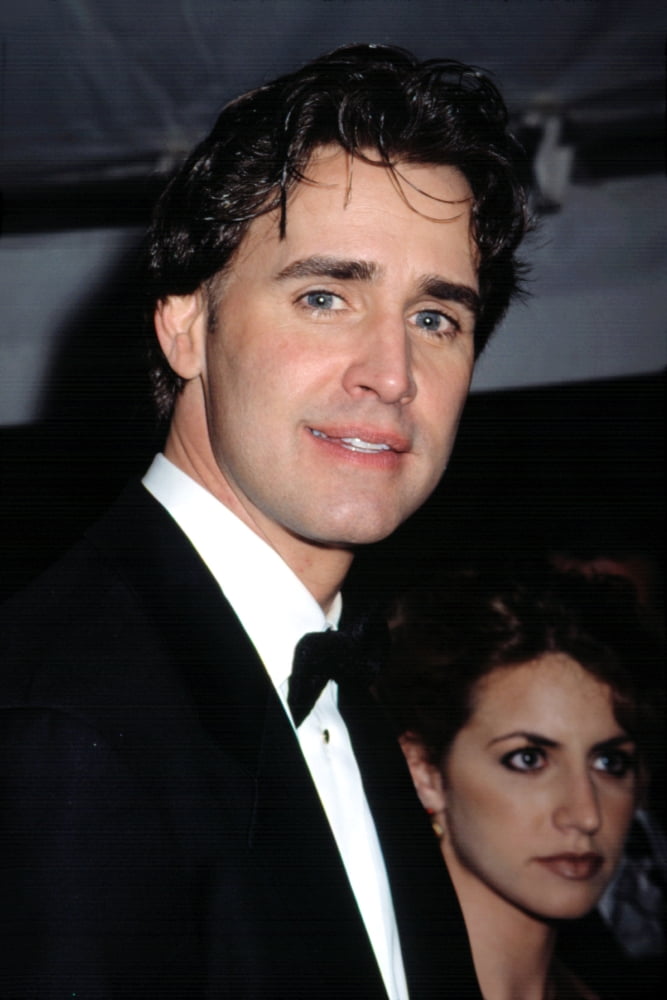

J Eddie Peck Net Worth refers to the total financial worth of J Eddie Peck, an American actor known for his roles in films and television shows such as "Days of Our Lives" and "The Young and the Restless." Net worth is typically calculated by combining all of an individual's assets, such as real estate, investments, and cash, and subtracting any liabilities, such as debts or loans.

Knowing a celebrity's net worth can provide insight into their financial success and lifestyle. It can also be an indicator of their popularity and influence within the entertainment industry. Additionally, net worth can be a factor in determining compensation for future projects and endorsements.

While J Eddie Peck's exact net worth is not publicly disclosed, various sources estimate it to be in the millions of dollars. This wealth has likely been accumulated through his successful acting career, business ventures, and investments. It is important to note that net worth can fluctuate over time due to changes in asset values, spending habits, and other financial factors.

J Eddie Peck Net Worth

J Eddie Peck's net worth, a measure of his financial standing, is a topic of interest due to his successful acting career and business ventures. Here are 9 key aspects related to his net worth:

- Assets: Real estate, investments, cash

- Liabilities: Debts, loans

- Income: Salary from acting, business profits

- Expenses: Living costs, taxes

- Investments: Stocks, bonds, real estate

- Business Ventures: Acting, production, investments

- Financial Management: Savings, investments, tax planning

- Lifestyle: Spending habits, personal expenses

- Net Worth: Total assets minus liabilities

These aspects provide a comprehensive view of J Eddie Peck's financial situation. His net worth is influenced by factors such as the success of his acting career, his business acumen, and his overall financial management. By understanding these aspects, we can better appreciate the factors that contribute to his overall wealth.

| Name | Birth Date | Birth Place | Occupation |

|---|---|---|---|

| J Eddie Peck | March 10, 1992 | Mesa, Arizona | Actor |

Assets

Assets, including real estate, investments, and cash, play a crucial role in determining J Eddie Peck's net worth. Assets are valuable resources or properties that contribute to an individual's overall financial standing. In the case of J Eddie Peck, his assets likely include the following:

- Real estate: This could include residential properties, commercial properties, or land. Real estate can be a valuable asset due to its potential for appreciation and rental income.

- Investments: Stocks, bonds, and mutual funds are common types of investments that can generate passive income or capital gains over time.

- Cash: Cash on hand or in liquid assets, such as savings accounts or money market accounts, provides financial flexibility and can be used for various purposes.

