Christine Belford's net worth is an indicator of her financial assets, including her income, investments, and debts.

Net worth is a crucial metric for assessing an individual's financial health and can be influenced by various factors, such as career earnings, investments, and spending habits. Understanding an individual's net worth provides insights into their financial stability and decision-making.

In the entertainment industry, net worth often reflects an individual's success and earning potential. Christine Belford's net worth is a testament to her achievements as an actress and her ability to leverage her talent into financial wealth.

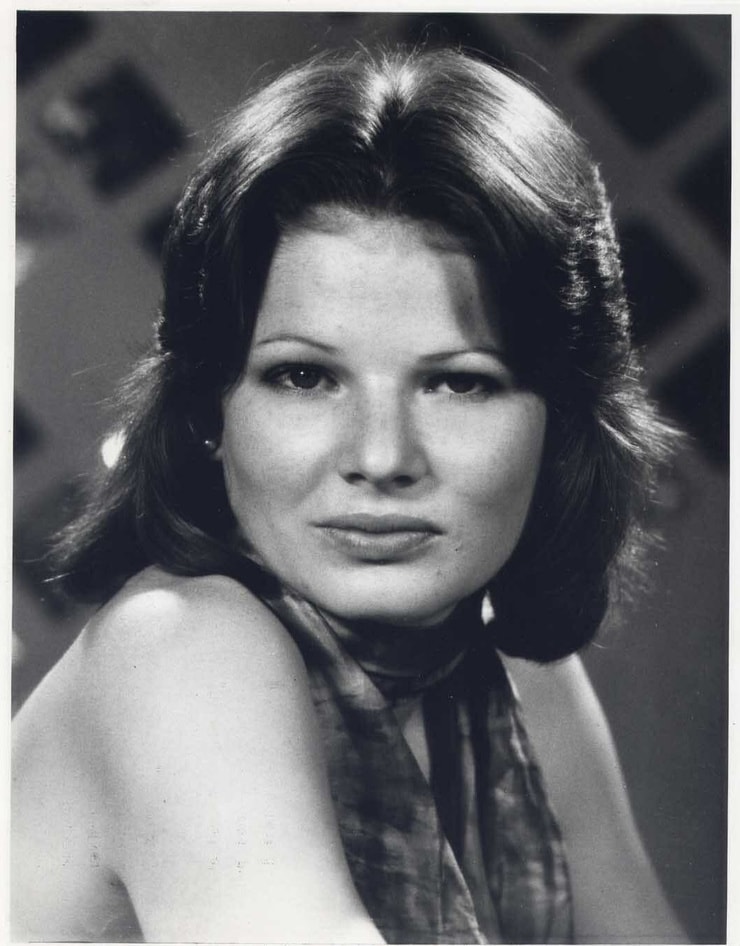

Christine Belford Net Worth

Christine Belford's net worth encompasses various aspects of her financial standing, including her assets, liabilities, and income streams.

- Earnings: Her income from acting roles, endorsements, and other ventures

- Investments: Her portfolio of stocks, bonds, real estate, and other investments

- Assets: Her ownership of property, vehicles, and other valuable possessions

- Liabilities: Her outstanding debts, such as mortgages, loans, and credit card balances

- Cash Flow: Her net income after expenses, which determines her ability to save and invest

- Spending Habits: Her patterns of expenditure, which influence her net worth accumulation

- Financial Planning: Her strategies for managing her finances and achieving financial goals

- Estate Planning: Her arrangements for distributing her assets after her death

Understanding these aspects provides a comprehensive view of Christine Belford's financial health and her ability to generate wealth. It highlights the importance of financial literacy, responsible spending, and strategic planning in achieving financial success.

| Name | Christine Belford |

|---|---|

| Occupation | Actress |

| Birth Date | May 25, 1951 |

| Birth Place | Toronto, Canada |

| Net Worth | $2 million (estimated) |

Earnings

Earnings, a key component of Christine Belford's net worth, encompass her income from acting roles, endorsements, and other business activities. These earnings are crucial in determining her financial stability and ability to accumulate wealth.

- Acting Roles:

Belford's income from acting roles forms a significant portion of her earnings. Her performances in films, television shows, and stage productions have generated substantial revenue.

- Endorsements:

Belford's credibility and popularity have made her an attractive choice for brands seeking endorsements. Partnerships with reputable companies further contribute to her earnings.

