Senthil Balaji net worth refers to the total value of the assets and income of an individual named Senthil Balaji. It encompasses all of his financial holdings, including cash, investments, property, and other assets, minus any outstanding debts or liabilities.

Understanding an individual's net worth can provide insights into their financial health and overall wealth. It can be a useful metric for assessing an individual's financial standing, creditworthiness, and overall financial well-being.

Factors that can affect an individual's net worth include their income, spending habits, investment decisions, and overall financial management. It's important to note that net worth can fluctuate over time due to changes in the value of assets, income, and expenses.

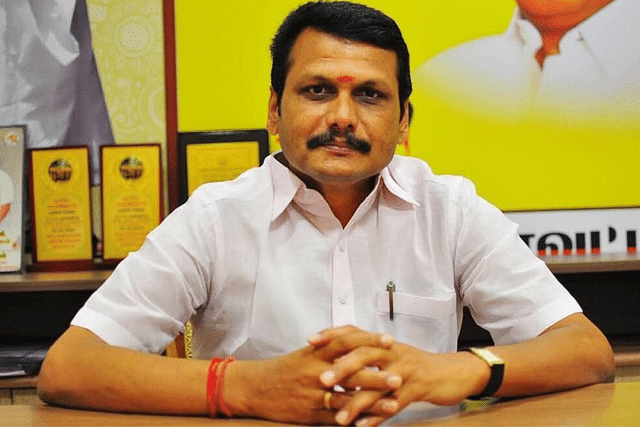

Senthil Balaji Net Worth

Understanding Senthil Balaji's net worth involves examining various aspects of his financial holdings and overall wealth. Here are 10 key aspects to consider:

- Assets: Properties, investments, and other financial holdings.

- Income: Earnings from employment, investments, and other sources.

- Liabilities: Outstanding debts, loans, and other financial obligations.

- Investments: Stocks, bonds, real estate, and other financial instruments.

- Cash: Physical currency and liquid assets.

- Property: Real estate, land, and other physical assets.

- Debt-to-Income Ratio: The percentage of income used to pay off debts.

- Net Worth Growth: The rate at which net worth increases over time.

- Financial Management: Strategies and decisions related to managing wealth.

- Tax Implications: The impact of taxes on net worth.

These aspects provide a comprehensive view of an individual's financial standing. By analyzing these factors, one can gain insights into their financial health, investment strategies, and overall financial well-being. Understanding net worth can be crucial for making informed financial decisions, planning for the future, and managing wealth effectively.

Assets

Assets constitute a crucial component of Senthil Balaji's net worth, representing the total value of his financial holdings. These assets encompass a range of categories, including properties, investments, and other income-generating or wealth-appreciating possessions.

- Real Estate: Properties such as land, residential and commercial buildings, and real estate investments contribute significantly to Senthil Balaji's net worth. The value of these properties can fluctuate based on market conditions, rental income, and development potential.

- Investments: Senthil Balaji's investment portfolio likely consists of stocks, bonds, mutual funds, and other financial instruments. These investments represent his stake in various companies and markets, providing potential returns in the form of dividends, interest, or capital appreciation.

- Other Financial Holdings: This category may include valuable collectibles, artwork, or intellectual property. These assets can contribute to Senthil Balaji's net worth and provide diversification to his overall financial portfolio.

Understanding the composition and value of Senthil Balaji's assets is essential for assessing his financial health and overall wealth. The combination of these assets, along with his income and liabilities, provides a comprehensive picture of his financial standing and net worth.

Income

Income plays a vital role in determining Senthil Balaji's net worth. It represents the inflow of funds from various sources, including employment, investments, and other income-generating activities. Understanding the composition and stability of Senthil Balaji's income is essential for assessing his financial health and overall wealth.

Employment Income: Senthil Balaji's salary, wages, and any other compensation received from his employment contribute significantly to his income. This income provides a stable foundation for his financial well-being and supports his lifestyle.

Investment Income: Senthil Balaji's investments in stocks, bonds, and other financial instruments can generate passive income in the form of dividends, interest, and capital appreciation. These investments diversify his income sources and contribute to the growth of his net worth.

