Auto tradelines are a type of credit-building tool that can help you improve your credit score. They are essentially lines of credit that are added to your credit report, and they can help you increase your credit limit and payment history.

Auto tradelines can be a great way to improve your credit if you have a low credit score or if you have negative items on your credit report. They can also be helpful for people who are new to credit and who need to build a credit history.

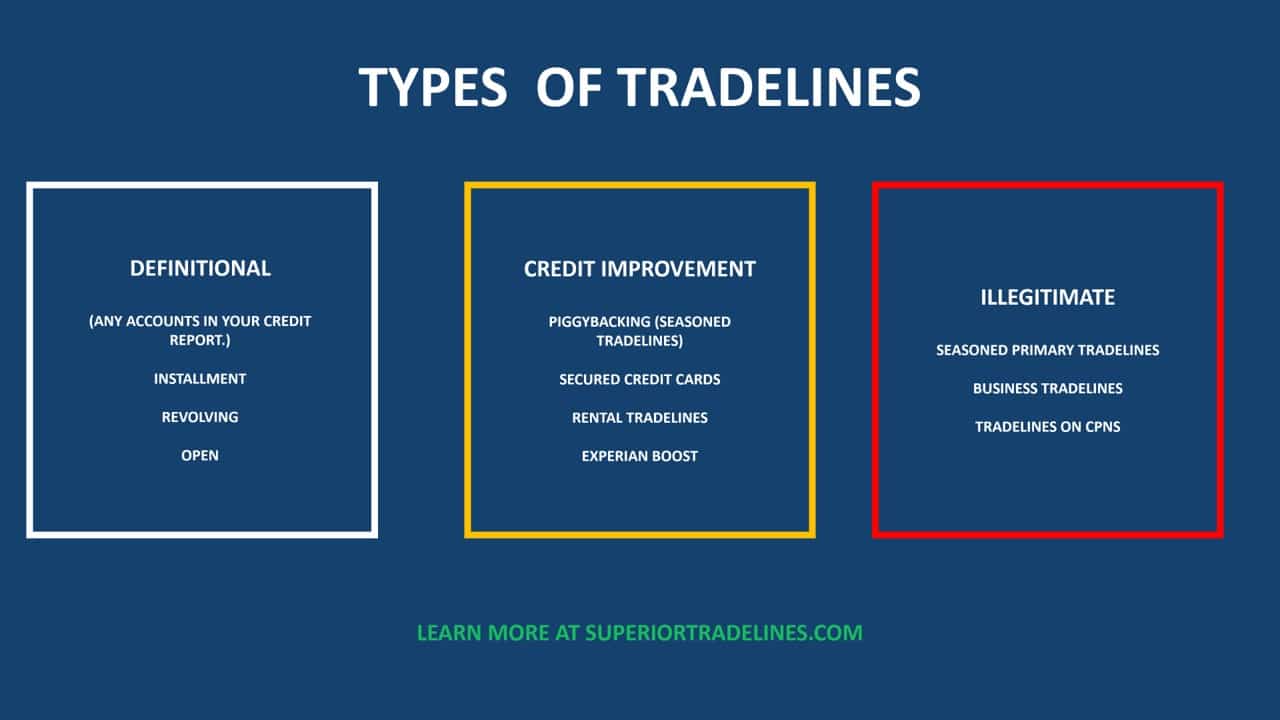

There are a few different ways to get auto tradelines. One way is to apply for a secured credit card. Secured credit cards are backed by a cash deposit, which reduces the risk to the lender. Another way to get auto tradelines is to become an authorized user on someone else's credit card. When you are an authorized user, you are added to the account and you can use the card to make purchases. However, you are not responsible for paying the bill, so this can be a good way to build credit without taking on any debt.

Auto Tradeline

Auto tradelines are a type of credit-building tool that can help you improve your credit score. They are essentially lines of credit that are added to your credit report, and they can help you increase your credit limit and payment history.

- Definition: A line of credit added to your credit report to improve your credit score.

- Purpose: To help individuals build or improve their credit history.

- Types: Secured credit cards, authorized user accounts.