- Other Ventures:

Aside from acting and endorsements, Belford may engage in other ventures, such as investments, business partnerships, and personal appearances. These ventures can supplement her income and contribute to her overall net worth.

The cumulative income from these earnings provides Belford with financial security, allowing her to maintain her lifestyle, invest for the future, and support charitable causes close to her heart. Moreover, her high earnings reflect her talent, hard work, and dedication to her craft.

Investments

Investments are a vital component of Christine Belford's net worth, contributing to its growth and preservation. Her portfolio of stocks, bonds, real estate, and other investments generates passive income and appreciates over time, providing financial stability and security.

Stocks represent ownership shares in publicly traded companies, offering the potential for capital appreciation and dividends. Bonds are loans made to corporations or governments, providing a fixed income stream. Real estate, including residential and commercial properties, can generate rental income and increase in value. Other investments, such as private equity, venture capital, and collectibles, can diversify her portfolio and further enhance her net worth.

Belford's investment strategy focuses on asset allocation, risk management, and long-term growth. Her financial advisors help her balance different asset classes, considering her risk tolerance and investment goals. By investing wisely, she ensures her net worth continues to grow, providing financial security for her future and enabling her to support the causes she cares about.

Assets

Christine Belford's assets, such as her ownership of property, vehicles, and other valuable possessions, are a significant component of her net worth. These assets represent her accumulated wealth and contribute to her financial stability and overall well-being.

- Real Estate:

Belford's real estate holdings, including her primary residence and any investment properties, constitute a substantial portion of her assets. The value of real estate appreciates over time, providing a solid foundation for her net worth.

- Vehicles:

Belford's vehicles, such as cars, motorcycles, or boats, are considered assets and contribute to her net worth. While vehicles depreciate in value over time, they provide convenience, transportation, and potential enjoyment.

- Collectibles and Artwork:

Belford's collection of valuable items, such as art, antiques, or rare coins, can contribute to her net worth. These collectibles may appreciate in value over time and provide diversification to her portfolio.

- Intellectual Property:

Belford's ownership of intellectual property, such as copyrights, trademarks, or patents, can be a valuable asset. These intangible assets can generate royalties, licensing fees, or other forms of income.

Collectively, Christine Belford's assets provide her with financial security, contribute to her overall net worth, and offer potential for future growth. They reflect her financial success and her ability to manage her wealth wisely.

Liabilities

Liabilities, representing Christine Belford's outstanding debts, are a crucial component of her net worth. Understanding the interplay between liabilities and net worth is essential for assessing her financial health and overall financial position.

Liabilities reduce an individual's net worth as they represent obligations that must be fulfilled. Mortgages, loans, and credit card balances are common types of liabilities that can accumulate over time. High levels of liabilities can strain an individual's financial resources and limit their ability to save and invest.

For instance, a high mortgage balance can significantly reduce Belford's net worth and limit her cash flow. Similarly, excessive credit card debt can lead to high-interest payments, further eroding her financial standing. Therefore, managing liabilities effectively is paramount for preserving and growing net worth.

Christine Belford's liabilities should be considered in conjunction with her assets and income when evaluating her net worth. By understanding the relationship between her liabilities and net worth, she can make informed financial decisions and strategies to optimize her financial position over time.

Cash Flow

Christine Belford's cash flow, or her net income after expenses, plays a critical role in determining her overall net worth. Cash flow represents the amount of money she has available to save and invest, which in turn contributes to the growth of her wealth.

Positive cash flow is essential for building net worth. When Belford's income exceeds her expenses, she can allocate the surplus funds towards investments that have the potential to grow over time. These investments, such as stocks, bonds, or real estate, generate returns that further increase her net worth.

Conversely, negative cash flow can hinder the accumulation of wealth. If Belford's expenses consistently exceed her income, she may have to rely on debt to cover the shortfall. This can lead to high-interest payments and further reduce her net worth. Therefore, managing cash flow effectively is crucial for Belford to maintain a healthy financial position and grow her net worth over the long term.

Spending Habits

Christine Belford's spending habits play a significant role in determining her overall net worth. Understanding how her spending patterns influence her financial standing provides valuable insights into her financial decision-making and its impact on her wealth accumulation.

- Discretionary Spending:

Discretionary spending refers to expenses that are not essential for survival, such as entertainment, dining out, and travel. Belford's choices in these areas can greatly impact her net worth. Prudent spending in discretionary categories allows for more savings and investments, contributing to net worth growth.