Other Income Sources: Senthil Balaji may have additional income streams from various sources, such as rental properties, royalties, or business ventures. These income sources can supplement his employment and investment income, further enhancing his net worth.

The stability and growth of Senthil Balaji's income are crucial factors in determining his net worth. A consistent and growing income provides him with the means to cover expenses, invest for the future, and build his overall wealth.

Liabilities

Liabilities represent the debts and financial obligations that Senthil Balaji owes to other entities or individuals. They are an essential component of his financial situation, as they reduce his net worth and impact his overall financial health.

Outstanding debts, such as mortgages, personal loans, and credit card balances, contribute significantly to Senthil Balaji's liabilities. These debts incur interest charges, which can strain his cash flow and limit his ability to save and invest. High levels of debt can also negatively impact his credit score, making it more challenging and expensive to borrow money in the future.

Understanding the types and amounts of Senthil Balaji's liabilities is crucial for assessing his financial stability and ability to meet his financial obligations. By managing his liabilities effectively, he can minimize interest payments, improve his creditworthiness, and increase his net worth over time.

Investments

Investments play a pivotal role in shaping Senthil Balaji's net worth, offering avenues for wealth growth and diversification. His investment portfolio comprises various asset classes, each with unique characteristics and potential returns.

- Stocks: Ownership shares in publicly traded companies, representing a claim on their future earnings and assets. Stock prices fluctuate based on market conditions and company performance, offering the potential for both capital appreciation and dividends.

- Bonds: Fixed-income securities issued by governments and corporations, providing regular interest payments until maturity. Bonds offer lower risk compared to stocks but generally have lower return potential.

- Real Estate: Properties acquired for investment purposes, including residential, commercial, and land. Real estate can generate rental income, appreciate in value over time, and provide tax benefits.

- Other Financial Instruments: This category encompasses a wide range of investments, such as mutual funds, exchange-traded funds (ETFs), and alternative investments like private equity and hedge funds. These instruments provide diversification and access to specialized investment strategies.

The allocation and performance of Senthil Balaji's investments significantly impact his net worth. A well-diversified portfolio, strategic asset allocation, and sound investment decisions contribute to the growth and preservation of his wealth.

Cash

Cash, encompassing physical currency and liquid assets, forms an integral component of Senthil Balaji's net worth. Liquid assets are those that can be easily converted into cash without significant loss of value, providing ready access to funds for various needs and opportunities.

- Immediate Liquidity: Cash on hand and in demand deposit accounts offers immediate liquidity, enabling Senthil Balaji to meet short-term financial obligations, seize investment opportunities, or cover unexpected expenses.

- Emergency Fund: A portion of Senthil Balaji's cash reserves may be allocated to an emergency fund, providing a safety net for unforeseen circumstances and mitigating financial risks.

- Market Opportunities: Liquid assets allow Senthil Balaji to capitalize on favorable market conditions and invest in stocks, bonds, or other financial instruments when attractive opportunities arise.

- Purchasing Power: Cash reserves provide purchasing power for Senthil Balaji to make direct purchases of goods and services, without relying on credit or incurring debt.

The amount and management of Senthil Balaji's cash and liquid assets directly impact his overall financial flexibility and preparedness. Maintaining an appropriate level of liquidity ensures his ability to navigate financial challenges, pursue growth opportunities, and preserve his net worth.

Property

Real estate, land, and other physical assets constitute a substantial component of Senthil Balaji's net worth, contributing significantly to his overall financial standing. These tangible assets offer several advantages that enhance their value as part of a diversified investment portfolio.

Firstly, properties, including residential and commercial buildings, generate rental income, providing a steady stream of passive income. This income can supplement Senthil Balaji's other sources of income and contribute to his overall financial stability.

Secondly, real estate often appreciates in value over time, particularly in desirable locations with strong economic growth. This capital appreciation increases Senthil Balaji's net worth and provides a potential hedge against inflation, preserving the purchasing power of his wealth.