The value of J Eddie Peck's assets, combined with his income and expenses, contributes to his overall net worth. By understanding the composition of his assets, we gain insight into the sources of his wealth and the factors that contribute to his financial success.

It is important to note that assets can also be liabilities if they depreciate in value or become difficult to sell. Therefore, proper asset management is crucial for maintaining a healthy financial position.

Liabilities

Liabilities, specifically debts and loans, play a significant role in determining J Eddie Peck's net worth. Liabilities represent financial obligations that reduce an individual's overall financial standing. In the case of J Eddie Peck, his liabilities may include the following:

- Debts: These could include personal loans, credit card balances, or mortgages. Debts can accumulate over time and impact an individual's cash flow and ability to save.

- Loans: Business loans or other types of loans taken out for various purposes can also contribute to J Eddie Peck's liabilities. Loans typically involve regular payments of interest and principal, which can affect his financial resources.

The amount of J Eddie Peck's liabilities, relative to his assets and income, influences his net worth. High levels of debt can reduce his financial flexibility and limit his ability to invest or pursue other opportunities. Conversely, managing liabilities effectively can contribute to a stronger financial position and increase his overall net worth.

Understanding the relationship between liabilities and net worth is crucial for financial planning and decision-making. By carefully managing his liabilities and minimizing unnecessary debt, J Eddie Peck can optimize his financial situation and work towards building a stronger net worth over time.

Income

Income plays a vital role in determining J Eddie Peck's net worth. His income primarily comes from two sources: salary from acting and profits from business ventures.

- Salary from Acting: As an actor, J Eddie Peck earns income from his roles in films, television shows, and stage productions. His salary can vary depending on the size of the role, the budget of the production, and his experience and reputation in the industry. Consistent acting work contributes significantly to his overall income and net worth.

- Business Profits: In addition to acting, J Eddie Peck is also involved in business ventures. These ventures could include investments, partnerships, or personal businesses that generate income. Business profits can provide a steady stream of revenue and contribute to his overall net worth.

J Eddie Peck's income from both acting and business activities directly impacts his net worth. A consistent and high level of income allows him to accumulate wealth, invest in assets, and build his financial standing over time. Understanding the sources and stability of his income provides insights into the factors that contribute to his net worth and financial success.

Expenses

Expenses, including living costs and taxes, play a crucial role in determining J Eddie Peck's net worth. Expenses represent the costs incurred to maintain a certain lifestyle and fulfill financial obligations.

Living costs encompass various expenses necessary for daily living, such as housing, food, transportation, and healthcare. These costs can vary depending on factors such as location, lifestyle, and personal preferences. Managing living costs effectively is essential for financial stability and accumulating wealth.

Taxes are mandatory payments made to government entities, such as income tax, property tax, and sales tax. Taxes contribute to the funding of public services and infrastructure. J Eddie Peck's tax obligations depend on his income and assets, and they impact his net worth by reducing his disposable income.

Understanding the relationship between expenses and net worth is crucial for financial planning. By controlling expenses, minimizing unnecessary spending, and optimizing tax strategies, J Eddie Peck can increase his net worth over time. Conversely, excessive spending and high tax burdens can erode his financial standing.

In summary, "Expenses: Living costs, taxes" is a critical component of "j eddie peck net worth" because it directly impacts the amount of wealth he accumulates. Managing expenses effectively and minimizing tax liabilities are essential strategies for building and maintaining a strong net worth.

Investments

The relationship between "Investments: Stocks, bonds, real estate" and "j eddie peck net worth" is significant, as investments play a crucial role in building and maintaining wealth. By allocating a portion of his income to investments, J Eddie Peck has the potential to grow his net worth over time.

- Stocks: Stocks represent ownership in publicly traded companies, and they can provide returns through dividends and capital appreciation. J Eddie Peck's investment in stocks can contribute to his net worth by potentially generating passive income and long-term growth.

- Bonds: Bonds are fixed-income securities that provide regular interest payments and return of principal at maturity. J Eddie Peck's investment in bonds can offer a stable source of income and diversification to his portfolio, contributing to his overall net worth.

- Real estate: Real estate investments can include residential or commercial properties. Properties have the potential to appreciate in value over time, and they can also generate rental income. J Eddie Peck's investment in real estate can contribute to his net worth through potential capital gains and passive income.

Diversifying his investments across stocks, bonds, and real estate allows J Eddie Peck to spread risk and potentially enhance his overall return. The performance of these investments, coupled with his investment strategy and risk tolerance, can significantly impact his net worth over the long term.

