemo eius aliquid ex quod hic.

- followers : 649

- following : 2516