Moreover, physical assets like land can provide diversification benefits. Unlike stocks or bonds, which are subject to market fluctuations, land is a tangible asset whose value is less correlated to financial markets. This diversification helps mitigate overall portfolio risk and enhances Senthil Balaji's financial resilience.

In conclusion, the inclusion of property and other physical assets in Senthil Balaji's portfolio strengthens his financial foundation by providing passive income, potential capital appreciation, and diversification benefits. These tangible assets contribute substantially to his overall net worth and play a vital role in his long-term financial security.

Debt-to-Income Ratio

The debt-to-income ratio (DTI) is a crucial financial metric that measures the proportion of an individual's income that is dedicated to servicing debt obligations. It plays a significant role in assessing Senthil Balaji's net worth and overall financial health.

- Impact on Net Worth: A high DTI can negatively impact Senthil Balaji's net worth by reducing his disposable income. When a large portion of income is allocated to debt repayment, less is available for savings, investments, and other wealth-building activities. This can hinder the growth of his net worth and limit his ability to accumulate wealth over time.

- Creditworthiness and Loan Eligibility: Lenders and financial institutions use DTI to evaluate Senthil Balaji's creditworthiness and determine his eligibility for loans and other forms of credit. A high DTI can indicate a high level of financial risk, making it more challenging to obtain favorable loan terms, secure new credit, or qualify for mortgages.

- Financial Stability: A low DTI indicates that Senthil Balaji has a manageable debt load and a relatively high level of financial stability. This means he has more flexibility in his budget and is less vulnerable to financial shocks or unexpected expenses. A low DTI can also provide peace of mind and reduce financial stress.

- Debt Management Strategies: Understanding his DTI can help Senthil Balaji develop effective debt management strategies. By reducing unnecessary debt, consolidating high-interest debts, or increasing income, he can lower his DTI and improve his overall financial situation.

In conclusion, the debt-to-income ratio is a key indicator of Senthil Balaji's financial health and plays a vital role in determining his net worth. By managing his debt effectively and maintaining a healthy DTI, he can enhance his financial stability, improve his creditworthiness, and position himself for long-term financial success.

Net Worth Growth

Net worth growth is a crucial aspect of Senthil Balaji's overall financial trajectory. It measures the rate at which his net worth increases over time, reflecting the effectiveness of his financial strategies and overall wealth management. Understanding the dynamics of net worth growth is essential to assess Senthil Balaji's progress towards his financial goals and identify areas for improvement.

Positive net worth growth is driven by several factors, including income growth, wise investment decisions, and effective debt management. A consistent increase in income provides Senthil Balaji with more resources to invest and grow his wealth. Prudent investment decisions that yield positive returns further contribute to net worth growth. Conversely, minimizing unnecessary debt and managing debt effectively can reduce financial obligations and free up more cash flow for investment and wealth accumulation.

Monitoring net worth growth is crucial for Senthil Balaji to stay on track towards his financial goals. By tracking the changes in his net worth over time, he can identify trends, adjust strategies as needed, and make informed decisions to maximize his wealth. Net worth growth is a key indicator of financial progress and serves as a benchmark against which Senthil Balaji can measure his financial success.

Financial Management

Financial management encompasses the strategies and decisions individuals make to manage their wealth effectively. In the context of "senthil balaji net worth," understanding the principles and practices of financial management is crucial for preserving and growing his wealth over time.

- Investment Strategies: Senthil Balaji's investment decisions play a significant role in shaping his net worth. Diversifying his portfolio across different asset classes, such as stocks, bonds, and real estate, helps spread risk and potentially enhance returns. Additionally, regular monitoring and rebalancing of his investments ensure they remain aligned with his financial goals and risk tolerance.

- Debt Management: Effective debt management involves minimizing unnecessary debt and managing existing debt wisely. By prioritizing high-interest debt and exploring debt consolidation options, Senthil Balaji can reduce the cost of debt and free up more cash flow for investment and wealth accumulation.

- Tax Planning: Understanding tax laws and implementing tax-efficient strategies can help Senthil Balaji minimize his tax liability and maximize his net worth. Utilizing tax-advantaged accounts, such as retirement accounts and investment accounts with tax benefits, can help him shelter his wealth from taxation.