Business Ventures

The connection between "Business Ventures: Acting, production, investments" and "j eddie peck net worth" is significant, as business ventures can contribute substantially to an individual's overall wealth. J Eddie Peck's involvement in acting, production, and investments represents a strategic approach to building and maintaining his net worth.

Acting is J Eddie Peck's primary source of income, and his success in the entertainment industry has undoubtedly contributed to his net worth. By securing roles in films, television shows, and stage productions, he earns substantial compensation that forms the foundation of his financial standing.

In addition to acting, J Eddie Peck has expanded his business ventures into production and investments. He has produced several films and television shows, which has allowed him to exercise greater control over his creative projects and potentially generate additional revenue streams. Moreover, his investments in various sectors, such as real estate and stocks, have the potential to yield significant returns over time, further contributing to his net worth.

The practical significance of understanding the connection between "Business Ventures: Acting, production, investments" and "j eddie peck net worth" lies in recognizing the importance of diversifying income sources and leveraging business opportunities to build wealth. J Eddie Peck's success serves as an example of how individuals can utilize their talents, skills, and financial acumen to create multiple revenue streams and grow their net worth.

Financial Management

The connection between "Financial Management: Savings, investments, tax planning" and "j eddie peck net worth" is significant, as financial management plays a crucial role in preserving and growing wealth. J Eddie Peck's net worth is not solely determined by his income and business ventures, but also by his ability to manage his finances effectively.

Savings, investments, and tax planning are essential components of financial management. By saving a portion of his income, J Eddie Peck can accumulate funds for future needs, emergencies, or investments. Investments, such as stocks, bonds, and real estate, have the potential to generate passive income and long-term growth, contributing to his net worth. Tax planning involves optimizing tax strategies to minimize tax liability and maximize after-tax income, which can significantly impact his overall financial standing.

Effective financial management allows J Eddie Peck to control his cash flow, reduce unnecessary expenses, and make informed decisions about his financial future. By understanding the importance of financial management and implementing sound strategies, he can protect and grow his net worth over time.

Lifestyle

The connection between "Lifestyle: Spending habits, personal expenses" and "j eddie peck net worth" is significant because lifestyle choices directly impact an individual's financial standing. J Eddie Peck's net worth is not solely determined by his income and business ventures, but also by his spending habits and personal expenses.

Spending habits refer to the patterns and choices individuals make regarding their consumption of goods and services. Personal expenses encompass all costs incurred for personal use, such as housing, transportation, entertainment, and travel. Managing spending habits and personal expenses effectively is crucial for maintaining financial stability and accumulating wealth.

Understanding the connection between lifestyle and net worth enables individuals to make informed decisions about their spending habits, prioritize essential expenses, and minimize unnecessary expenditures. By adopting a balanced approach to lifestyle and expenses, J Eddie Peck can optimize his financial health and work towards long-term financial goals, ultimately contributing to the growth of his net worth.

Net Worth

The concept of "Net Worth: Total assets minus liabilities" lies at the heart of understanding "j eddie peck net worth." Net worth represents the financial health of an individual or entity, calculated by subtracting liabilities from total assets. It provides a snapshot of one's financial standing, considering both what is owned and what is owed.

- Assets: Assets encompass all valuable possessions, such as cash, real estate, investments, and personal property. These assets contribute positively to net worth, as they represent resources and potential sources of future income.

- Liabilities: Liabilities, on the other hand, represent financial obligations or debts. Common examples include mortgages, loans, and credit card balances. Liabilities impact net worth negatively, as they reduce the overall value of assets.

- Net Worth Calculation: By subtracting total liabilities from total assets, we arrive at net worth. A positive net worth indicates that assets exceed liabilities, while a negative net worth suggests that liabilities outweigh assets.

- Importance for "j eddie peck net worth": Understanding J Eddie Peck's net worth provides valuable insights into his financial stability, investment strategies, and overall financial health. It helps assess his ability to meet financial obligations, make informed financial decisions, and plan for future financial goals.

In conclusion, "Net Worth: Total assets minus liabilities" is a crucial aspect of "j eddie peck net worth" as it provides a comprehensive measure of his financial standing. By analyzing assets, liabilities, and their net effect, we can gain valuable insights into his financial well-being and decision-making capabilities.

FAQs about "j eddie peck net worth"

This section addresses frequently asked questions and misconceptions surrounding "j eddie peck net worth."

Question 1: How is "j eddie peck net worth" calculated?J Eddie Peck's net worth is calculated by subtracting his liabilities, such as debts and loans, from his total assets, which include cash, investments, and real estate.