- Savings Rate:

The savings rate represents the percentage of income that Belford sets aside for future use. A high savings rate indicates that she is prioritizing wealth accumulation and investing for the long term. A low savings rate, on the other hand, may hinder her ability to grow her net worth.

- Debt Management:

Belford's debt management practices have a direct impact on her net worth. Responsible use of credit and avoidance of excessive debt can help her preserve her financial standing and increase her net worth over time. Conversely, high-interest debt can erode her wealth and make it more challenging to accumulate assets.

- Tax Planning:

Tax planning is an essential aspect of managing spending habits and maximizing net worth. Belford's understanding of tax laws and her ability to optimize deductions and credits can significantly impact her financial outcomes. Effective tax planning allows her to keep more of her hard-earned income and contribute to her net worth.

In conclusion, Christine Belford's spending habits are closely intertwined with her net worth. By making informed decisions about her discretionary expenses, maintaining a high savings rate, managing debt responsibly, and implementing effective tax planning strategies, she can optimize her financial well-being and continue to grow her net worth.

Financial Planning

Financial planning plays a crucial role in optimizing Christine Belford's net worth. It involves developing and implementing strategies to manage finances, minimize risks, and achieve specific financial objectives.

- Asset Allocation:

Belford's financial plan defines the mix of different asset classes, such as stocks, bonds, and real estate, in her investment portfolio. This asset allocation strategy aims to balance risk and return, ensuring her investments align with her risk tolerance and investment goals.

- Retirement Planning:

Belford's financial plan includes provisions for her retirement, ensuring she has sufficient income and assets to maintain her desired lifestyle during her post-work years. This may involve contributions to retirement accounts, investments in growth-oriented assets, and tax-efficient strategies.

- Risk Management:

The financial plan addresses risk management strategies to protect Belford's assets and income. It may include insurance policies, diversification of investments, and contingency plans to mitigate potential financial risks.

- Tax Optimization:

Belford's financial plan considers tax implications and incorporates strategies to minimize her tax liability. This may involve utilizing tax-advantaged accounts, maximizing deductions and credits, and optimizing her investment returns after taxes.

Effective financial planning is essential for maximizing Christine Belford's net worth and achieving her financial goals. It provides a framework for making informed financial decisions, managing risks, and growing her wealth over the long term.

Estate Planning

Estate planning plays a crucial role in managing Christine Belford's net worth and ensuring her assets are distributed according to her wishes after her passing. It involves making legal arrangements to manage and distribute her property, investments, and personal belongings.

- Last Will and Testament:

Belford's will outlines her final wishes regarding the distribution of her assets. It specifies the beneficiaries who will inherit her property, the executor who will oversee the estate administration, and any specific bequests or charitable donations she wishes to make.

- Trusts:

Trusts can be established to manage Belford's assets during her lifetime or after her death. They provide flexibility in managing and distributing her wealth, reducing estate taxes, and ensuring her assets are used for specific purposes.

- Powers of Attorney:

Belford can grant powers of attorney to trusted individuals to make financial and healthcare decisions on her behalf if she becomes incapacitated. This ensures her assets are managed according to her wishes, even if she is unable to do so herself.

- Beneficiary Designations:

Belford can designate beneficiaries for her retirement accounts, life insurance policies, and other financial instruments. These designations override any instructions in her will, ensuring her assets are distributed directly to her intended beneficiaries.

Effective estate planning ensures that Christine Belford's net worth is managed and distributed according to her wishes, protecting her legacy and providing for her loved ones. It also minimizes estate taxes, avoids legal disputes, and provides peace of mind knowing that her assets will be handled responsibly after her passing.

FAQs on Christine Belford's Net Worth

This section addresses frequently asked questions about Christine Belford's net worth, providing concise and informative answers to common inquiries.

Question 1: What is Christine Belford's net worth?

Christine Belford's net worth is estimated to be around $2 million, primarily accumulated through her successful acting career, endorsements, and wise investments.

Question 2: How did Christine Belford accumulate her wealth?

Belford's wealth stems from her earnings as an actress in films, television shows, and stage productions. She has also supplemented her income through brand endorsements and strategic investments.

Question 3: What is the significance of net worth in assessing financial health?