- Estate Planning: Senthil Balaji's financial management also involves planning for the distribution of his wealth after his lifetime. Creating a will or trust ensures his assets are distributed according to his wishes and minimizes the tax burden on his beneficiaries.

Overall, sound financial management practices are essential for Senthil Balaji to preserve and grow his net worth. By implementing prudent investment strategies, managing debt effectively, optimizing tax planning, and considering estate planning, he can safeguard his financial well-being and achieve his long-term financial goals.

Tax Implications

Understanding the tax implications related to "senthil balaji net worth" is crucial for managing and preserving his wealth effectively. Taxes can significantly impact an individual's net worth, and strategic tax planning can help minimize their impact and maximize financial growth.

- Income Tax: Senthil Balaji's income tax liability is a major factor influencing his net worth. The amount of tax he pays on his income reduces his disposable income, which can impact his ability to invest and grow his wealth. Effective tax planning strategies, such as utilizing tax deductions and credits, can help reduce his tax burden and increase his net worth.

- Capital Gains Tax: Senthil Balaji's investments may generate capital gains, which are subject to capital gains tax when sold. Understanding the tax implications of capital gains and implementing tax-efficient investment strategies can help him minimize his tax liability and maximize his returns.

- Property Tax: Senthil Balaji's real estate holdings are subject to property tax, which can be a significant expense. Optimizing his property portfolio and considering tax-advantaged investment properties can help him reduce his property tax burden and preserve his net worth.

- Estate Tax: Estate tax is levied on the assets of an individual upon their passing. Senthil Balaji can implement estate planning strategies, such as creating a trust or utilizing tax-saving gifting techniques, to minimize the impact of estate taxes on his net worth and ensure the smooth transfer of his wealth to his beneficiaries.

In summary, tax implications play a vital role in shaping "senthil balaji net worth." By understanding the various tax laws and implementing effective tax planning strategies, he can minimize his tax liability, maximize his wealth, and preserve his net worth for the long term.

Frequently Asked Questions (FAQs) About "senthil balaji net worth"

This section addresses some common questions and misconceptions surrounding "senthil balaji net worth" to provide a comprehensive understanding of the topic.

Question 1: How is "senthil balaji net worth" calculated?

Senthil Balaji's net worth is calculated by taking the total value of his assets, such as cash, investments, and properties, and subtracting any outstanding liabilities, such as debts or loans. The resulting figure represents his overall financial standing.

Question 2: What factors can affect "senthil balaji net worth"?

Various factors can impact Senthil Balaji's net worth, including changes in the value of his assets, fluctuations in investment performance, real estate market conditions, and changes in his income and expenses.

Question 3: Is a high "senthil balaji net worth" always indicative of financial success?

While a high net worth is often associated with financial success, it does not always fully capture an individual's financial well-being. Factors such as debt-to-income ratio, cash flow, and investment strategy should also be considered for a comprehensive assessment of financial health.

Question 4: How can "senthil balaji net worth" be used for decision-making?

Understanding Senthil Balaji's net worth can assist in making informed financial decisions. It can provide insights into his financial capacity, risk tolerance, and investment strategy, enabling better planning for the future.

Question 5: Are there any potential risks associated with tracking "senthil balaji net worth"?

While tracking net worth can be beneficial, it is essential to approach it with realistic expectations. Net worth can fluctuate over time, and it is important to avoid basing significant financial decisions solely on short-term changes.

Question 6: How often should "senthil balaji net worth" be reviewed?

The frequency of reviewing net worth depends on individual circumstances and preferences. It is generally recommended to review it periodically, such as annually or semi-annually, to track changes and make any necessary adjustments to financial strategies.

In summary, "senthil balaji net worth" is a valuable metric for understanding an individual's financial standing, but it should be considered in conjunction with other financial factors for a comprehensive assessment. By tracking and understanding net worth, individuals can make informed decisions and plan for their financial future.

Transition to the next article section: This concludes the FAQs section. The following section will delve into strategies for managing and growing net worth effectively.