- Benefits: Increase credit limit, improve payment history, build credit.

- Considerations: Requires a security deposit or existing credit history.

- Alternatives: Credit builder loans, rent reporting services.

- Impact on Credit Score: Positive impact if payments are made on time.

- Eligibility: Varies depending on lender and creditworthiness.

- Fees: May include annual fees, interest charges, or setup fees.

- Monitoring: Regular monitoring of credit report to track progress.

Auto tradelines can be a valuable tool for improving your credit score. However, it's important to use them responsibly and to understand the potential risks involved. If you have any questions about auto tradelines, be sure to speak with a financial advisor or credit counselor.

Definition

Auto tradelines are a type of credit-building tool that falls under this definition. They are lines of credit that are added to your credit report, typically through secured credit cards or authorized user accounts. By establishing and maintaining these tradelines, individuals can improve their credit score by increasing their available credit limit and demonstrating a positive payment history.

The connection between this definition and auto tradelines lies in the purpose and functionality of these tradelines. Auto tradelines are specifically designed to address the need for credit building or improvement. They provide individuals with an opportunity to establish or re-establish a positive credit history, which is a crucial factor in determining creditworthiness and accessing favorable credit terms.

Real-life examples showcase the practical significance of this understanding. Individuals who have struggled with low credit scores or limited credit history have utilized auto tradelines to make significant improvements in their credit profiles. By consistently making timely payments and managing their tradelines responsibly, they have been able to increase their credit limits, reduce their credit utilization ratios, and establish a positive payment history. This, in turn, has opened doors to better loan and credit card offers, lower interest rates, and improved overall financial standing.

Purpose

Auto tradelines directly align with this purpose by providing individuals with a means to establish or enhance their credit history. For those with limited or no credit history, auto tradelines offer an opportunity to create a positive credit profile. By making timely payments and managing their tradelines responsibly, individuals can demonstrate their creditworthiness and build a solid foundation for future financial endeavors.

For individuals with damaged credit, auto tradelines can serve as a path to credit repair and improvement. By consistently making on-time payments and maintaining low credit utilization, individuals can gradually rebuild their credit scores and regain access to favorable credit terms.

Real-life examples abound, showcasing the transformative power of auto tradelines in helping individuals achieve their credit goals. Individuals who have successfully utilized auto tradelines have been able to secure better interest rates on loans, qualify for credit cards with higher limits, and improve their overall financial standing.

Types

In the context of auto tradelines, two primary types emerge: secured credit cards and authorized user accounts. These methods serve distinct roles in assisting individuals in building or improving their credit profiles.

- Secured Credit Cards

Secured credit cards require a security deposit, typically in the form of cash, which serves as collateral for the credit extended. This type of card is often recommended for individuals with limited or no credit history, as it offers a lower risk to lenders. By making regular payments and maintaining responsible credit utilization, individuals can gradually build their credit score and establish a positive payment history. - Authorized User Accounts

Authorized user accounts allow individuals to be added to someone else's credit card account, with the primary account holder retaining primary responsibility for payments. This option can be beneficial for individuals who have no credit history or who are seeking to improve their credit scores. As an authorized user, timely payments and responsible credit usage will be reflected on the individual's credit report, contributing to a positive credit history.

The choice between a secured credit card and an authorized user account depends on individual circumstances and financial goals. Both options provide pathways to credit building or improvement, and selecting the most suitable method can enhance the effectiveness of auto tradelines in achieving desired credit outcomes.

Benefits

Auto tradelines offer a multitude of benefits that can positively impact an individual's credit profile. These benefits stem from the inherent features of auto tradelines and their impact on key aspects of creditworthiness.

- Increase Credit Limit

Auto tradelines can help increase an individual's overall credit limit. By adding new lines of credit to their credit report, individuals can expand their borrowing capacity. This is particularly beneficial for those with limited credit history or low credit limits, as it provides them with greater flexibility to manage their finances and make larger purchases if needed. - Improve Payment History

Auto tradelines provide an opportunity to establish a positive payment history. By making timely payments on their auto tradelines, individuals can demonstrate their creditworthiness and reliability. This positive payment history can significantly improve their credit scores, making them more attractive to lenders and potentially qualifying them for lower interest rates on loans and credit cards. - Build Credit

Auto tradelines can assist individuals in building credit from scratch or rebuilding damaged credit. For those with no credit history, auto tradelines can provide the necessary foundation to establish a positive credit profile. For those with negative items on their credit report, auto tradelines can help offset the impact of these negative marks and gradually improve their overall credit score.