Question 2: What is the significance of "j eddie peck net worth"?Understanding J Eddie Peck's net worth provides insights into his financial health, investment strategies, and overall financial well-being.

Question 3: Is "j eddie peck net worth" publicly available information?Specific details about individuals' net worth, including that of J Eddie Peck, are typically not publicly disclosed and may vary depending on sources and estimation methods.

Question 4: What factors can affect "j eddie peck net worth"?J Eddie Peck's net worth can fluctuate based on changes in asset values, income, expenses, and liabilities over time.

Question 5: How can "j eddie peck net worth" be used?Information about J Eddie Peck's net worth can be useful for assessing his financial standing, making informed decisions, and planning for future financial goals.

Question 6: What are some limitations of using "j eddie peck net worth" as a measure of financial success?While net worth provides a snapshot of financial standing, it does not capture all aspects of financial well-being, such as cash flow, liquidity, or investment strategies.

In summary, understanding "j eddie peck net worth" involves considering his assets, liabilities, and the factors that influence them. It offers insights into his financial health but should be interpreted with an understanding of its limitations.

Moving on, let's explore the next section of our article.

Tips on Building and Managing Net Worth

Effective net worth management is crucial for long-term financial success. Here are some tips to consider:

Tip 1: Track Your Assets and LiabilitiesKeep a comprehensive record of your assets, including cash, investments, and property. Similarly, track your liabilities, such as mortgages, loans, and credit card balances. Regularly reviewing this information provides a clear understanding of your financial standing.

Tip 2: Create a Budget and Stick to ItA budget outlines your income and expenses, helping you allocate funds wisely. By adhering to your budget, you can control spending, prioritize savings, and avoid unnecessary debt.

Tip 3: Invest WiselyDiversify your investments across different asset classes, such as stocks, bonds, and real estate. Consider your risk tolerance and financial goals when making investment decisions. Seek professional advice when necessary.

Tip 4: Manage Debt EffectivelyMinimize unnecessary debt and prioritize paying down high-interest debts first. Explore debt consolidation options if managing multiple debts becomes challenging.

Tip 5: Plan for the FutureEstablish financial goals, both short-term and long-term. This could include saving for retirement, purchasing a home, or funding education. Create a plan to achieve these goals, considering potential risks and opportunities.

Tip 6: Seek Professional AdviceConsult with a financial advisor to develop a personalized financial plan. They can provide guidance on investment strategies, tax optimization, and estate planning, helping you make informed decisions.

Tip 7: Be Patient and DisciplinedBuilding and managing net worth is a gradual process that requires patience and discipline. Avoid making impulsive financial decisions and stay committed to your long-term financial goals.

By following these tips, individuals can work towards building and maintaining a strong net worth, securing their financial future.

Conclusion

In summary, "j eddie peck net worth" encompasses the totality of his financial standing, reflecting his assets, liabilities, and overall financial health. It is influenced by various factors, including his income, investments, spending habits, and financial management strategies. Understanding net worth provides insights into an individual's ability to meet financial obligations, plan for the future, and achieve financial goals.

Effective net worth management involves tracking assets and liabilities, creating a budget, investing wisely, managing debt effectively, planning for the future, and seeking professional advice when necessary. By adhering to sound financial principles and making informed decisions, individuals can work towards building and maintaining a strong net worth, securing their financial well-being in the long run.

Detail Author:

- Name : Dock Pollich MD

- Username : nglover

- Email : kconnelly@yahoo.com

- Birthdate : 1973-04-18

- Address : 979 Edison Mill West Jordi, KY 65068

- Phone : 1-440-513-3411

- Company : Lebsack, O'Kon and Barrows

- Job : Executive Secretary

- Bio : Voluptatem ipsum temporibus velit maiores dicta ullam dolores explicabo. Magni adipisci reprehenderit ea laboriosam. Iusto illum tempora repellendus eos.

Socials

twitter:

- url : https://twitter.com/rosaliaondricka

- username : rosaliaondricka

- bio : Ex sint suscipit beatae sunt quo non repudiandae. Molestiae nesciunt nihil nisi est commodi ullam quo. Eos soluta quia quo iusto a temporibus fugiat.

- followers : 6019

- following : 304

facebook:

- url : https://facebook.com/rosalia6457

- username : rosalia6457

- bio : Nihil sequi et voluptas nam excepturi corrupti dolores dolore.

- followers : 5083

- following : 1970

tiktok:

- url : https://tiktok.com/@ondrickar

- username : ondrickar

- bio : Alias cumque ut iure sint eaque. Vero explicabo tempora amet nemo.

- followers : 257

- following : 2892