Senthil Balaji Net Worth Management Tips

Effectively managing and growing net worth requires a combination of strategic planning and disciplined execution. Here are some valuable tips to consider:

Tip 1: Set Financial GoalsEstablish clear and specific financial goals to provide direction and motivation for managing your net worth. Define your short-term and long-term objectives, whether it's saving for retirement, purchasing a property, or building an investment portfolio.

Tip 2: Create a Comprehensive BudgetTrack your income and expenses meticulously to understand your cash flow and identify areas for optimization. Allocate funds efficiently to essential expenses, savings, and investments while minimizing unnecessary expenditures.

Tip 3: Invest WiselyDiversify your investments across different asset classes, such as stocks, bonds, real estate, and alternative investments. Research and analyze investment opportunities thoroughly, considering factors like risk tolerance and potential returns.

Tip 4: Manage Debt EffectivelyMinimize unnecessary debt and prioritize paying down high-interest debt. Explore debt consolidation strategies or negotiate lower interest rates to reduce the cost of borrowing and free up cash flow.

Tip 5: Reduce ExpensesReview your expenses regularly and identify areas where you can cut back or negotiate lower rates. Consider lifestyle adjustments, renegotiating bills, or exploring cost-saving alternatives without compromising your quality of life.

Tip 6: Increase IncomeExplore opportunities to increase your income through career advancement, starting a side hustle, or investing in income-generating assets. Additional income can accelerate wealth accumulation and enhance your overall financial well-being.

Tip 7: Seek Professional AdviceConsult with qualified financial advisors or wealth managers for personalized guidance and support in managing your net worth. They can provide expert insights, help you navigate complex financial decisions, and optimize your financial strategies.

By implementing these tips and maintaining financial discipline, you can effectively manage and grow your net worth, achieving your financial goals and securing your financial future.

Conclusion: Managing net worth is an ongoing process that requires continuous attention and adjustment. By adopting these strategies and seeking professional guidance when needed, you can build and maintain a strong financial foundation that will support your long-term financial well-being.

Conclusion

In conclusion, understanding "senthil balaji net worth" encompasses a comprehensive examination of an individual's financial standing. It involves evaluating their assets, income, liabilities, and other financial factors to determine their overall wealth.

Effective management and growth of net worth require strategic planning, disciplined execution, and continuous monitoring. By setting financial goals, creating a comprehensive budget, investing wisely, managing debt responsibly, reducing expenses, increasing income, and seeking professional advice when needed, individuals can build and maintain a strong financial foundation for the future.

Detail Author:

- Name : Allan Wiza

- Username : ikertzmann

- Email : katarina.hammes@hotmail.com

- Birthdate : 1973-05-17

- Address : 104 Maureen Viaduct Apt. 532 New Janburgh, CT 37982-9995

- Phone : +1 (484) 756-2227

- Company : Kihn PLC

- Job : Landscaper

- Bio : Perferendis possimus quo nihil nulla. Dignissimos aliquam natus et quaerat reprehenderit est quae. Tempora sit architecto et enim quos quo qui.

Socials

instagram:

- url : https://instagram.com/cronin1994

- username : cronin1994

- bio : Aut aliquam itaque optio quae et corrupti at. Nihil nesciunt error ratione magnam dolores.

- followers : 5482

- following : 240

linkedin:

- url : https://linkedin.com/in/croninj

- username : croninj

- bio : Alias velit et est quia.

- followers : 1272

- following : 2690

twitter:

- url : https://twitter.com/jaunita_id

- username : jaunita_id

- bio : Aut reprehenderit nihil itaque aut libero provident. Et suscipit aut ex incidunt iste fugiat iusto. Quo ea est officiis perferendis voluptates aut.

- followers : 3089

- following : 2348

facebook:

- url : https://facebook.com/jaunita187

- username : jaunita187

- bio : Fugit et consequatur autem voluptatibus quisquam eligendi.

- followers : 6921

- following : 35

tiktok:

- url : https://tiktok.com/@cronin2006

- username : cronin2006

- bio : Facere aperiam aut occaecati tenetur aut commodi enim.

- followers : 6346

- following : 2079