In conclusion, the benefits of auto tradelinesincreasing credit limits, improving payment history, and building creditare directly tied to their ability to enhance an individual's credit profile. By utilizing auto tradelines responsibly and consistently making timely payments, individuals can unlock these benefits and lay the groundwork for improved financial outcomes.

Considerations

Auto tradelines often require a security deposit or existing credit history as a way to mitigate risk for lenders. This consideration is closely tied to the nature of auto tradelines as a credit-building tool.

For individuals with limited or no credit history, a security deposit can serve as a guarantee to the lender that the borrower will fulfill their financial obligations. The deposit reduces the lender's risk by providing a financial cushion in case of non-payment. Similarly, for individuals with existing credit history, a strong credit score can indicate their creditworthiness and reduce the need for a security deposit.

Real-life examples illustrate the practical applications of this consideration. Individuals who have successfully utilized auto tradelines with a security deposit have been able to build their credit scores and establish a positive payment history. Over time, as they consistently make timely payments and manage their credit responsibly, they may be able to reduce or eliminate the need for a security deposit in the future.

Understanding this consideration is important for individuals seeking to utilize auto tradelines effectively. By meeting the requirements of a security deposit or establishing a positive credit history, individuals can increase their chances of qualifying for auto tradelines and harness their benefits to improve their overall credit profile.

Alternatives

In the realm of credit building, auto tradelines are not the only option available. Alternative methods, such as credit builder loans and rent reporting services, offer unique approaches to improving credit scores and establishing a positive credit history.

- Credit Builder Loans

Credit builder loans are designed specifically to help individuals with limited or damaged credit build their credit scores. These loans typically involve making regular payments over a period of time, with the loan proceeds being held in a savings account until the loan is paid off. By consistently making timely payments, individuals can demonstrate their creditworthiness and gradually improve their credit scores. - Rent Reporting Services

Rent reporting services provide a way for individuals to build credit by reporting their rent payments to credit bureaus. These services track and report rent payments, which can be a valuable tool for individuals who have difficulty qualifying for traditional credit products or who want to improve their credit scores without taking on additional debt.

These alternatives to auto tradelines offer distinct advantages and considerations. Credit builder loans provide a structured approach to building credit, while rent reporting services allow individuals to leverage their existing rental payments to improve their credit profiles. Understanding these alternatives can empower individuals to choose the most suitable method for their specific needs and financial goals.

Impact on Credit Score

Auto tradelines can have a positive impact on your credit score, provided that the payments are made on time. This is because payment history is a major factor in determining your credit score. By consistently making timely payments on your auto tradelines, you can demonstrate your creditworthiness and reliability to lenders.

- Establishing a Positive Payment History:

Auto tradelines provide an opportunity to establish a positive payment history, which is crucial for building and maintaining a good credit score. By making timely payments on your auto tradelines, you are showing lenders that you are a responsible borrower who meets your financial obligations. - Improving Credit Utilization:

Auto tradelines can help you improve your credit utilization ratio, which is the amount of credit you are using compared to your total available credit. By increasing your total available credit through auto tradelines, you can reduce your credit utilization ratio, which can positively impact your credit score. - Lengthening Credit History:

Auto tradelines can help you lengthen your credit history, which is another important factor in determining your credit score. The longer your credit history, the more data lenders have to evaluate your creditworthiness.

Overall, auto tradelines can be a valuable tool for improving your credit score, provided that you use them responsibly and make your payments on time. By establishing a positive payment history, improving your credit utilization ratio, and lengthening your credit history, you can increase your credit score and improve your overall financial profile.