Net worth is a crucial indicator of an individual's overall financial well-being. It represents the value of assets minus liabilities, providing insights into their financial stability and ability to generate wealth.

Question 4: How does estate planning impact Christine Belford's net worth?

Estate planning ensures that Belford's assets are managed and distributed according to her wishes after her passing. It minimizes estate taxes, avoids legal disputes, and provides peace of mind knowing that her wealth will be handled responsibly.

Question 5: What is the relationship between net worth and financial planning?

Financial planning plays a critical role in optimizing net worth by developing strategies for managing finances, minimizing risks, and achieving financial goals. It involves asset allocation, retirement planning, risk management, and tax optimization.

Question 6: How can I increase my net worth?

Increasing net worth requires a combination of increasing income, reducing expenses, and investing wisely. It involves setting financial goals, creating a budget, managing debt effectively, and seeking professional financial advice when necessary.

Understanding Christine Belford's net worth and the various factors that influence it can provide valuable insights into financial management and wealth accumulation. Effective financial planning and estate planning are essential for preserving and growing net worth, ensuring financial security and peace of mind.

Tips to Enhance Financial Well-being

Understanding and managing your finances is crucial for long-term financial success. Here are several tips to help you optimize your financial well-being:

Tip 1: Track your income and expenses

Monitoring your cash flow is essential for understanding your financial situation. Create a budget to track your income and expenses, identifying areas where you can save or allocate funds more effectively.

Tip 2: Prioritize saving and investing

Make saving and investing a priority to build wealth over time. Set financial goals, determine your risk tolerance, and develop a diversified investment portfolio.

Tip 3: Minimize debt

High-interest debt can hinder financial progress. Prioritize paying off high-interest debts and consider consolidating or refinancing to reduce interest rates.

Tip 4: Seek professional financial advice

Consult with a qualified financial advisor for personalized guidance. They can help you develop a comprehensive financial plan tailored to your specific needs and goals.

Tip 5: Stay informed and educate yourself

Continuously expand your financial knowledge. Read books, attend workshops, and stay updated on financial news and trends to make informed decisions.

Tip 6: Protect your assets

Safeguard your financial assets through adequate insurance coverage. Consider health, life, disability, and property insurance to protect yourself and your loved ones from unexpected events.

Tip 7: Plan for the future

Retirement and estate planning are crucial for long-term financial security. Start planning early and consider factors such as retirement income, healthcare expenses, and legacy goals.

Tip 8: Be patient and persistent

Building financial well-being takes time and consistent effort. Stay committed to your financial plan, make adjustments as needed, and don't give up on your financial goals.

By following these tips, you can take control of your finances, maximize your wealth, and achieve long-term financial success.

Understanding Christine Belford's Net Worth

Christine Belford's net worth encapsulates her financial standing, encompassing her assets, liabilities, income streams, and overall financial health. Her earnings from acting, endorsements, and investments contribute significantly to her wealth accumulation, while her expenses, debts, and financial planning strategies shape her net worth trajectory.

Understanding the complexities of net worth is essential for making informed financial decisions. By analyzing assets, liabilities, cash flow, spending habits, and financial planning, individuals can gain insights into their financial well-being and identify areas for improvement. Effective management of these factors can lead to increased wealth, financial security, and long-term financial success.

Detail Author:

- Name : Vince Kihn

- Username : ebert.lourdes

- Email : stiedemann.norbert@hotmail.com

- Birthdate : 1993-02-19

- Address : 7258 Hane Mountain Suite 085 Agnesport, MO 77268-5709

- Phone : 854-970-8393

- Company : Nader-Kirlin

- Job : Refrigeration Mechanic

- Bio : Quia debitis autem ex quibusdam repellat nulla. Eveniet sapiente architecto et esse. Reiciendis eum corporis nisi magnam.

Socials

instagram:

- url : https://instagram.com/toney_dev

- username : toney_dev

- bio : Et totam neque quo et ipsa quia. Enim numquam impedit sint rerum.

- followers : 3648

- following : 1323

linkedin:

- url : https://linkedin.com/in/tmitchell

- username : tmitchell

- bio : Veniam aperiam beatae quam quae aut.

- followers : 1482

- following : 543

tiktok:

- url : https://tiktok.com/@toney.mitchell

- username : toney.mitchell

- bio : Molestiae fugit neque itaque dolore omnis voluptas.

- followers : 2814

- following : 2422