Eligibility

The eligibility criteria for auto tradelines vary depending on the lender and the applicant's creditworthiness. Lenders assess an individual's credit history, income, debt-to-income ratio, and other factors to determine their eligibility for auto tradelines.

For individuals with limited or no credit history, qualifying for auto tradelines may be challenging. Lenders may require a security deposit or a co-signer to mitigate the risk associated with extending credit. However, for individuals with a strong credit history and a high credit score, qualifying for auto tradelines is typically more straightforward.

Understanding the eligibility criteria for auto tradelines is crucial for individuals seeking to utilize them effectively. By meeting the lender's requirements and demonstrating their creditworthiness, individuals can increase their chances of qualifying for auto tradelines and harness their benefits to improve their overall credit profile.

Fees

Fees associated with auto tradelines are an important consideration for individuals seeking to utilize them for credit building or improvement. These fees can vary depending on the lender and the specific auto tradeline product.

- Annual Fees

Annual fees are charged on an annual basis for maintaining an auto tradeline account. These fees can range from a few dollars to several hundred dollars, depending on the lender and the features offered with the account. - Interest Charges

Interest charges may apply to auto tradelines, particularly for secured credit cards. These charges are typically calculated based on a variable interest rate, which can fluctuate over time. It's important to compare interest rates and fees charged by different lenders before selecting an auto tradeline product. - Setup Fees

Setup fees are one-time charges that may be incurred when opening an auto tradeline account. These fees can vary depending on the lender and the type of auto tradeline. Understanding and comparing setup fees can help individuals make informed decisions when choosing an auto tradeline provider.

Considering the fees associated with auto tradelines is crucial for individuals to budget effectively and make the most of these credit-building tools. By carefully comparing fees and choosing the most suitable auto tradeline product, individuals can maximize the benefits and minimize the costs associated with improving their credit.

Monitoring

Regular monitoring of your credit report is a crucial component of utilizing auto tradelines effectively for credit building. By tracking your progress, you can assess the impact of auto tradelines on your credit score and make adjustments as needed.

Monitoring your credit report allows you to:

- Verify the accuracy of your credit information:

Regularly reviewing your credit report helps you identify any errors or discrepancies that may negatively impact your credit score. By disputing inaccuracies, you can maintain the accuracy of your credit history. - Track the progress of your auto tradelines:

Monitoring your credit report allows you to track the impact of your auto tradelines on your credit score. You can observe how your score changes over time as you make timely payments and manage your auto tradelines responsibly. - Identify potential issues:

Regular monitoring can help you identify any potential issues with your auto tradelines, such as missed or late payments. By addressing these issues promptly, you can minimize their negative impact on your credit score.

In conclusion, regular monitoring of your credit report is essential for maximizing the benefits of auto tradelines for credit building. By staying informed about your credit history and taking proactive steps to address any issues, you can effectively manage your auto tradelines and improve your overall credit profile.

Auto Tradeline FAQs

This section addresses frequently asked questions (FAQs) about auto tradelines, providing clear and informative answers to common concerns or misconceptions.

Question 1: What are auto tradelines, and how do they work?Auto tradelines are credit-building tools that involve adding lines of credit to your credit report. They can help improve your credit score by increasing your available credit limit and demonstrating a positive payment history.

Question 2: Who can benefit from using auto tradelines?Auto tradelines can be beneficial for individuals with limited or no credit history, as well as those seeking to improve their credit scores.

Question 3: Are there any risks associated with using auto tradelines?As with any credit product, there are potential risks involved. It's important to use auto tradelines responsibly, make timely payments, and avoid excessive debt.

Question 4: How can I qualify for an auto tradeline?Qualification requirements vary depending on the lender, but generally involve an assessment of your credit history, income, and debt-to-income ratio.

Question 5: What are the costs associated with auto tradelines?Auto tradelines may involve fees such as annual fees, interest charges, or setup fees. It's important to compare fees and choose a product that aligns with your financial situation.

Question 6: How can I monitor the impact of auto tradelines on my credit?Regularly reviewing your credit report allows you to track your progress and identify any potential issues, ensuring you effectively manage your auto tradelines and improve your overall credit profile.

In summary, auto tradelines can be a valuable tool for credit building, but it's essential to understand their benefits, risks, and costs. By using auto tradelines responsibly and monitoring your progress, you can harness their power to improve your credit score and financial well-being.

Transition to the next article section: Understanding Credit Scores and Their Impact

Auto Tradeline Tips

Harness the power of auto tradelines to elevate your credit profile and achieve financial success. Implement these expert tips to maximize their effectiveness.

Tip 1: Establish a Positive Payment History

Timely payments are crucial for auto tradelines. Consistently fulfilling your payment obligations demonstrates creditworthiness and significantly boosts your credit score.

Tip 2: Maintain a Low Credit Utilization Ratio

Avoid using excessive credit on your auto tradelines. Keep your credit utilization ratio low by utilizing only a small portion of your available credit limit. This responsible credit management enhances your creditworthiness.

Tip 3: Monitor Your Credit Regularly

Regularly reviewing your credit report allows you to track your progress and identify any errors or discrepancies. By proactively addressing potential issues, you safeguard your credit health.

Tip 4: Avoid Closing Old Auto Tradelines

Closing old auto tradelines can shorten your credit history and potentially harm your credit score. Keep these accounts open, even if you're not actively using them.

Tip 5: Seek Professional Advice if Needed

If you encounter challenges in managing your auto tradelines or improving your credit, consider consulting a financial advisor or credit counselor. Their expert guidance can help you navigate the complexities of credit building.

By incorporating these tips into your financial strategy, you can effectively utilize auto tradelines to build a strong credit foundation, improve your creditworthiness, and unlock a brighter financial future.

Conclusion: Auto tradelines can be a powerful tool for credit building, but responsible management is key. By following these tips, you can harness their full potential and reap the benefits of an improved credit profile.

Conclusion

Auto tradelines have emerged as a valuable tool for individuals seeking to establish or enhance their credit profiles. Through the strategic utilization of these credit-building instruments, individuals can increase their credit limits, demonstrate a positive payment history, and ultimately improve their credit scores.

Harnessing the power of auto tradelines requires a commitment to responsible credit management. Timely payments, prudent credit utilization, and regular credit monitoring are essential practices for maximizing the benefits of auto tradelines. By adhering to these principles, individuals can unlock the potential of auto tradelines and pave the way for a brighter financial future.

Detail Author:

- Name : Jaylon Blanda

- Username : rempel.marina

- Email : laron.balistreri@gulgowski.info

- Birthdate : 1991-03-12

- Address : 6793 Lemke Meadow Port Rooseveltmouth, NY 05965-8539

- Phone : (347) 786-2440

- Company : Reichel, Goldner and Luettgen

- Job : Technical Specialist

- Bio : Similique aut distinctio illo sit consectetur. Velit deleniti eos praesentium et. Asperiores rerum id atque necessitatibus et neque ab. Ipsa architecto tempore in nihil est porro.

Socials

tiktok:

- url : https://tiktok.com/@coralie.koelpin

- username : coralie.koelpin

- bio : Temporibus excepturi illo amet consequatur molestias sed.

- followers : 804

- following : 2388

facebook:

- url : https://facebook.com/ckoelpin

- username : ckoelpin

- bio : Est eos sint aspernatur minima aut. Accusantium laboriosam ab fugiat.

- followers : 5786

- following : 356

instagram:

- url : https://instagram.com/koelpin2023

- username : koelpin2023

- bio : Magni excepturi quae rem voluptas dolorem odio. Eius aperiam itaque quasi saepe dolore.

- followers : 4130

- following : 2149

twitter:

- url : https://twitter.com/coralie.koelpin

- username : coralie.koelpin

- bio : Expedita numquam sapiente repellendus ea mollitia tenetur. Nam ab voluptatem non illum laboriosam eum. Assumenda neque rerum consectetur enim nihil sed iste.

- followers : 3785

- following : 10

linkedin:

- url : https://linkedin.com/in/coraliekoelpin

- username : coraliekoelpin

- bio : Harum autem rerum excepturi saepe reiciendis.

- followers : 2882

- following : 825